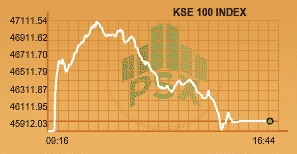

The Pakistan Stock Exchange showed an impressive performance with a turnaround from 45911.74 points to 47111.54 points, closing at +98.42 points or 0.21 % to close at 46010.45 points. The index succumbed to profit-taking in the latter half of the session, closing with 98 points with an intraday gain of almost 1199+ points KSE 100.

The market opened positive and continued to gain until midday, before all intra-day gains were wiped off over the Pakistani Rupee’s deficiency and some companies’ results.

The market added 1201 points in the intraday today. From the high of 1199 points index, the market went down to bottom flat.

According to financial analysts, the Pakistan Stock Exchange was facing tumult for the past two months due to the Panama case in the apex court. However, after the Supreme Court verdict the market has become stable.

Total of 386 companies changed hands where 255 advanced, 114 declined and 17 remained unchanged.Volumes are getting better since the Panama verdicts as it boosted the investor’s confidence as the overall shares traded were 316 million shares. While in KSE 100, 150 million shares changed hands with a net worth of Rs 14.79 billion.

TEXTILE COMPOSITE was the top traded sector with total traded volume of 45,754,140 shares. It was followed by COMMERCIAL BANKS with a total traded volume of 35,513,800 shares and ENGINEERING sector with a total traded volume of 29,073,400.

Azgard Nine was the volume leader with 33.14 million shares, gaining Rs 0.46 to close at Rs 14.65. It was followed by K-Electric LTD with 19.77 million shares, losing Rs 0.03 to close at Rs 6.56, Sui Southern Gas with 18.23 million shares, losing Rs 1.38 to close at Rs 41.25 and TRG PAK LTD with 15.53 million shares, gaining Rs 0.45 to close at Rs 41.82

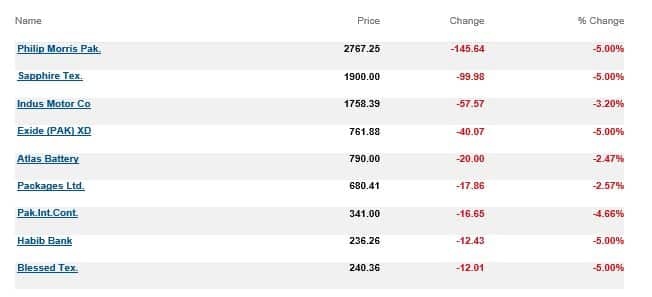

Top gainers of the market were SNGP, ENGRO, OGDC, MARI and HUBC whereas the laggers were HBL, FFC, PPL, UBL and INDU.

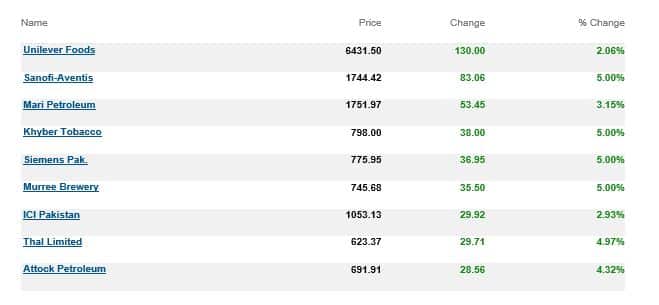

Top advancers of the market were:

Habib Bank Ltd has now received all regulatory approvals in Pakistan and Kenya for transfer of HBL branches in Kenya to Diamond Trust Bank Kenya (DTKB) which will be effective from August 1 2017. HBL will receive an additional 4.18% shareholding in DTKB taking its shareholding to 16.15% from 11.97%.

After this news HBL script went down to the floor and closed at RS 236.26 (-5%) by the end of the trading session.

Whereas Arif Habib Limited expanded its profits by 45% YOY with a payout of Rs 10. Earning per share increased to 78 % with Rs 16.01 this year as compared to 7.45 last year.