Telecom companies have been in the news lately for tax evasion, an allegation that operators have termed as wrong and an attempt to subvert the industry.

This all started a year ago when a Senate Committee on Telecom and IT discussed the matter of some taxes — particularly the withholding tax — which weren’t applicable on majority of cellular subscribers due to their income being non-taxable.

FBR, in response, said that it didn’t have the required capabilities to access mobile operators’ records and that it was hard to identify if a subscriber was liable to withholding tax or not.

Mobile phone operators, as one may imagine, responded that they were willing to share the data if FBR got the capability to audit it.

Things progressed and few weeks ago, FBR was enabled to read and analyze mobile operator’s data, and currently they are in the process of auditing the tax records of each and every transaction of mobile phone operators.

Comes the Senate Committee

While the audit process has been ongoing, FBR is being called by Senate’s Standing Committee on Telecom and IT almost every week. As a result of these meetings and based on what FBR officials say to Senate’s committee, Senators issue press releases against operators for tax evasions and things blow up.

So for example, just this past week, FBR officials were quoted as saying that they thought mobile phone operators evaded Rs. 100 billion in withholding taxes.

It is unclear how FBR officials arrived at this figure but they issued the statement and it made headlines.

A week earlier, FBR alleged that one operator — which was being audited — didn’t collect tax from FATA and a short collection of some Rs. 267 million was reported.

Mobile operators — on the other hand — say that FATA doesn’t come under provincial or federal tax laws and they aren’t collecting withholding tax or sales tax from FATA based on a decade long understanding with FBR.

In fact, three out of four operators don’t deduct taxes from FATA. The fourth operator is only deducting taxes there because it doesn’t have the capability to charge withholding or other taxes based on geographical location.

Not to mention, there’s a Peshawar High Court Ruling that prohibits federal or provincial governments from collecting taxes from FATA.

Govt Demand for Telcos to Collect Taxes from FATA is Unconstitutional

Without actually speaking with the operators, asking for their input, or resolving the issue — if there is one in the first place — FBR made a public statement about tax evasion and the results are in front of us.

Just the Statements?

If you go back by a few more weeks, Chairman NAB alleged that telecom companies were evading as much as Rs. 400 billion in taxes every year. We are unclear how he calculated the figure as the total revenue for telecom companies in 2015-16 stood at around Rs. 457 billion.

The chart below lists the combined revenues of mobile phone companies (Source: PTA Report):

So if Chairman NAB is to be believed, operators are evading as much in tax as much they are earning in a year.

This is very serious and must be investigated. The problem, however, remains that government officials issue press statements without any research or evidence for the sake of making headlines and allegations are leveled before investigations.

Not Helping The System

What I am contesting here is that if there’s a tax evasion, FBR or the NAB or anyone else should get to the data, dig it out and then nab the operator.

What is happening is quite the opposite. They make an allegation — for getting the press attention – and then investigation takes place, if it takes place at all.

This is hurting the industry more than helping the country.

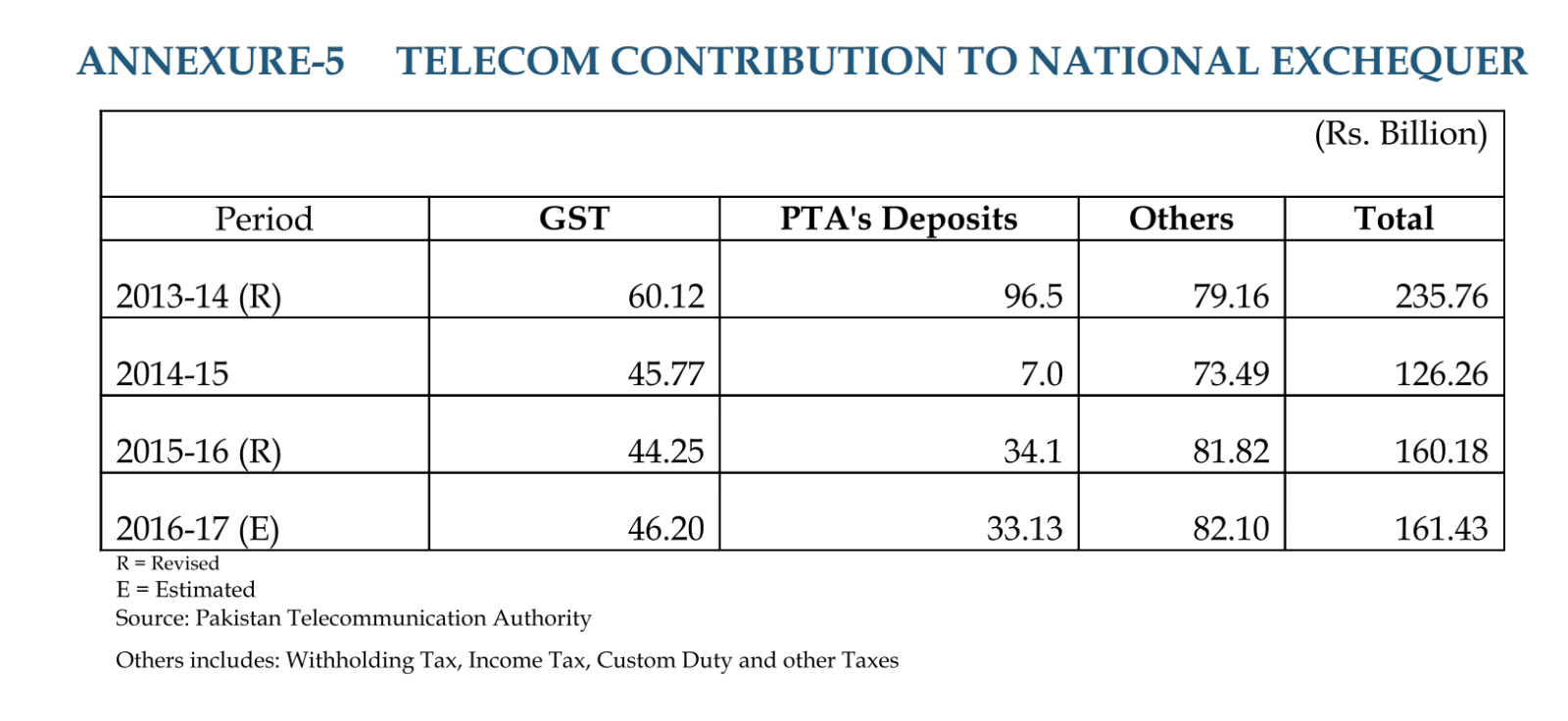

If we look at the data, Telecom industry sector is one the largest contributors to our national exchequer. You can see the figures yourself. (Source: PTA Report)

So for instance, if there’s a tax evasion allegation against an operator — that too without any statistical backing — news gets to the group level and they reconsider plans of investing in Pakistan.

Almost every group operating in Pakistan has operations in several other markets, and we should know that the any investment made in Pakistan is based on comparative analysis of all the markets where these groups operate.

News of such serious allegations directly impacts decisions in global headquarters of telecom companies and Pakistan loses more than it actually gains.

So the crux is: if there’s any discrepancy, go out and find it. Otherwise, with just statements, you are hurting the system more than helping it.

i am a retailer and last 3 month, i am calling jazz for tax certificate but jazz is not proving me certificate,I am sure Jazz is not giving tax to govt.

The story is one thing but more importantly I am surprised at the really basic grammar and verbiage mistakes in this article and that too by the Editor in Chief himself…..

This all started-> All this started

FBR was enabled to read -> FBR was given access to

FBR officials tell things -> What THINGS?

Just past this week -> Just this Past week

That went well in Making the headlines-> that made headlines

And the rest is A history -> REALLY? A HISTORY?

If you go back by a few weeks -> A few weeks ago

As much in tax as much they -> are evading in taxes as much as they

This,actually, is there is tax evasion

Telecom Industry sector -> Telecom sector or Telecom Industry

Bingo! Well spotted!

Pro PK needs better editors including the Editor in Chief who may need grammar classes!

Ek tou en angraiz ghulamoun nay saray mulk ko english bolnay wala samagh rakha hai.

America sai jhotay khatay hain aur pakistan mai angraiz bantay hain.

Jaali log.

Oh the irony of this statement.

Urdu is being types in “English” words. And you had the audacity to criticize the ‘mulk’ for non english speakers mostly.

Bhai tu rhenday.

Mohtaram Chu**** bhai,

Pehlay to yeh samajh lein k angraiz Bartania k logon ko kaha jata hai, Amrika k logon ko nahi. Is liye jotay khanay wali baat durust ker lein. Dosri baat yeh k jis website per aap apnay farsooda khayalaat ka izhar ker rahay hein, woh pichli aik dihai say angraizi mein technology ki khabrein shayaa ker raha hai. To angraizi bolnein wala aitraaz in say kerain, mujh say nahi.

Aakhir mein sab say zaroori baat, woh yeh kay 10 saal mein insaan kuch pehsawarana maharat hasil ker leta hai jisay hum ghulam professional expertise kehtay hein. Ager aap aik angraizi zubaan ka blog 10 saal say chala rahay hein to aap say tawaqqa ki jati hai kay aap ab tak us mein peshwarana maharat hasil ker chukay hoon gay. Tanqeed ka maqsaad behtri hai, aap k pichwaray mein aag lagana nahi.

Choonkay aab aag lag chuki hai, to aap ko Burnol kay saath thanday pani mein saiknay ka mashwara doon ga.

Shukriya,

Aik Jaali Insaan

Oye, English seekhny sy mout nahi aa jani tjhy, Urdu b nahi aati hogi tjhy bay sharam admi, English mn fail hoty rahy ho is mn hmara qasoor nahi, dimagh ka soorakh khol lo jahil

While I can not justify the issues, just a small correction, I am not editor. I have asked the editor to look at the English again.

Also I was on mobile when drafted this. I appreciate your concerns.