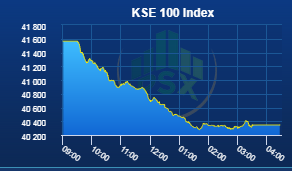

A bloodbath was seen at the Pakistan Stock Exchange (PSX) today, with the benchmark KSE-100 index suffering the biggest intra-day fall of 2018 by going down by 1290 points or 3.07%.

The KSE 100-share Index fell for the fourth consecutive day and went below 40,400 points

The benchmark index was closed at 40345 points with a fall of 1218 points or 2.93%.

Intraday high for the day was yesterday’s closing level of 41,564 as the market has been in a negative momentum since the start of the trading session.

The market saw huge panic selling after the accountability court on Tuesday reserved its verdict in the Avenfield properties reference against former prime minister Nawaz Sharif, his daughter Maryam Nawaz and son-in-law Captain (retd) Sardar.

ALSO READ

Rs 857 Billion Wiped Off Pakistan’s Stock Market in FY 17-18

The court would announce the judgment in Avenfield properties case on July 06.

Overall during the whole week, there were low trading volumes with no interest in buying whatsoever.

Major laggers of the market were OGDC with (-99.72 points). HBL (-85.21 points), LUCK (-59.58 points), UBL (-47.44 points) and Engro (-46.66 points)

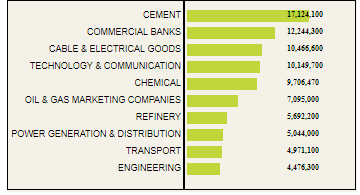

Top Sectors:

Top Volumes:

| Name | Price | Change | % Change | Volume |

| Pak Elektron Ltd. | 34.45 | -1.81 | -4.99% | 10,236,500 |

| Bank Of Punjab. | 11.40 | -0.68 | -5.63% | 6,951,500 |

| TRG Pakistan Ltd. | 27.35 | -1.43 | -4.97% | 4,520,500 |

| K-Electric Limited. | 5.18 | -0.24 | -4.41% | 4,302,500 |

| Pakistan Intl. Bulk Terminal Ltd.(XR) | 10.84 | -0.45 | -4.02% | 4,285,500 |

| Fauji Cement Co Ltd. | 22.40 | -1.17 | -4.96% | 4,036,000 |

| Maple Leaf Cement Factory Ltd. | 48.63 | -2.55 | -4.98% | 3,663,500 |

| Unity Foods Limited. | 28.98 | -1.13 | -3.78% | 3,383,500 |

| D. G. Khan Cement Co. Ltd. | 107.00 | -5.63 | -5.00% | 3,378,500 |

Some of the macroeconomic indicators worsening in an election year, analysts and followers predict a further weakening of Pakistan’s economic position. Whereas some of the analysts said that the valuation and outlook remain intact despite negative ratings macro-wise in the market.

With record Pak Rupee devaluation of 16% in FY18, concern still remains amongst foreigners regarding future dollar returns. These concerns are aggravating at a time when Pakistan is facing external account weakness and the general election are around the corner.

From its 2018 high of 46,637.62 on April 6, the index has plunged 13.61% in almost three months. Pakistan was among six stock exchanges worth a combined $8 trillion that is in a bear market.