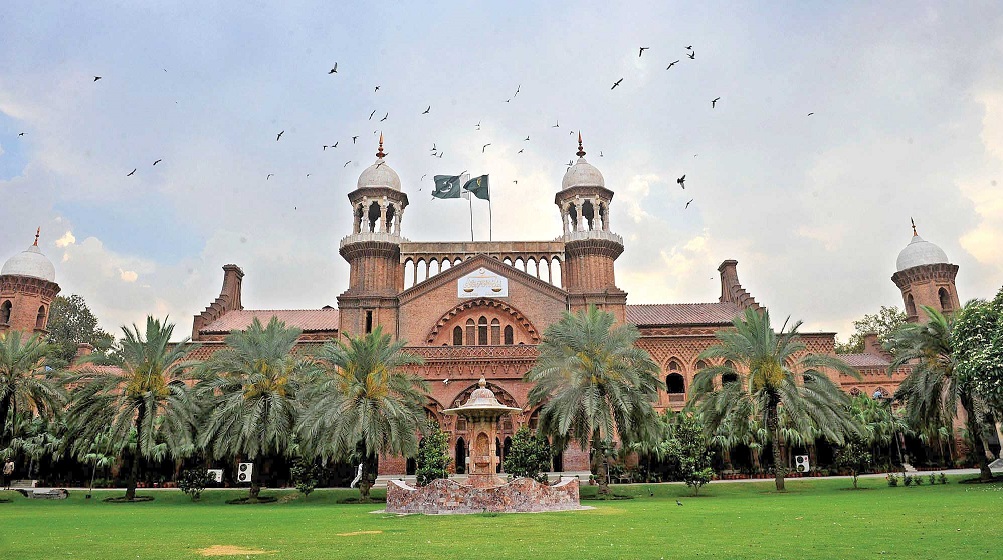

The Lahore High Court (LHC) has declared the collection of sales tax by FBR on its own as unlawful.

The court directed the Federal Bureau of Revenue (FBR) to stop collecting sales tax from unregistered traders on its own.

A two-member bench of the high court, headed by Justice Sajid Mehmood Sethi, announced the reserved verdict on numerous petitions. The verdict states that the board cannot recover sales tax from unregistered businessmen.

ALSO READ

Govt to Launch Online Portal for Registration & Tax Payment of Phones

The LHC made it obligatory for the FBR to register the traders first and then collect the sales tax. The bench termed the current practice of the FBR as unlawful under the Sales Tax Act, 1990.

The court maintained that the provision 3 of the Sales Tax Act is applicable to any businessman who is registered as a taxpayer.

Sales tax is imposed by the government on the sale of goods and services. Usually, it is levied at the point of sale and collected by the retailer who forwards it to the government.

Where is the list of Unregistered traders by FBR : ?