International money transfer service has launched a debit MasterCard along with a multicurrency account.

The card can transact in over 40 currencies without any balance limit. Moreover, conversion fees are at competitive currency exchange rates. The new product will make lives easier for people who are on frequent travels, as it will make on-the-go transactions swift and very economic.

The card does not entail any foreign transaction fees. Not only this but it is also four times cheaper than several other bank accounts and PayPal for foreign spending. Another unique feature of Transferwise Debit MasterCard is that it can be availed easily.

With this debit MasterCard, the tourists will be charged as if they are a local person. They will be able to transact in the local currencies without paying a lot as fees.

Along with lower conversion fees, the ATM withdrawals are free and the card can be used in any country that accepts Mastercard or Apple Pay. Also, the app is user-friendly and enables the consumer to send and receive multiple currencies right from their phone.

As for the Transferwise account, it caters to the need of people who live and work in multiple currencies. The transactions in over 40 currencies are free. The account offers bank details for the UK, US, Eurozone, New Zealand, and Australia.

The user will receive a British account number and sort code, European IBAN, Australian account number and BSB code, New Zealand account number, and US account number and routing number.

Availability

The TransferWise card is currently available for borderless account-holders in the following countries:

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France (only Metropolitan), Germany, Hungary, Iceland, Italy, Ireland, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Netherlands, United Kingdom, United States, Switzerland, Gibraltar (British Overseas Territory) and the UK Crown Dependencies: Guernsey, Isle of Man, and Jersey.

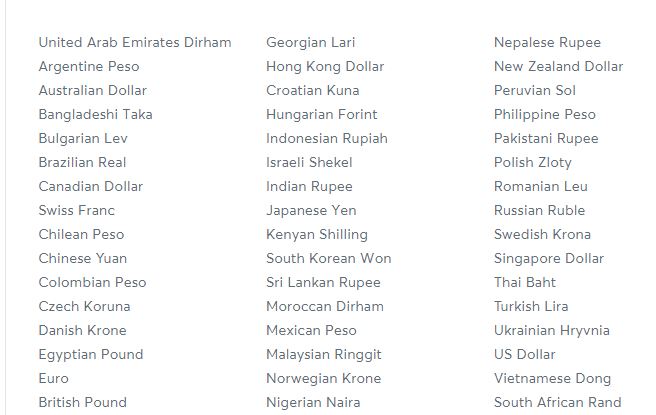

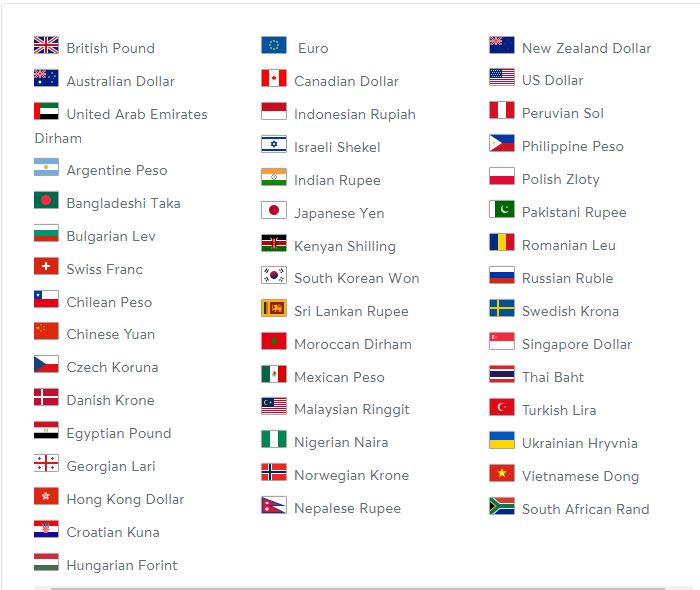

The card can be used to send money to over 50 countries:

Currencies:

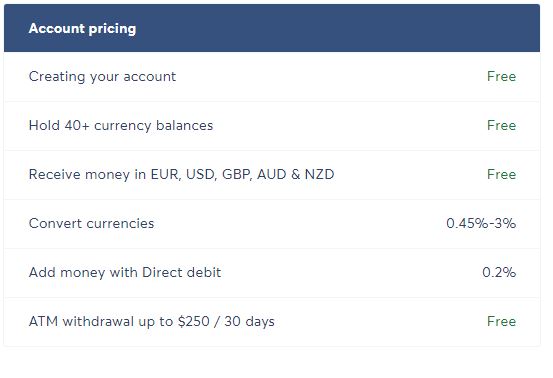

Account Pricing

The cost of acquiring the account is minimal:

Source: TransferWise

Can someone comment .. Is Transferwise legal in Pakistan?

I heard somewhere that it is kind of Wundi, and this is the only reason they can offer such good transfer rates.

If someone sends money from abroad to Pakistan it is not considered as remittance because they do not transfer from a foreign account in foreign currency.

What they do instead is that they get foreign currency from the sender in a foreign country and transfer an equivalent amount in Pakistan from one of their Pakistan based bank accounts, charging the sender only the transfer fee.

It would be nice if someone could verify it.

It is legal and benificial for Pakistan. Because transfering equivalent amount needs to infact purchase currency in advance.

It will be nice if there is some official statement about it, like from State bank or such. Because at the end of the day if someone sends a relatively big amount back home and it gets caught, it will be a mess dealing with Pakistani authorities.

I would in fact like to request the author to investigate this matter if possible.

I am sorry i refrain from commenting on this tabloid masala site, but your question intrigued me to respond. Transferwise follows same mechanism as other MTO’s like ExpressMoney, Worldremit etc. they prefund banks with foreign currency deposits or provide equal bank guarantee, banks process their remittances into accounts or through over the counter channels based on the request from these companies to transfer equivalent local currency in beneficiary account. you cannot transfer foreign currency as foreign currency using these MTO’s, you may have to use banking channels via swift for that. Transferwise is legit, you can check them at the following PRI (Pakistan Remittance Initiative) website listed among many other companies working on various corridors.

http://www.pri.gov.pk/pri-tie-ups/

Thank you Salman,

Your reply was very useful

Bro you are right, I have transferred once the amount is transferred from a local account.

In UK worldremit is good, if you transfer it shows your name on receiver bank statement.

Just tried and got

We’re sorry, cards haven’t reached Pakistan yet

Click below to be the first to know when they do.

What is the purpose of this news? I mean you are making it sound like its available for Pakistan when its obviously not.

Stupid writer this is not avaliable in Pakistan.

Transferwise also gives lame excuses, that have no base in evidence, for not opening an account even when every document they asked for is provided. They might assume every other Muslim person is a terrorist so, their account cannot be opened.

Kya “Chay” bana rahey ho logon ko. chaloo is main albakistan to hai hee nahi

yaar is tarah ki posts na kiya karo jo ke pakistanio ke liye achi nahi. Woh pakistan walon ko card offer hi nahi kar rahe phir faida kya

Not available in Pakistan…

Atleast edit the article to include that its not available in Pakistan

Yes its working and it’s legal . They have a partner tranglo. Search for it. And its good

They are not offering card to Pakistanis same as Skrill, Neteller and etc

We’re sorry, cards haven’t reached Pakistan yet

Click below to be the first to know when they do.

has anyone tried???? is it available in pakistan>?