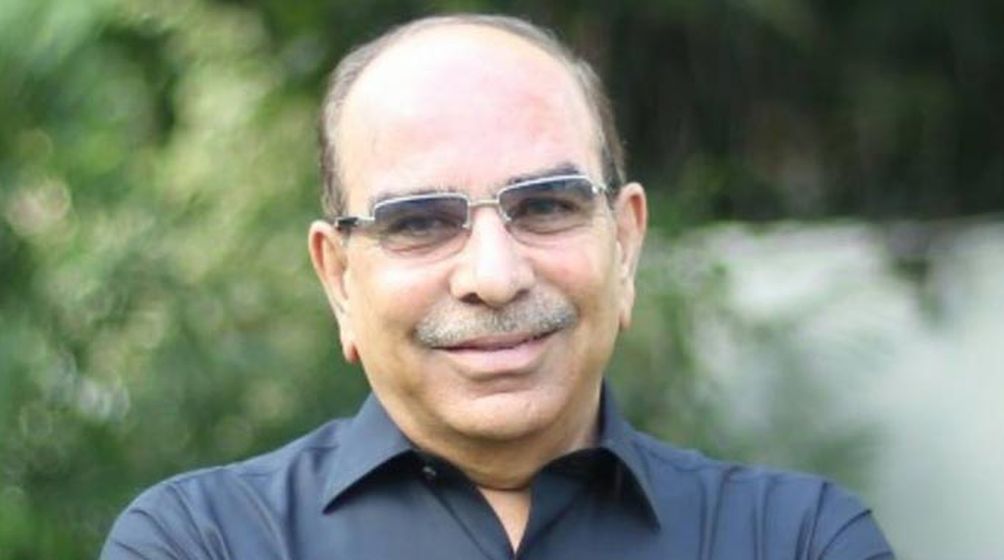

Pakistani biggest business tycoon, Malik Riaz, has agreed to hand over cash and assets worth £190 million to UK investigators.

The £190 million settlement is the result of an investigation by the National Crime Agency into Malik Riaz Hussain, whose business is one of the biggest private-sector employers in Pakistan.

The National Crime Agency has agreed on a settlement figure with the family that owns large property developments in Pakistan and elsewhere.

The haul, previously controlled by property developer Malik Riaz Hussain, includes the Grade II listed building 1 Hyde Park Place, valued at £50 million.

In August 2019, eight account freezing orders were secured at Westminster Magistrates’ Court in connection with funds totalling around £120 million. These followed an earlier freezing order in December 2018 linked to the same investigation for £20 million. All of the account freezing orders relate to money held in UK bank accounts, on the grounds that the cash may be the proceeds of crime.

The NCA has agreed a £190m settlement with a family that owns large property developments in Pakistan and elsewhere after a frozen funds investigation.

Read more ➡️ https://t.co/YmPqE7JlWv pic.twitter.com/n6TGySbRT5

— National Crime Agency (NCA) (@NCA_UK) December 3, 2019

So in all, Investigators from the National Crime Agency (NCA) secured nine freezing orders covering £140 million in funds in UK bank accounts.

The NCA has accepted a settlement offer of around £190 million which includes a UK property, 1 Hyde Park Palace, valued at approximately £50 million and all of the funds in the frozen accounts.

According to the announcement, the agreement had been reached with Malik Riaz to hand over the cash and ownership of the exclusive address, which overlooks Hyde Park. The assets will be given to the government of Pakistan.

The freezing orders were on the cash and assets rather than against any individual, and the settlement is a civil legal procedure that does not mean anyone has been found guilty.

Malik Riaz owns Bahria Town, which is one of the biggest private-sector employers and housing schemes in Pakistan.

So we should expect another increase in transfer fees …

More to come after Dharna party funding case…