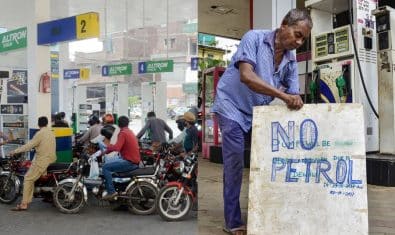

Petroleum Oil and Lubricant sales in the country surged by 39% on a month-on-month basis in May-2020 to 1.48 million tons mainly due to ease in lockdown with the resumption of intercity transport amidst the COVID-19 outbreak and a considerable decline in prices of retail fuels.

Oil Companies Advisory Committee’s data showed that oil marketing companies witnessed a recovery in sales during May when compared to the preceding month.

The rise in demand was mainly driven by a 46% month on month increase in Motor Spirit (MS) while High-Speed Diesel (HSD) demand rose by 25%.

Sales of furnace oil were reported at 144,000 tons, while motor spirit volumes recorded a 46% surge to 636,000 tons during May compared with 435,000 tons in April. Similarly, high-speed diesel sales increased 26 percent to 687,000 tons in May over April.

The economic stabilization measures during FY20 followed by the lockdowns have kept HSD sales depressed during the 11 months of FY20, down 14 percent on a year-on-year basis during the period. Even though declines have been witnessed across all major products, the dip in HSD led the 13 percent decline in total POL sales during year-to-date in FY20.

Pakistan State Oil witnessed a 60% increase in volumes to 622,000 in May compared with April which can be attributed to a 94% increase in volumes of furnace oil, a 72% increase in motor spirit volumes, and a 55% increase in diesel sales.

Attock Petroleum saw an increase of 45% in volumes to 138,000 in May due to a 175% increase in furnace oil sales to 28,000 tons during May remained the major contributor.

Hascol Petroleum’s volumes soared to 117,000 tons, up by 43% in May. The major contributor for Hascol remained diesel, which surged 90% followed by a 20% increase in gasoline. Shell Pakistan’s sales increased by 23% in May on a sequential basis.

All listed companies have experienced depressed sales during the 11 months of FY20. Overall, oil marketing companies’ offtakes declined 13% to 14.7 million tons during the July-May period of 2019/20 compared with 16.9 million tons in the same period last year.

Hascol Petroleum Limited saw the largest decline of 46%, causing it to lose nearly 4% points in market share (mostly taken up by PSO and other smaller OMCs). Shell recorded a notable decrease of 15% during 11MFY20 sales.