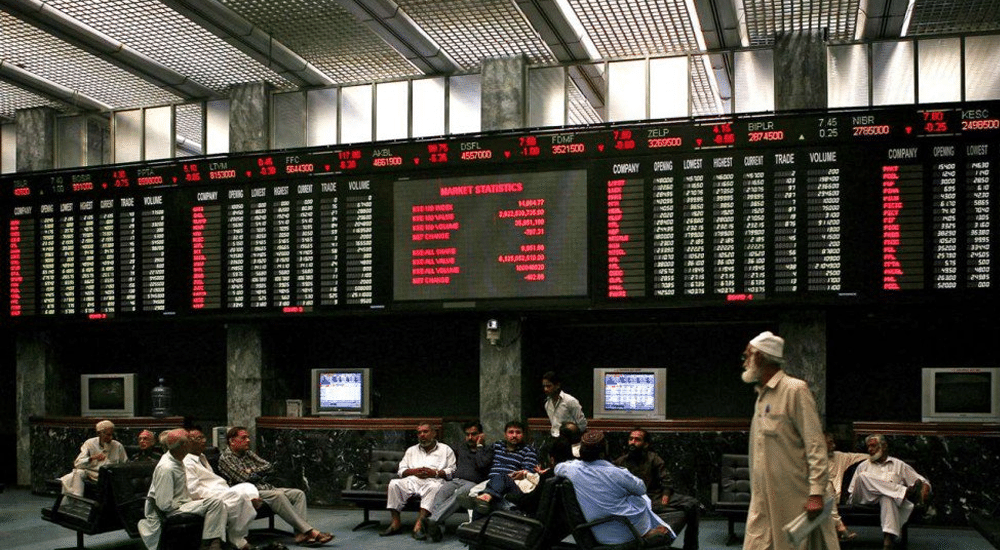

The brokerage house Topline Securities released a report on Monday highlighting the best and worst performing sectors and stocks at the Pakistan Stock Exchange (PSX).

Overall performance of the PSX showed that Pakistan equities returned 5.8 percent during 2020 (5 sessions remaining) in PKR terms. In USD terms, this return is calculated to be 2 percent.

Recovery was witnessed in second half of the year, where KSE-100 gained 25.2 percent (USD: 31.1 percent). In the first half of the year, the index dropped by 15.5 percent (USD: negative 22 percent).

The market capitalization of PSX has reached to Rs. 7.9 trillion ($49 billion), up 2 percent from Dec 2019 closing.

About how the company chose stocks for the best and worst performers, the report explained, “We have filtered sectors having market capitalization $100 million or more and have adjusted returns for right shares and new listings,” adding, “We have not adjusted dividends in calculating sector returns. We have done performance analysis of sectors using classification used by Pakistan Stock Exchange.”

For stocks screening and adjustments, the stocks were screened having a free float capitalization of $10 million. “Returns are adjusted for dividends, bonus and right issues,” the report said.

Regarding the expectations for the upcoming year, Topline Securities said, “We are Overweight on Cements, E&Ps, Banks and Autos for 2021”. A poll conducted by Topline Securities from top notch financial market participants suggests Cements and Banks are likely to be outperformers in 2021 while E&Ps and Autos are likely to underperform.

The top performing sectors were Technology, Vanaspati and Allied segment, and Paper and Board segment.

The report said that the technology sector showed 98 percent return so far in 2020, while broad based gains were witnessed in technology stocks following pattern of global technology stocks. COVID-19 outbreak brought investors attention to this sector due to its lasting impact on bringing economic landscape to normal level.

About the Vanaspati and Allied sector, findings revealed the return of this sector to be above 79 percent, led by Unity Foods (UNITY), which returned 79 percent (adjusted) during 2020. Appreciation in UNITY is attributed to its growth story and robust 1QFY21 results.

Paper & Board sector provided a return of 70 percent due to improved financial results of the companies on the back of higher revenues and better margins.

On the other end of the spectrum were Tobacco, Exploration and Production (E&P), and Power Generation that came out as worst performing sectors.

Topline report said that Tobacco sector lost 36 percent of its market capitalization during 2020 due to rise in duties on cigarettes and decline in its production by 7 percent during 10M2020.

Exploration and Production posted a decline of 23 percent due to restricted payouts of the companies amidst circular debt concerns and lower international oil prices.

And finally, IPPs in Power Generation sector, like E&Ps, also underperformed and lost 16 percent of its market capitalization due to circular debt concerns which contained payout capabilities of the companies.

On the evaluation of individual stocks, an overview of the stock trade over the year shows that tech stocks doubled.

Systems Limited (SYS) was the top performer as the company has given a solid return to investors during 2020 due to strong financial results during 9M2020, wherein revenues and profits of the company are up by 41 percent YoY and 46 percent YoY during 9M2020 despite COVID-19.

Pioneer Cement (PIOC) closely trailed behind. Rebound in cement dispatches and better retention prices resulted in rally in cement stocks during the outgoing year. PIOC topped the return chart in cement sector due to its high operating leverage.

The third best performing stock came out to be TRG Pakistan (TRG). Successful listing of IBEX (indirect subsidiary), surprising 1QFY21 financial results and rally in global stocks led to 197 percent gains in TRG during 2020.

On the other hand, Hascol Petroleum (HASCOL) was a key worst performer during 2020 due to complete erosion of its equity and abnormal losses since 2018. The company was exposed to international oil price and exchange rate volatility.

Philip Morris (PMPK), and Tobacco industry as a whole, underperformed in 2020 due to imposition of duties and 7 percent decline in industry’s cig production (source: PBS).

Likewise, Sui North (SNGP) showed poor performance. Unfavorable changes in treatment of UFG on RLNG coupled with rising circular debt resulted in 40 percent decline in SNGP’s share price.