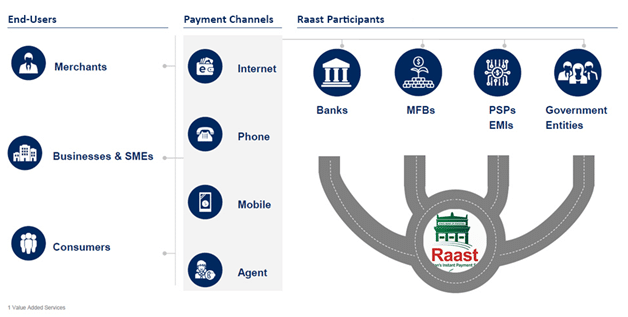

Prime Minister Imran Khan launched Pakistan’s first instant payment system – Raast – to enable end-to-end digital payments among individuals, businesses, and government entities instantaneously.

This state-of-the-art payment system will be used to settle small-value retail payments in real-time while at the same time provide cheap, and universal access to all players in the financial industry, including banks and fin-techs.

The Prime Minister while addressing the gathering termed the launch a major step forward by the State Bank of Pakistan towards Digital Pakistan and said it would help include the low-income groups and make them part of the mainstream economy. He was optimistic that it would go a long way in fighting poverty, particularly in rural areas.

وزیراعظم عمران خان کا ملک کے پہلے فوری ڈیجیٹل ادائیگی کے نظام "راست" کے اجراء کی تقریب سے خطاب۔@StateBank_Pak https://t.co/Y5ftcAbVGq

— Government of Pakistan (@GovtofPakistan) January 11, 2021

Pakistan’s Faster Payment System, Raast, would be used not only to settle small-value retail payments in real-time but also to provide cheap and universal access to all players in the financial industry including banks and fintech.

Imran Khan said the instant payment system would not only document the economy but also generate more taxes to help build the country. He regretted that only two million people in a country of 220 million paid taxes, which was not enough to build hospitals, schools and provide other basic facilities of life for the common man. He said only 3000 of the taxpayers, pay 70% of the tax.

He said Pakistan’s foreign remittances have been constantly on the rise for the past five months and has helped stabilize the Pakistan Rupee. He said after a gap of 17 years Pakistan’s current account has gone into surplus and, lowered pressure on the Pakistan Rupee, and played a key role in strengthening the national economy.

Any pressure on the dollar raises the cost of commodities – like edible oil, ghee, pulses, etc imported for the common man, he said.

Dr. Reza Baqir informed that the Central Bank has been encouraging technological innovations in banking and payment systems for a long time; however, following the vision of the PM and his support it has stepped up its efforts further to accelerate the pace of digitalization in the country.

To modernize the country’s banking and payment systems, SBP has taken various initiatives such as enabling Fintechs and modernizing payments’ infrastructure.

Referring to the National Payments Strategy prepared with the help of the World Bank and announced in November 2019, Governor Baqir remarked that Raast is the first major step taken to implement the strategy.

He highlighted that SBP initiated the project Raast, with the support of Bill and Melinda Gates Foundation and Karandaaz Pakistan, after a thorough review of ground realities about prevailing payment habits and in line with international best practices and standards. The state-of-the-art faster payment system will provide cheap and universal access to the people of Pakistan especially those who are financially excluded and less privileged like women.

Dr Baqir told the gathering that the faster payment system will help spur economic growth especially by facilitating small businesses and individuals. He shared SBP’s plan to launch the system in a phased manner, starting with a bulk payment module which will include digitization of dividend payments, salaries, pensions and other payments of government departments.

Pakistan has had low electronic transactions for several reasons, including low banking penetration, lack of trust, and awareness of digital payment methods, limited interoperability, difficult accessibility, and high cost of transactions.

The Real-Time Gross Settlement System (RTGS) of Pakistan provides instant payment settlements for large value and corporate transactions only. Raast will facilitate retail payment settlements with greater efficiency.

Digital payments only account for 0.2 percent of Pakistan’s approximately 100 billion transactions today, whereas the share of digital transactions in peer countries ranges from 1.5 percent to 7 percent. This can be attributed to the challenges within the payment ecosystem.

ALSO READ

Jazz and NayaPay Team Up For Digitization of Payments

Features of Raast

Raast will provide instant payments services, as it will facilitate near real-time digital payments across individuals, merchants, businesses, and government entities.

It will charge low-to-no transaction costs for end-users. Designed to operate at a cost-recovery model, Raast will make digital payments affordable to end-users of all socio-economic backgrounds.

Raast will be functional on sector-wide interoperability. It will allow all financial institutions to seamlessly connect via a single link to the central infrastructure, making digital payments accessible across any channel to customers of any financial institution.

It will offer customer-centric innovative products and services. Raast will be built on cutting-edge technological standards, allowing financial institutions to develop innovative and user-friendly digital payment products and services (e.g., payment through phone number/email).

Raast will ensure reliability and enhanced security. It will introduce secure payment types, ensure that each transaction is authorized by the payer, and offer enhanced data protection and fraud detection services.

DFSs are extended by Financial Institutions including:

- Banks

There are in total 44 banks, of which there are with a network spanning 16,121 branches. These institutions are licensed to provide a full range of financial services to Pakistanis.

- PSOs/ PSPs

Licensed under the Rules for Payment System Operator/ Payment Services Provider (PSO & PSP) 2014, these institutions are licensed to provide the following services to Pakistanis.

- An electronic platform for clearing, processing, routing, and switching of electronic transactions.

- It can make agreements with banks, FIs, and other PSOs and PSPs merchants, e-commerce service providers, and any other company for the provision of services mandated to the PSO and PSP under the said rules.

3. EMIs

The Electronic Money Institutions (EMIs) offer innovative, user-friendly, and cost-effective low-value digital payment instruments like wallets, prepaid cards, and contactless payment instruments. E-money has played a crucial role in digitizing different types of payments in various countries.

The EMIs in Pakistan will offer interoperable and secure digital payment products and services to end-users.

Under the regulations, prospective EMI applicants are granted EMI license in three stages viz In-Principle Approval, Approval for Commencement of Pilot Operations, and the Final Approval, i.e., License.

4. Government Entities

Government Entities play a significant role in extending Digital Financial Services to Pakistanis. RaastPay enables Dividend Payments, Salary Disbursements, and other Government to Person (G2P) transfers.

ALSO READ

Pakistan’s Instant Payment System is Almost Ready: SBP Governor

Payment Infrastructure in Pakistan

Raast project is an on-going collaboration between Karandaaz and the State Bank of Pakistan (SBP). The project aims to improve the payment infrastructure, with the objectives of further developing digital financial services, reducing reliance on cash, and driving financial inclusion in Pakistan. It will become a core component of Pakistan’s payment infrastructure that will enable individuals, businesses, and government entities to make any payment digitally in a simple, fast, low-cost, and secure manner.

Besides Raast, various payment systems are being operational in Pakistan under the supervision of the State Bank of Pakistan with their designated scope of works, including Large Value Payment Systems (LVPS), Pakistan Real-time Interbank Settlement Mechanism (PRISM), and Retail Payment Systems.

In the next phases, Raast will digitize payments of micro and small business owners or merchants, who can then pay suppliers on time and fulfill other urgent payment obligations. Similarly, the system will provide seamless Person-to-Person payments that will include features such as sending requests for payments and initiating payments using identifiers such as phone numbers or any other alias.

raast koi naam howa :

Unique Name he Business Ko Growth deti hai

Like PayFast

FastPay

PakPAY Etc

Aur Is Main International Payment AliBaba AliExpress Apps Payment ON RAKHO TO BT BANE

Naam english mein hona zrori ha? kindly colonial mind se niklo brother. Grow up

KISI BI SAMIT MY AP KA PEHLA ACHA QADAM RAY-E-RAAST KI JANAB PAISH QADMI HI.

“RAAST” best name in this context.

It is another fraud by State Bank. The claim was made by Dr. Ishtar in his concept paper in 2000. After wasting $ 40 million of world Bank loan we are again being befooled by State Bank and Work Bank.

No real content in such a long article. What is so unique about this Raast system, is it going to replace onelink & mnet ?

How do they plan get organizations to shift to raast when they are already using alternatives for everything possible for more than a decade now.