Moody’s, a credit rating agency, in its latest report, has termed the robust growth in Pakistan’s Islamic banking assets as credit positive for banks.

On 24 March, the State Bank of Pakistan (SBP) released its quarterly Islamic Banking Bulletin for December 2020, which showed that Shariah-compliant banking assets grew 30 percent in 2020.

“The growth is credit positive for Pakistani banks because it attracts customers from the previously unbanked population, which creates new business opportunities and boosts banks’ financial performance,” said the credit rating agency.

ALSO READ

Asset Value of Islamic Banking Industry Surges Over Rs. 4 Trillion

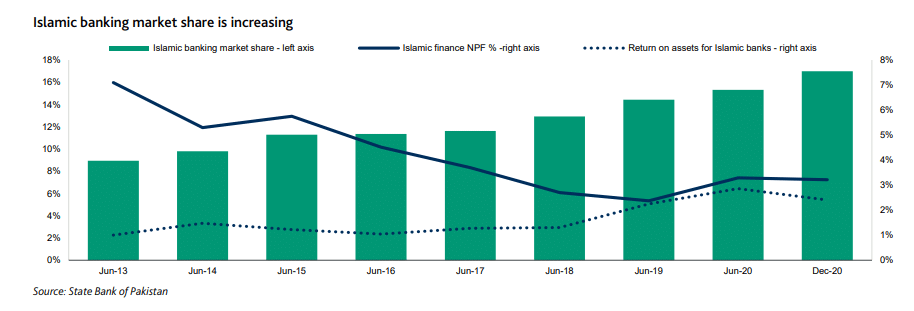

Supported by numerous government and SBP initiatives, Islamic banking assets grew to PKR 4.3 trillion as of year-end 2020, comprising 17 percent of total banking system assets. Islamic deposits have had a 22 percent annual compound growth rate since June 2013, it added.

Despite conventional deposits also growing 11 percent annually since June 2013, Islamic banks’ new clients did not erode the existing conventional depositor base.

Islamic financing (loans) also grew faster than conventional loans and were Rs. 9 trillion, or 23 percent of Pakistani banks’ total loans at year-end 2020 (see exhibit). The profitability of Islamic operations has also been higher, with return on assets for Islamic banking institutions was 2.4 percent at year-end 2020 versus the system average ROAA of 1.8 percent, and Islamic non-performing financing (NPF) was 3.2 percent, lower than the system weighted average of 9.2 percent at year-end 2020.

Moody’s stated that Islamic banking growth would benefit Pakistan’s banking sector because attracting previously unbanked customers facilitates deposit and loan growth while reducing funding costs because of the banks’ access to a large pool of non-remunerated deposits.

Moody’s expects Shariah-compliant banking, which is an integral part of Pakistan’s National Financial Inclusion Strategy (NFIS), to continue growing by targeting customers who prefer Islamic products or are voluntarily excluded or underserved because of their religious belief. According to the enhanced NFIS targets, the government and SBP target an Islamic Banking market share of 25 percent by 2023. The government and central bank are also supporting the sector by introducing a Shariah-compliant regulatory framework and adopting the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) Shariah standard.

ALSO READ

Bridging Gaps in the Local Shariah-Compliant Banking Products Market

During the pandemic, SBP issued numerous Shariah-compliant Islamic finance schemes to pay employees’ wages, purchase new plant and machinery, and purchase medical equipment. SBP also issued Islamic finance government securities and attracted funds from local and Pakistani diaspora investors.

Pakistan’s population is more than 96 percent Muslim, according to the Pakistan Bureau of Statistics, and around 100 million adults are unbanked, according to World Bank Data.

Moody’s believe that all rated banks will benefit from the increase in Islamic banking penetration, especially Habib Bank Ltd. (HBL, B3 stable, caa11), which, at year-end 2020, had a 7.5 percent market share of Pakistan’s Islamic banking assets and MCB Bank Limited (B3 stable, b3) which had a 3.3 percent market share, the largest shares among their rated peers.