By Osama Rizvi

The world has profoundly changed post-pandemic. From our daily lives to companies and from a local organization to the workings of the government, everything has drastically changed. In this regard, the recent phenomenon of rising prices across the globe has become a serious concern for policy-makers and central banks.

ALSO READ

PSX Submits Proposals for Federal Government’s Budget 2021-22

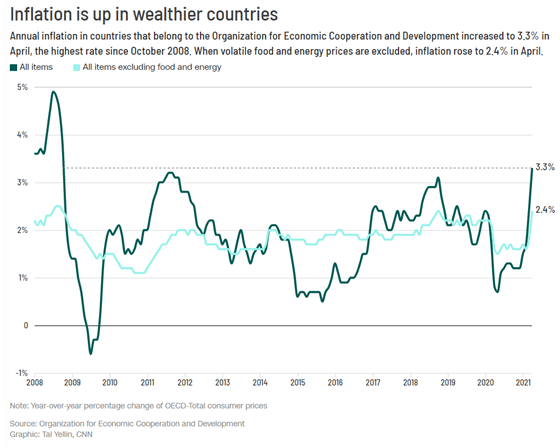

While the signs were always present, the mainstream media only recently took them into consideration. Global inflation has reached levels not seen since 2008, with energy prices among the OECD countries averaging 3.3 percent in April as compared to 2.4 percent in March. In almost 38 countries that account for more than 60 percent of the global economy, there have been price increases such as 4.2 percent in the US (from 2.4 percent) and 3.4 percent in Canada (up from 2.2 percent).

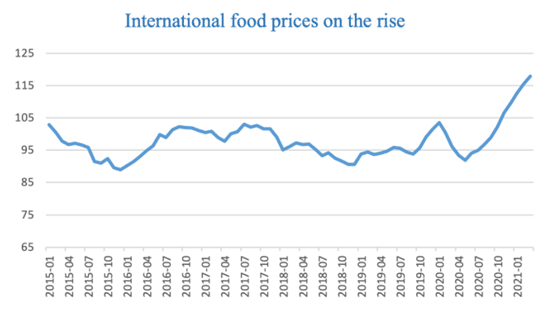

Emerging markets are evidently suffering too, with their currencies not rising in pace with the rise in commodity prices, putting further pressure on their reserves. China, for instance, has started to pass increasing costs to its clients across the world that includes many emerging economies, that in a way are now importing inflation. Global food prices have spiked up to 7-year highs (rising at the fastest pace in 10 years), with sugar prices rising 60 percent.

Source: Voxeu.org

The purpose of mentioning the global scale of these changes is to emphasize the challenges the current government in Pakistan faces as the budget approaches. The two most daunting challenges for the government would be to increase taxation, according to IMF’s new target, and all the while controlling inflation. It will be critical for the government to uphold its promises and stop its already draining political capital.

ALSO READ

Pakistan is Seeing Lower Food Inflation Despite International Price Hikes: NPMC

The Federal Board of Revenue (FBR) of Pakistan has recently gained much applaud, and rightfully so, on crossing a milestone in tax collection. FBR surpassed 4,000 billion in taxes for the first time ever – this amount is 18 percent higher than the same time last year.

This is a laudable achievement, indeed. However, the next year’s target of Rs 5.8 trillion – and according to estimates, the country can collect only Rs 5.3 trillion – will need additional measures such as increasing sales tax and import of oil. However, the government is in talks with the IMF, and this writer believes that it will prove extremely harmful, not only for the government but also for the people contributing to such a target given the context as described above.

ALSO READ

SBP Revises GDP Growth Projection for FY21

We should note that our tax base is still very narrow with the latest figures showing a worrisome fall of 30 percent. It was only recently that the ATL (Active Taxpayer List) crossed 3 million (still very low for a country of more than 220 million population). With rising food prices, stagnant wage rate, and a shrinking job market, this will only create unmanageable pressure for the common man.

Inflation is another critical issue. Pakistan inflation levels have been hovering in the double-digit rate for more than a month now with the recent figures showing the number (CPI) to be at 10.9 percent, with a rise in energy and food prices being the main culprit. Food inflation is even worse, with the number being as high as 15.3 percent in the urban areas and 12.8 percent in rural. In one month, May, chicken prices rose 60 percent.

Albeit the current government has achieved much progress in terms of economy with the latest figures being very promising. However, for the common man, current account surplus and GDP growth would not matter (even though they get affected by it). What matters for them is the price they pay for their food, rent, or bills.

ALSO READ

FBR Planning to Raid Real-Estate Businesses from Next Week to Ensure Compliance

In the months to follow, inflation will worsen (increase) on a global scale. Energy prices are already posting pandemic highs. The amount of money that the Federal Reserve Bank of America (Fed) has injected into the U.S. surpasses 2008 levels. This has created a ripple effect as the U.S. is the largest economy in the world, with inflation levels expected to cross 4 percent next year.

Inflation in the UK has more than doubled in April and there have been alarms regarding this. Fed’s recently released Financial Stability Report has voiced similar concerns. Business inventories across the globe are at their lowest while orders are piling up. This has resulted in rising shipping costs. Resultantly, increasing the prices paid for the businesses.

It is only a matter of time, as it has already started to happen (in China), that it will be passed to the consumers as the effect will be resonated in the global supply chain. As an aftermath of COVID-19 disruptions across the world in the form of rising shipping costs, low inventories, government stimulus, and a skewed resurgence of consumer demand, inflation has started to increase from U. S. to Europe to Asia, Pakistan is, of course, being adversely affected.

ALSO READ

SBP Plans to Offer New Loan Scheme for Cottage Industry

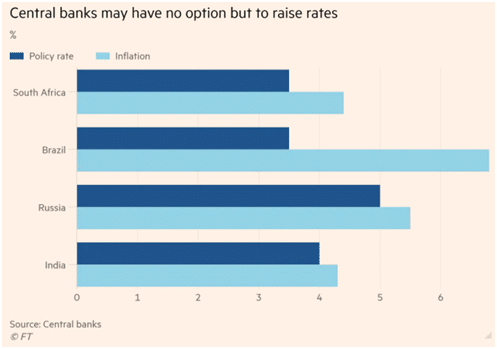

Inflation and the resulting rise in interest rates can cause a domino effect resulting in the outflow of capital from emerging countries and also making commodities further expensive for others. Developing countries such as Pakistan, already under crushing debt, will find it even difficult to pay it creating further pressure on its national exchequer.

All of this presents a tough challenge for Pakistan and the current government. Unfortunately, The upcoming budget will not be an easy one as the whole world is grappling with post-pandemic financial inconsistencies. For the common man, many things will become more expensive. However, prudent policy and constant revision may provide some relief. The situation in Pakistan is only a snapshot of a bigger picture issue that has now enveloped the whole world.

Osama Rizvi is an Energy and Economic Analyst at Primary Vision Network – A U.S.-based big data company that provides market intelligence and consultancy.