The Pakistani Rupee (PKR) finally held out against the US Dollar (USD) and reported zero changes against the greenback in the interbank market today. However, it did hit an intra-day low of Rs. 178.20 against the USD during today’s open market session.

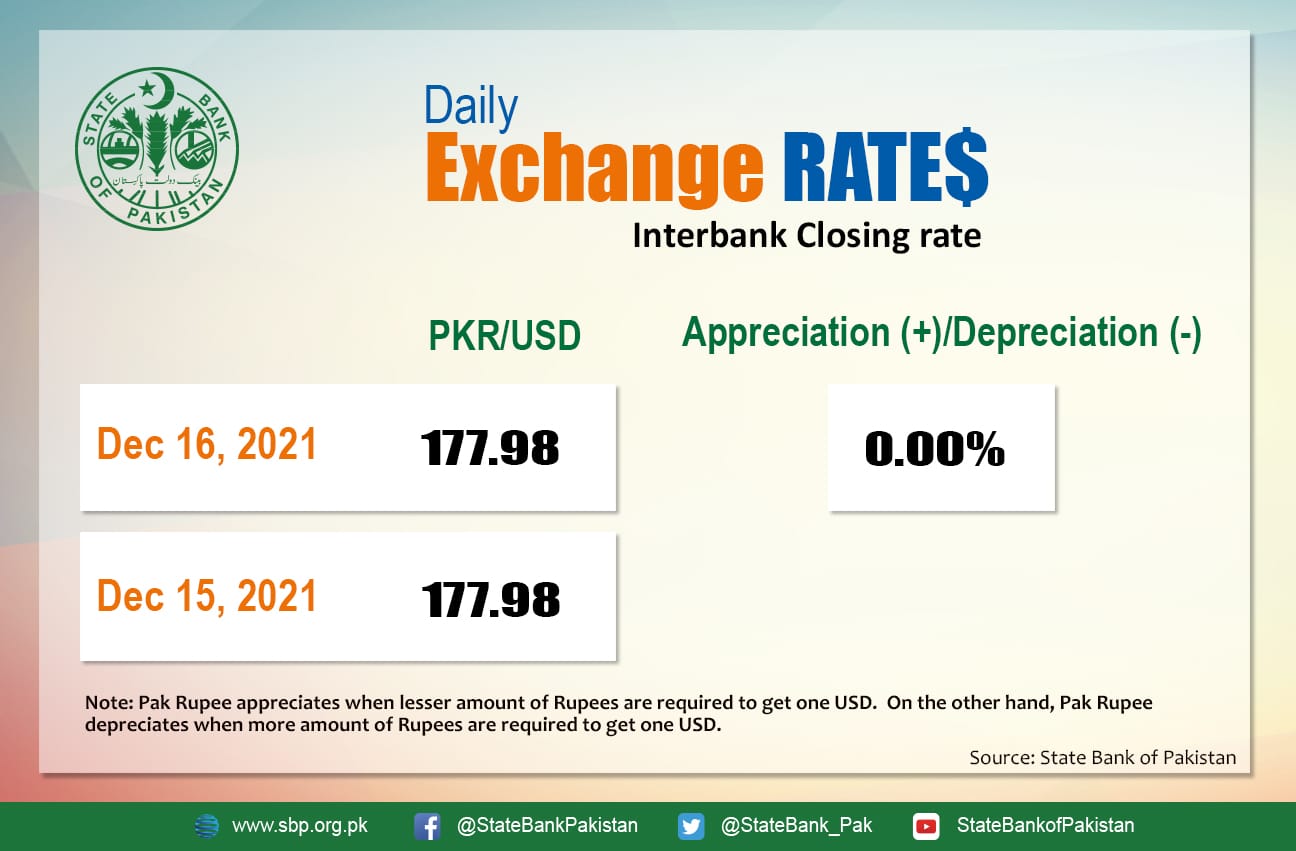

The PKR managed to hold its own against the USD and closed at Rs. 177.98 today after it posted losses of 10 paisas and closed at the same 177.98 level in the inter-bank market on Wednesday, 15 December.

So far, the local currency has lost 12.97 percent on a fiscal-year-to-date basis after recording another historic low yesterday, besides depreciating by 11.36 percent on a calendar-year-to-date basis.

Several financial indicators, including the Central Bank’s Monetary Policy Decision and related inflationary pressures, have offered little leeway for the rupee to settle at comfortable levels. So, today’s holdout provides a little reprieve for the exchange ledger as its focus gradually shifts towards the outcome of the upcoming mini-budget. This instrument, which is worth almost Rs. 550 billion, is expected to help withstand the storm of inflationary pressures, and will, perhaps, shed light on how the local unit will progress in the midst of the near-term economic uncertainty.

Moreover, the International Monetary Fund (IMF) has projected Pakistan’s government gross debt at 83.4 percent of the GDP in 2021.

The government raised funds of Rs. 1.37 trillion on Wednesday through a fresh auction of treasury bills (T-Bills) against the target of Rs. 1.4 trillion and against the maturity of Rs 1.5 trillion. This shows that the rising interest rate is making borrowing costlier for the government and the private sector, and is exerting more pressure on the local unit.

Regarding the PKR’s interbank performance during the trading hours earlier today, the former Treasury Head of Chase Manhattan Bank, Asad Rizvi, said, “Despite several attempts, [the] PKR continues to trade around 178, as it failed to move beyond. Y’day Forward & Fx Swap Points, which is below interest rate parity, eased further by 20-40 paisa[s]. It suggest[s] [that] banks are SHORT of USD, or tight in NOSTROs & opted for B/S swaps”.

INTER BANK

Despite several attempts #PKR continues to trade around 178, as it failed to move beyond.

Y’day Forward & Fx Swap Points, which is below interest rate parity eased further by 20-40 paisa. It suggest banks are SHORT of USD or tight in NOSTRO’s & opted for B/S swaps.— Asad Rizvi (@asadcmka) December 16, 2021

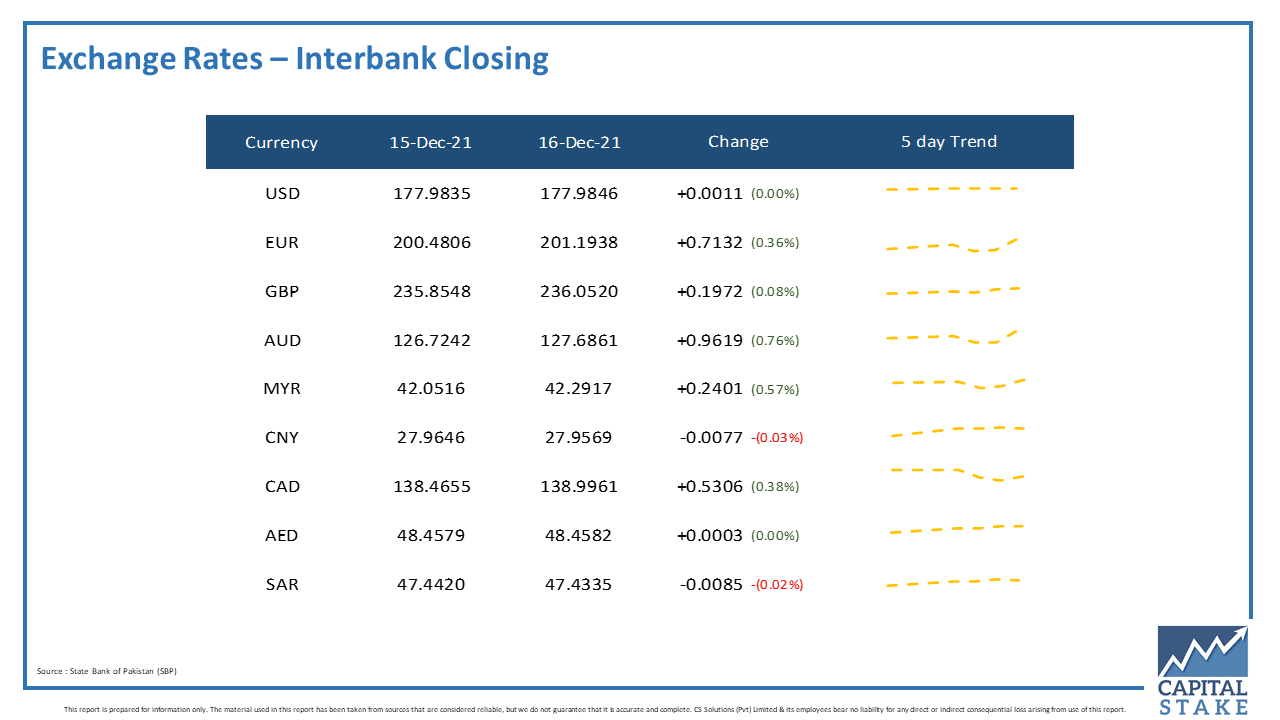

Conversely, the PKR maintained its declining trend against most of the other major currencies. It posted losses of 19 paisas against the Pound Sterling (GBP), 96 paisas against the Australian Dollar (AUD), and 71 paisas against the Euro (EUR).

It depreciated against the Canadian Dollar (CAD) and posted losses of 53 paisas in today’s interbank currency market.

Interestingly though, the Rupee managed to hold out against both the UAE Dirham (AED) and the Saudi Riyal (SAR) in today’s interbank currency market.