The Pakistani Rupee (PKR) continued its record-breaking fall against the US Dollar (USD) and reported losses in the interbank market today. The local currency lost Rs. 2.09 against the greenback at the close of the session today. This is the biggest single-day loss that the local currency has reported in over a year.

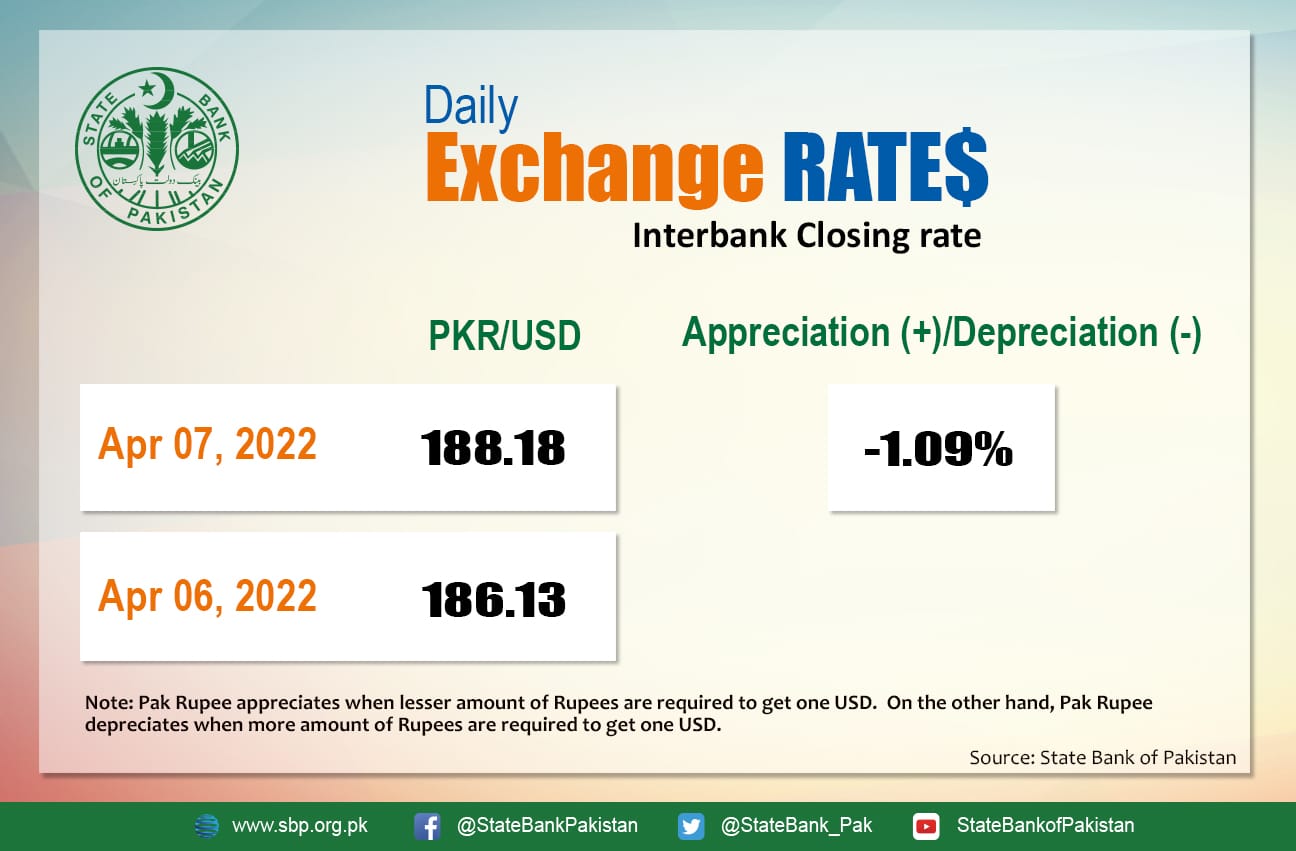

It depreciated by 1.09 percent against the USD and closed at Rs. 188.18 today after losing 89 paisas and closing at Rs. 186.13 in the interbank market on Wednesday, 6 April. The domestic currency hit an intra-day low of Rs. 189.00 against the USD during today’s open market session.

So far, the PKR has lost Rs. 11.67 against the US$ during the calendar year 2022. On a fiscal-year-to-date (FYTD) basis, the local unit has depreciated by 19.45 percent or Rs. 30.63 against the dollar.

Economic Analyst, A. H. H. Soomro, told ProPakistani,

There is a free fall in the currency market. An extreme form of uncertainty is prevailing the country. There is no ownership, and we are rattled with heightened domestic political ambiguity and unfavorable global commodity prices. The Supreme Court’s verdict is going to increase the noise further. There is a clash of titans and ants are being slaughtered. Businesses, masses and government are all in pain. This is as bad as it can get.

He added that the current situation “requires an immediate SBP hike, the announcement of a caretaker government, or the resumption of voting on no-confidence motion in NA. Whatever is needed, it is needed NOW”.

Pakistan’s bond and currency markets have come under severe pressure amid rising political uncertainty in the country. Economic and political uncertainties have soared considerably since Prime Minister Imran Khan dissolved the National Assembly (NA) on Sunday.

The political noise increased further when the Deputy Speaker of the Punjab Assembly, was not allowed to conduct voting of the Punjab Chief Minister. Currently, the case is with the Supreme Court and the announcement is expected soon.

On the flip side, market statistics indicate that the 6M Kibor is at a 2-year high of 13.19 percent as such rates were last seen in March 2020. The 6M Kibor is also up 200 basis points since March 8, 2022, when the no-confidence motion was moved in NA by the opposition parties.

Similarly, 3-year and 5-year bonds are also at an almost 2.5-year high of 12.7 percent and 12.5 percent, respectively. Since March 8, 2022, yields have gone up by around 130 basis points.

Just like the bond market, the currency market has also come under severe pressure as the dollar briefly crossed an all-time high of Rs.189 in the interbank market today, a 6 percent hike since the no-confidence motion was moved.

Weakness in currency coincides with dwindling forex reserves which have dropped to $12 billion as of March 25, 2022, from a peak of $20 billion as of August 27, 2021. It More or less, other factors including the deferment of the IMF program, Chinese debt repayments, and the rising current account deficit have added substantial pressure on foreign exchange reserves. As a result, the import cover has fallen from 3 months of import in August 2021 to two months.

Pakistan Eurobond yields have also been rising, with yields on bonds maturing in 2024 having increased to 17.3 percent versus 5 percent in December 2021 amid rising default risk. Similarly, the 2025 bond is also up from 5.72 percent in December 2021 to 15.99 percent.

Market players suggest that clarity on the political situation and relations with IMF will remain the key to Pakistan’s economic, currency, and bond market outlook. Adjustments in policy rates and petrol price hikes will also remain key going ahead.

Discussing the local currency’s performance earlier during the day, the former Treasury Head of Chase Manhattan Bank, Asad Rizvi, commented that unless and until political tensions subside, the interbank market will remain uneasy and directionless. Overall, the economy is in jeopardy as a result of volatile market circumstances.

He added, “Though the PKR is undervalued, but SBP will desist from direct intervention & will continue with its ongoing policy”.

INTER BANK MARKET

Unless political tension subsides I/B market will remain jittery & directionless.

Over all economy is at risk due to uncertain market condition.

Though #PKR is undervalued, but SBP will desist from direct intervention & will continue with its ongoing policy

— Asad Rizvi (@asadcmka) April 7, 2022

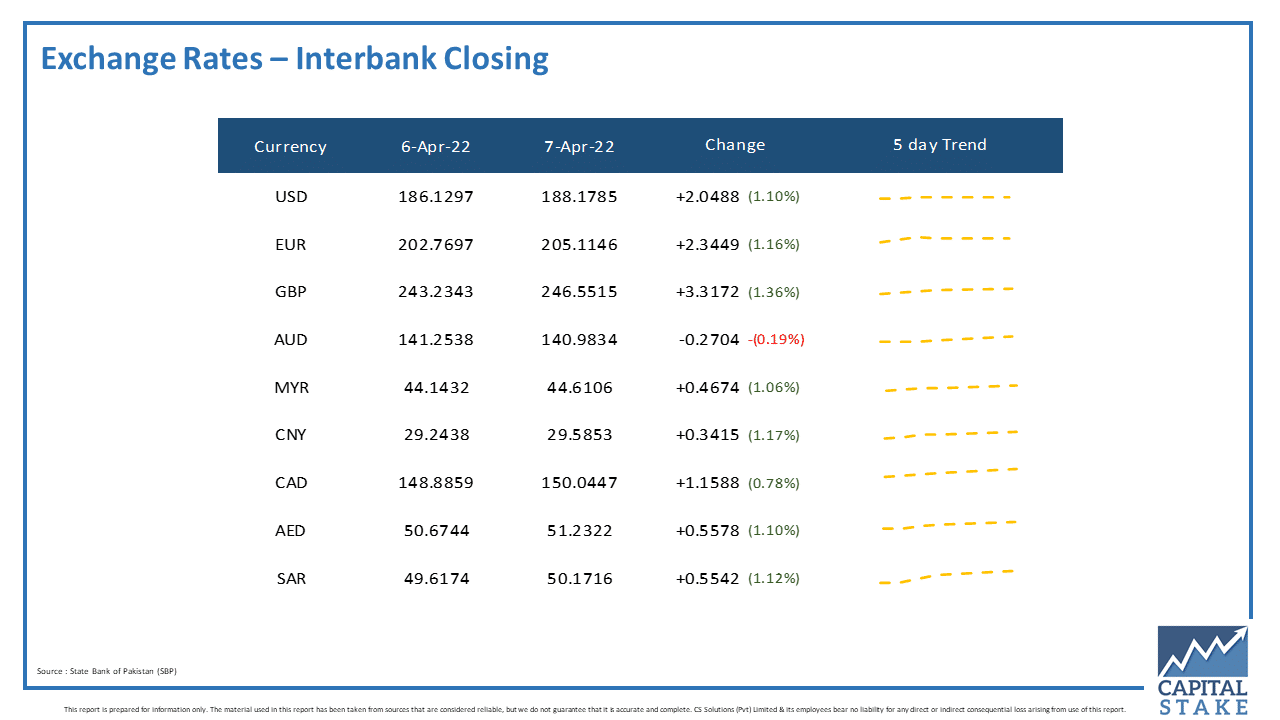

The PKR struggled against most of the major currencies and reported losses in the interbank currency market today. It lost 55 paisas against both the Saudi Riyal (SAR) and the UAE Dirham (AED), Rs. 1.15 against the Canadian Dollar (CAD), Rs. 2.34 against the Euro (EUR), and Rs. 3.31 against the Pound Sterling (GBP).

Conversely, it gained 27 paisas against the Australian Dollar (AUD) in today’s interbank currency market.