The Pakistani Rupee (PKR) halted gains against the US Dollar (USD) and posted huge losses in the interbank market today.

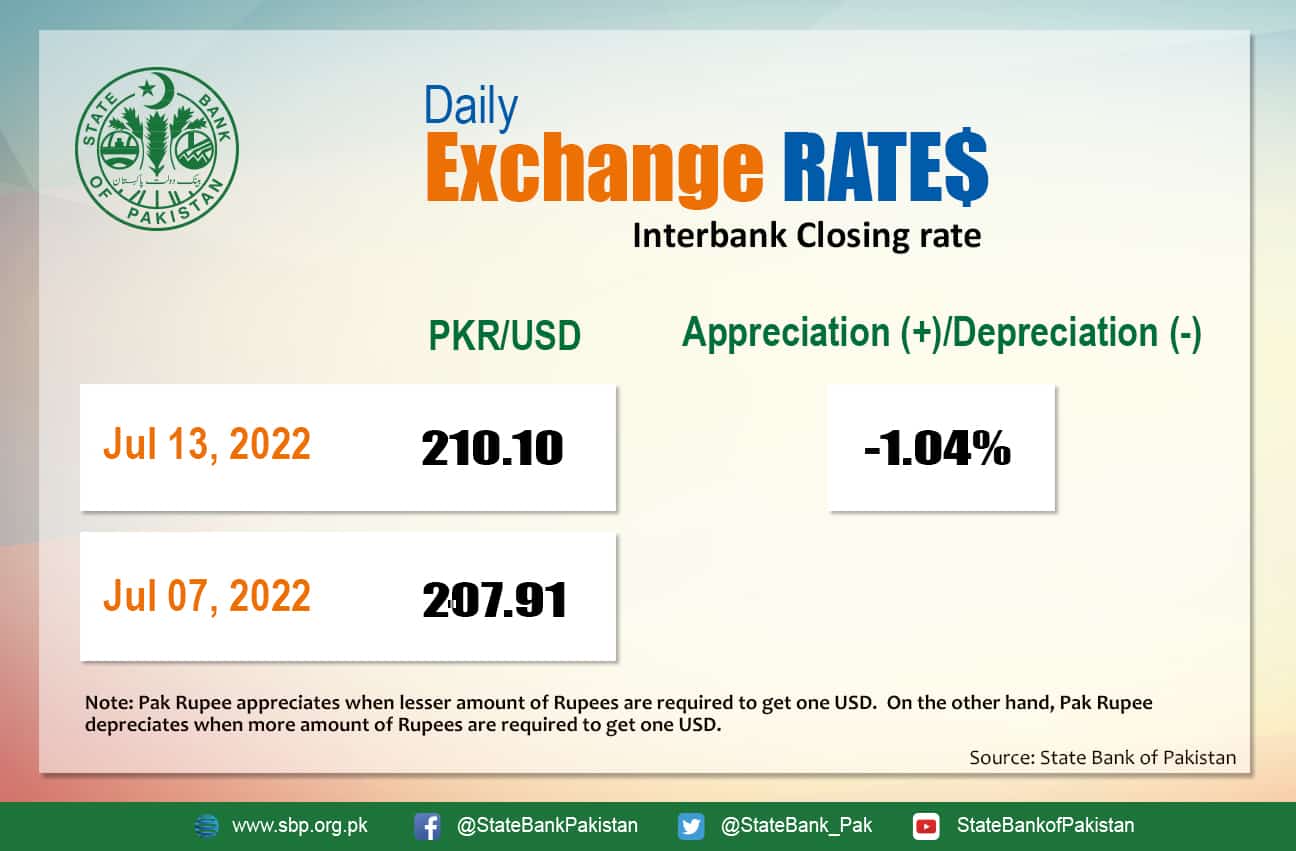

It depreciated by 1.04 percent against the USD and closed at Rs. 210.10 after gaining eight paisas in the interbank market today. The local unit hit an intra-day low of Rs. 210.25 against the USD during today’s open market session.

The local unit closed in red against the dollar today despite news that the prices of petroleum products are likely to decrease further by up to Rs. 20-25 per liter on July 15 following global price movements and home politics.

On Tuesday, Prime Minister Shehbaz Sharif tweeted that he has “ordered Ministries of Petroleum & Finance to pass on the reduction in the prices on POL products in the international market to people”.

Currently, the per liter price of petrol is Rs. 248.74. On 30 June 2022, the federal government increased petroleum prices by Rs. 14.85, which took the cumulative amount of all hikes since May 26 up to Rs. 132 per liter. The hike was planned in order to meet the petroleum levy target agreed with the International Monetary Fund (IMF) for reviving stalled $6 billion bailout program. To recall, Pakistan recently agreed with the agency on a schedule to increase the prices of petroleum products by imposing a 17 percent general sales tax (GST) and PDL of Rs. 50 per liter during FY23.

Today’s tumble also showed that the rupee has devalued against the dollar to as low as the Euro for the first time in Pakistan’s history. Globally, the euro dropped below $1.02 this week, continuing its slide to new 20-year lows and potential parity with the US dollar.

The eurozone’s shared currency has been steadily declining as worries of a recession grow, fueled by increased uncertainty over the bloc’s energy supply, with Russia threatening to limit gas supplies to Europe.

In terms of global commodities impacting progress at home, oil prices moved higher on Wednesday, a day after falling below $100 a barrel for the first time since April, but gains were restricted by a supply report showing swelling stocks and caution ahead of US inflation data. Brent is down sharply since jumping as high as $139 in March, close to the all-time high reached way back in 2008.

Despite a tight physical oil market, speculators have sold oil futures on concerns that aggressive interest rate hikes to combat inflation will hinder economic development and reduce demand for oil.

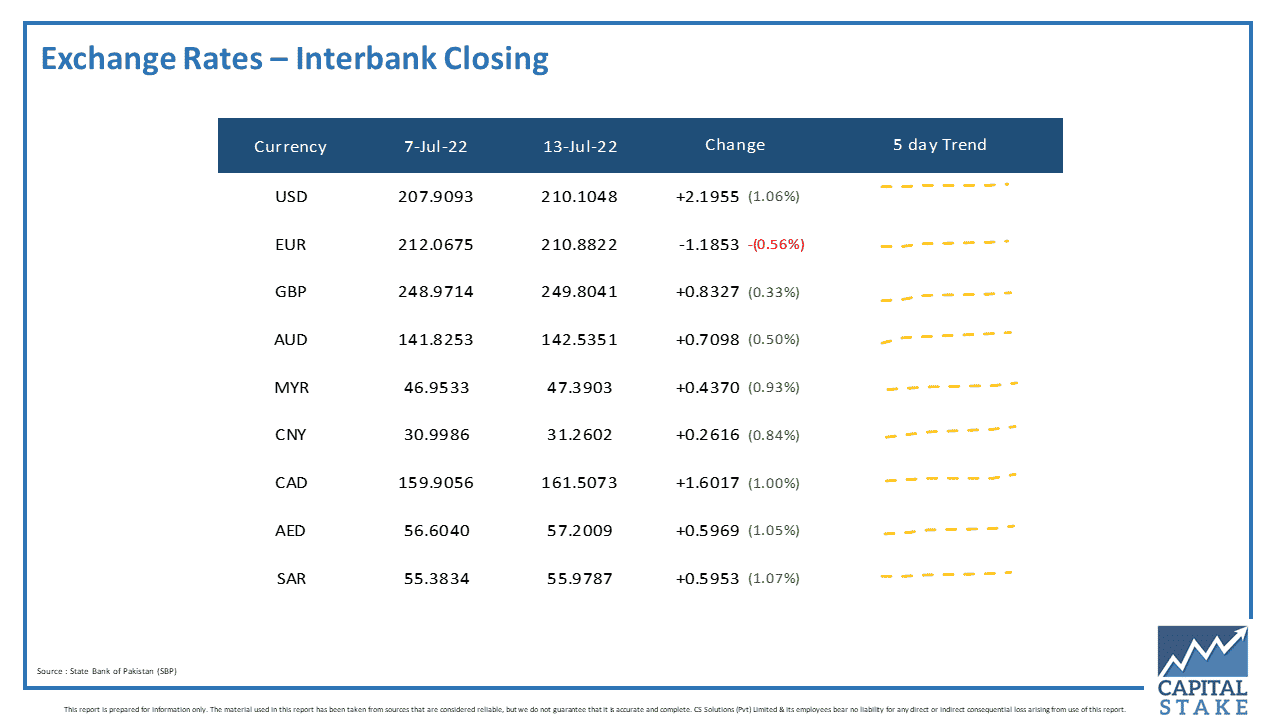

The PKR slid against most of the other major currencies in the interbank market today. It lost 70 paisas against the Australian Dollar (AUD), 83 paisas against the Pound Sterling (GBP), and Rs. 1.60 against the Canadian Dollar (CAD),

It lost 59 paisas against both the Saudi Riyal (SAR) and the UAE Dirham (AED), and Rs. 1.18 against the Euro (EUR) in today’s interbank currency market.

I don not have sufficient balance

nice

What does it have to do with PKR crash