The Pakistani Rupee (PKR) again reversed gains against the US Dollar (USD) and posted losses during intraday trade today.

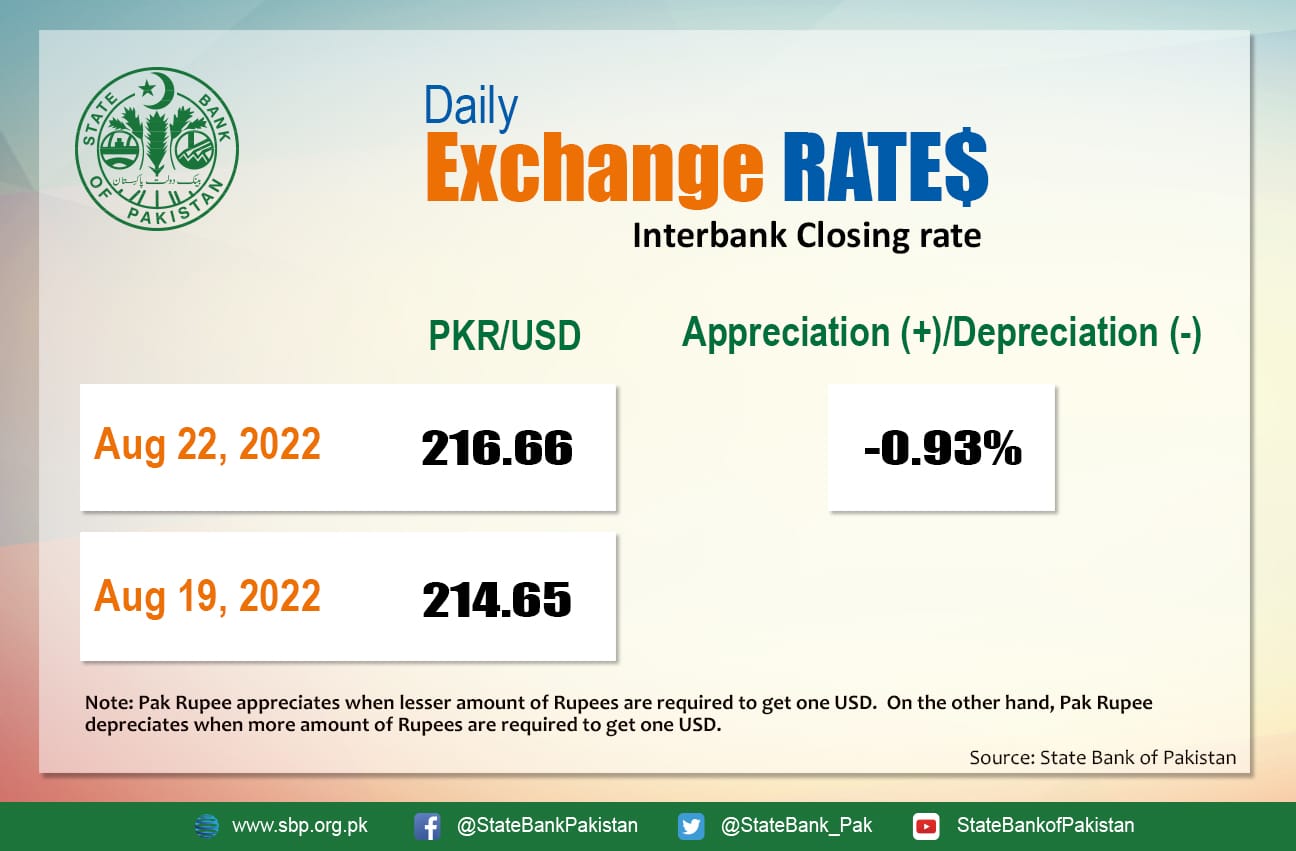

It depreciated by 0.93 percent against the USD and closed at Rs. 216.66 after losing Rs. 2.01 in the interbank market today. The local unit quoted an intra-day high of Rs. 214.625 against the USD during today’s open market session.

The local unit was all red when trade resumed early in the morning against the greenback and traded at Rs. 214.7 in the open market at 10:05 AM. By midday, the greenback went as high as 215.625 against the rupee. After 2 PM, the local unit was trading between the 215-217 level against the top foreign currency before the interbank close.

The rupee reversed Friday’s gains against the dollar today after reports that currency markets in Pakistan are facing a dirham shortage after the United Arab Emirates (UAE) notified Islamabad that Pakistanis traveling to the Gulf state must have AED 5,000 with them.

Money changers have said the local unit could face added pressure as the AED shortage significantly increased the price of US$ against the PKR during intraday trade today.

Globally, oil prices were steady on Monday after briefly falling during early hours of the day as a relatively tight global supply picture competed with fears of a recession and a rising dollar. Overall, supply remains congested, with the operator of a pipeline supplying about 1 percent of global oil through Russia saying it will cut output again because of faulty equipment.

Brent crude had hit nearly $140 per barrel in March but has since trickled down as inflation hit multi-decade highs across the globe. The benchmark crude product was down by 0.05 percent at $96.67 per barrel, while the US West Texas Intermediate (WTI) edged above $90 and went up by 1 percent to settle at $90.79 per barrel.

Dollar Runs Riot Worldwide

Economies across the globe are scrambling for directions once again, pushing the resurgent US dollar to its highest level in nearly two years against China’s Yuan and back through parity with the Euro (EUR). While the United States faces the unenviable task of trying to calm down irrational summer markets, China’s central bank went in the opposite direction on Monday, cutting key interest rates.

Even though crude oil prices fell slightly on Monday, benchmark European natural gas rates increased by 10 percent, taking them to nearly 600 percent higher than a year ago.

With this month’s overall business sentiment readings, the EUR retreated to parity with the dollar for the first time in over a month, while the British Pound Sterling (GBP) fell.

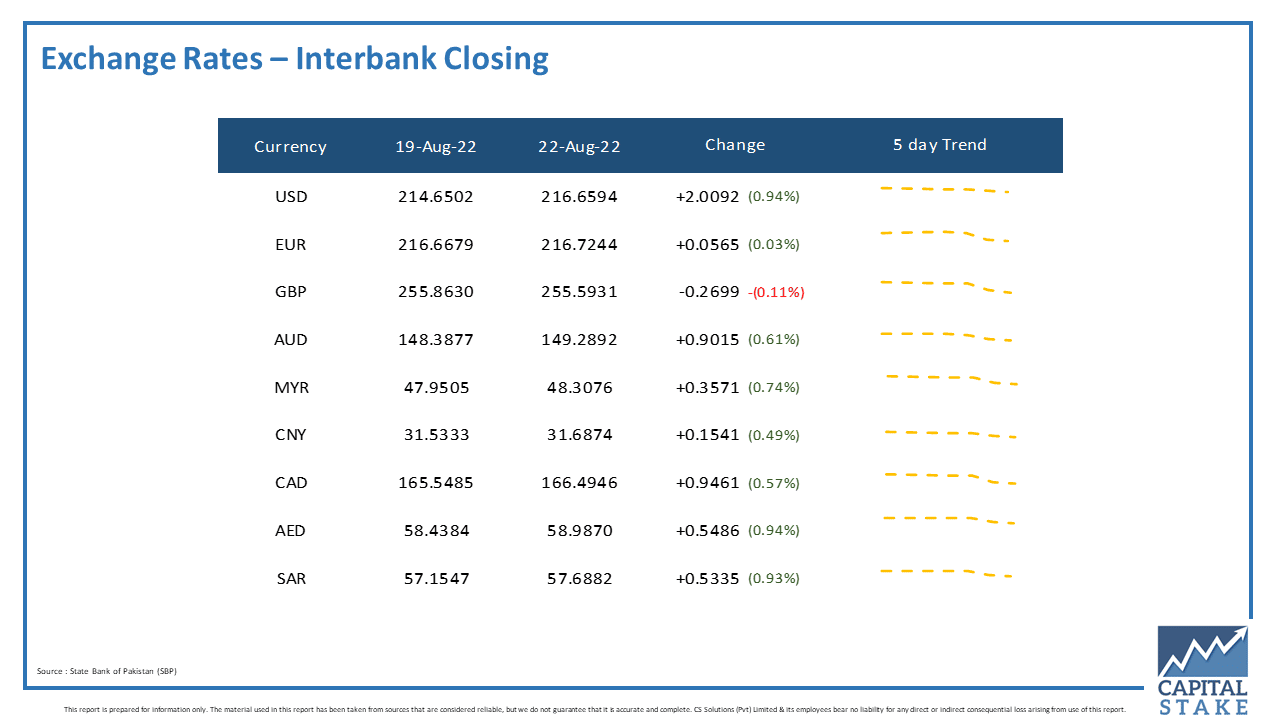

The PKR fell against most of the other major currencies in the interbank market today. It lost five paisas against the Euro (EUR), 53 paisas against the Saudi Riyal (SAR), 54 paisas against UAE Dirham (AED), 90 paisas against the Australian Dollar (AUD), and 94 paisas against the Canadian Dollar (CAD).

Conversely, it gained 26 paisas against the Pound Sterling (GBP) in today’s interbank currency market.