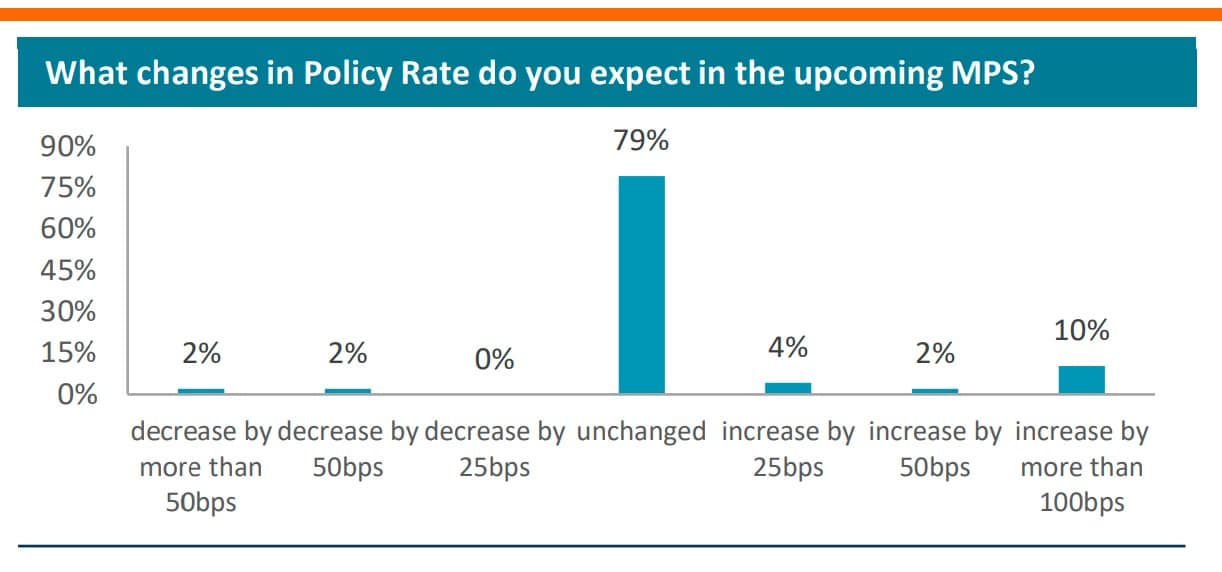

A poll conducted by Topline Research found that 79 percent of market participants are of the view that there will be no change in the interest rate in the upcoming Monetary Policy announcement scheduled for November 25, 2022.

The survey shows that a majority, 79 percent of the participants, expect the policy rate to remain at 15 percent, while around 16 percent of the participants anticipate an increase, while 5 percent expect a decrease in the policy rate.

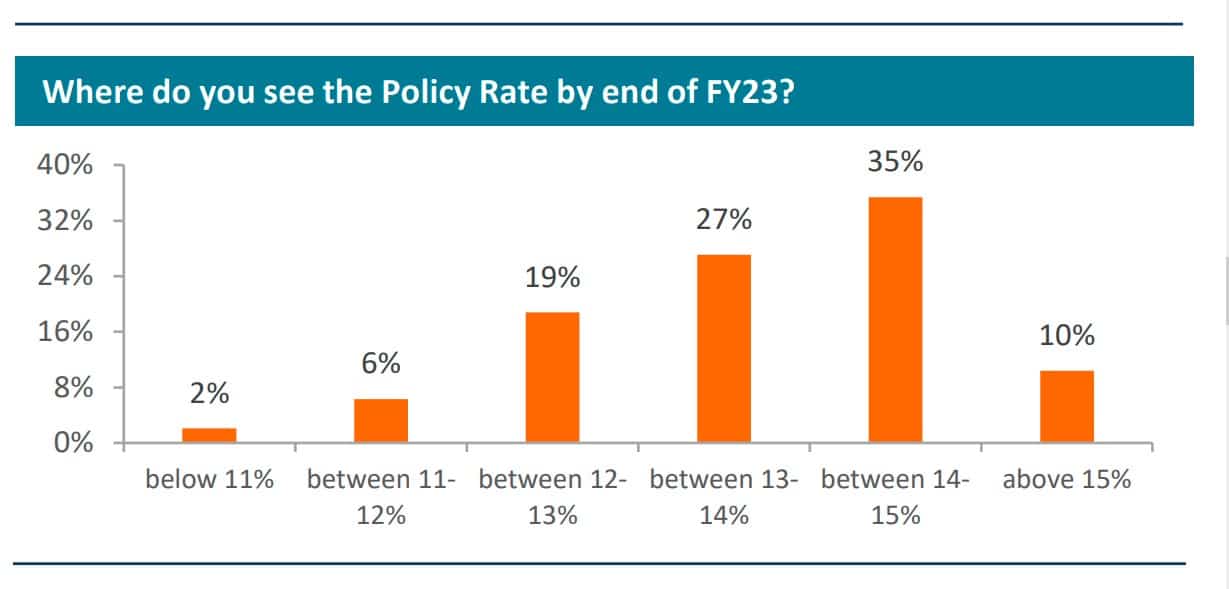

The poll also shows that a majority is of the view that the policy rate will be lower than what it is currently by the end of the fiscal year (FY) 2023. 35 percent of the participants anticipate the policy rate to be in the range of 14 to 15 percent, 27 percent expect the policy rate to be in the range of 13 to 14 percent, and 19 percent of the participants expect it to be in the range of 12 to 13 percent by June 2023.

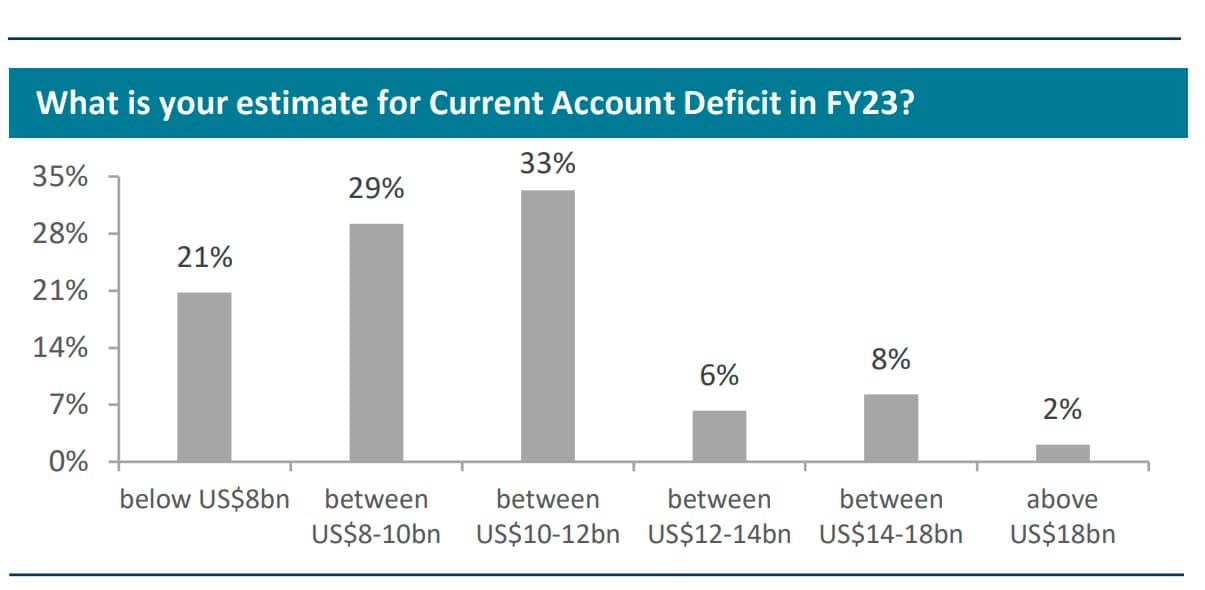

In terms of the outlook for the current account deficit (CAD), 62 percent of the participants expect the CAD to be in the range of $8-12 billion in FY23, while 21 percent expect it to be below $8 billion in FY23. 16 percent of the participants expect CAD to be over $12 billion in FY23. To recall, CAD in FY22 clocked in at $17.4 billion, led by a sharp uptick in imports.

The survey expects that the policy rate will remain unchanged and that it is currently at its peak, while anticipating a decline in the policy rate in the second half of FY23.

Moreover, since the last monetary policy statement on October 10, 2022, consumer price index (CPI) inflation increased to 26.6 percent in October 2022 as compared to 23 percent in September 2022, but this was primarily due to a major adjustment in electricity tariffs, which will not be recurring.

Furthermore, imports fell 13 percent in October 2022, and the trade deficit fell to $2.3 billion in October 2022, down from $2.9 billion in September 2022. This is likely to keep a check on CAD going forward and will be a key driver in the State Bank of Pakistan’s (SBP) monetary policy stance.

Moreover, floods and monetary and fiscal tightening measures have led to a slowdown in aggregate demand, which could lead SBP to opt for the status quo, the survey anticipates.