The Pakistani Rupee (PKR) was bearish against the US Dollar (USD) and posted losses during intraday trade today.

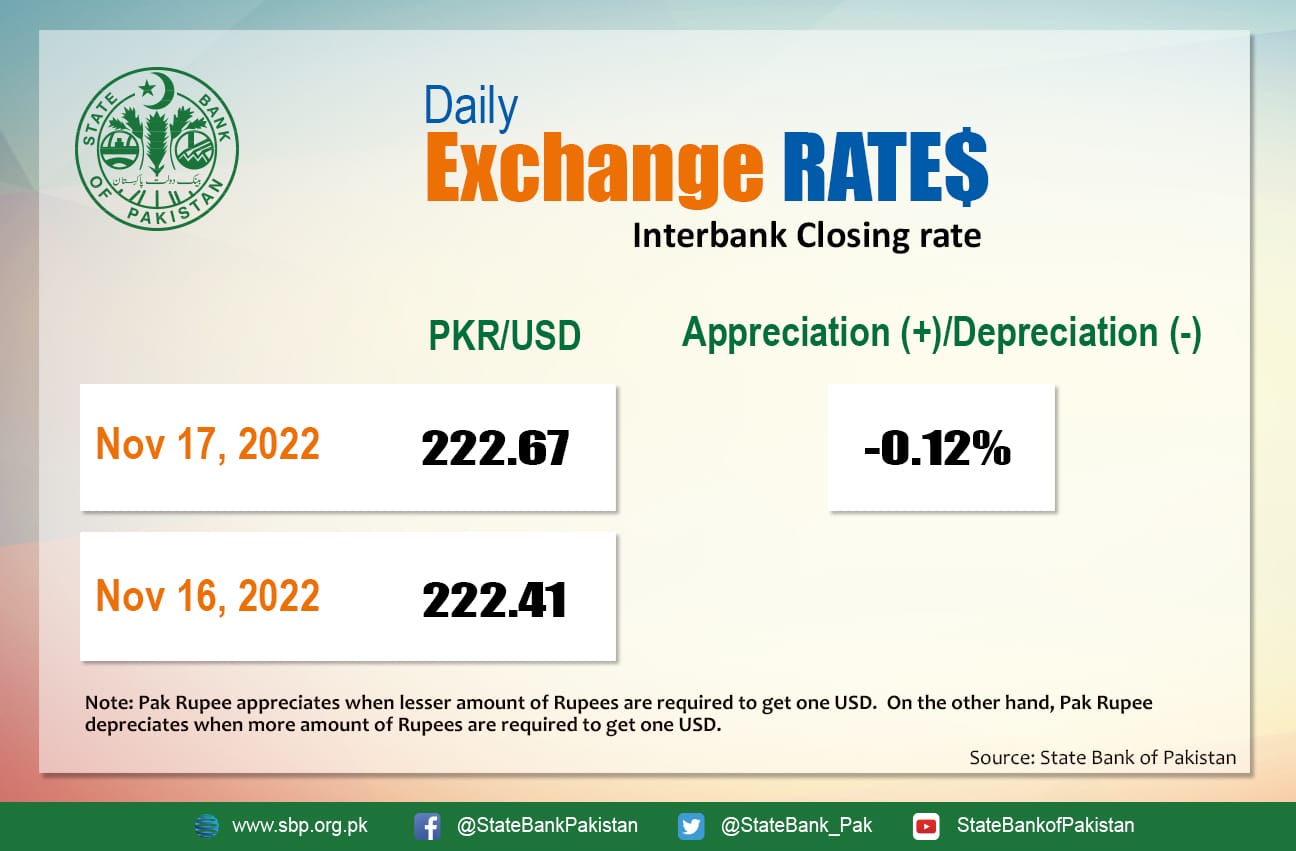

It depreciated by 0.12 percent and closed at Rs. 222.67 after losing 25 paisas against the greenback. The local unit quoted an intraday low of 222.97 against the greenback.

The local unit was all red in the morning against the greenback and opened trade at 222.56 in the open market. By midday, the greenback moved higher against the rupee. After 1 PM, the local unit was red and stayed on the 222-223 level against the top foreign currency before the interbank close.

The rupee reported losses for the fifth consecutive day against US Dollar today.

Money changers said there is a shortage of dollars in the open market due to insufficient supplies and customer reluctance to sell dollars. Remittances have slowed as well. Furthermore, the ongoing political unrest, as well as a delay in negotiations between the International Monetary Fund and Pakistan for the completion of the ninth review of the Extended Fund Facility, weighed heavily on investor sentiment.

Broadly, markets were bearish with Pakistan’s benchmark 5-year Credit Default Swap (CDS) spiking on 16 November to 79.3 percent.

Pertinently, Pakistan’s debt and liabilities profile increased by Rs. 2.768 trillion to Rs. 62.466 trillion from Rs. 59.698 trillion during the first quarter of the current fiscal year.

Globally, oil prices fell on Thursday, weighed down by easing concerns about geopolitical tensions and Chinese demand concerns, though signs of tighter supply, such as lower US inventories, lent support.

At 3:45 PM, Brent crude was down by 0.29 percent at $92.59 per barrel, while the US West Texas Intermediate (WTI) slid by 0.56 percent to settle at $85.11 per barrel.

Crude markets were red after Poland and NATO said on Wednesday that a missile that crashed inside NATO member Poland was most likely a stray fired by Ukraine’s air defenses rather than a Russian strike, allaying fears that the conflict between Russia and Ukraine would spill over the border.

Official figures showed that US crude stocks slid by more than 5 million barrels in the most recent week, more than analysts had predicted. In November, supply tightens as OPEC and its allies, known as OPEC+, implement their latest output cut designed to help the market.

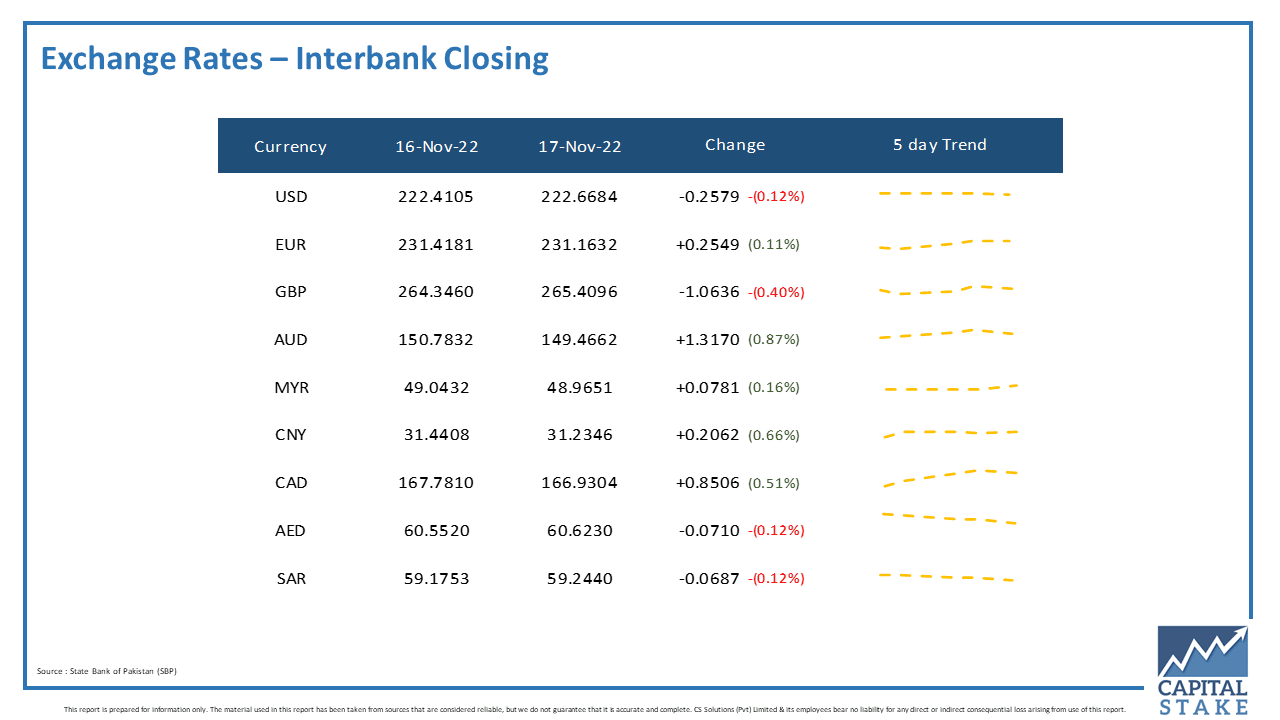

The PKR was bullish against most of the other major currencies in the interbank market today. It gained 25 paisas against the Euro (EUR), 85 paisas against the Canadian Dollar (CAD), and Rs. 1.31 against the Australian Dollar (AUD).

Conversely, it lost six paisas against the Saudi Riyal (SAR), seven paisas against the UAE Dirham (AED), and Rs. 1.06 against the Pound Sterling (GBP) in today’s interbank currency market.