Drama ensued last week when Pakistan’s benchmark 5-year Credit Default Swap (CDS) sharply reduced to 71 percent from 123 percent while the country’s likelihood of defaulting on its debt – scheduled for the one-year period – spiked to a little over 10 percent.

The default fever has cooled down since then, with yield hunting back to average blows of mid-July.

Many metrics factored in for the two distinct indicators, but logic decided to go out for a stroll when Finance Minister Ishaq Dar on Friday gave the idea that CDS and debt probability are the same metrics.

“Inflation and recession fears have rattled markets and exposed cracks in credit markets. The expectation is that a country’s lead on finance would be more well-versed on the subject, but his take on the issue was an unexpected delight for dissidents, and rightfully so,” a policy expert told ProPakistani.

CDS cracked

A CDS is the cost of buying insurance on debt. The buyer buys protection against the chances that the issuer of the debt may default over a given period.

In our case, the Government of Pakistan is the debt issuer, and entities such as banks, hedge funds, and mutual funds are the buyers. Sometimes retail investors who like to invest in swaps through exchange-traded funds (ETFs) also partake in advice from private equity rating agencies like Moody’s and Fitch.

In today’s terms, a 71 percent CDS for Pakistan means that someone is willing to pay 71 cents to insure their $1 loan. More importantly, a one-year default probability of 10 percent is worrying since this number was well below the single digits only 6 months ago.

The expert added, “Fundamentals are relatively entrapped and the default rate may rise slightly in 2022-23 due to idiosyncratic factors. While this happens, it is important to remember that they are rising from historically low levels that are not sustainable over a cycle. Only a strong fundamentals backdrop will help bring default risk below 5 percent in 2022 and below historical averages throughout 2023”.

Pertinently, a sovereign Sukuk of $1 billion is due for repayment on December 5, 2022. The payment isn’t expected to make any changes to Pakistan’s debt sustainability assessment in the Fitch-denominated ‘Caa1’ category, which was assigned to the country’s dollar bonds earlier in October.

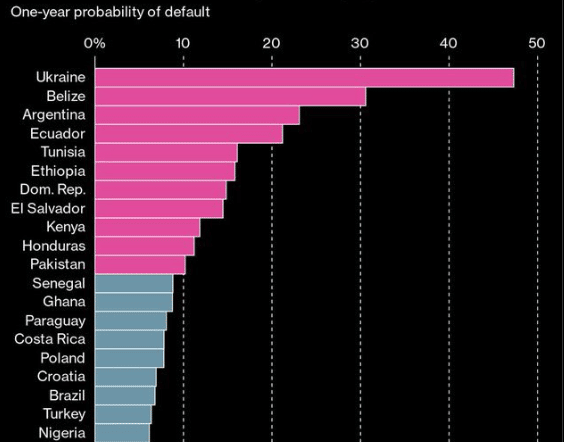

Pakistan’s Debt Profile Worse than Senegal, Ghana, Nigeria

Currently drooling over an incoming $13 billion investment from bilateral investors in the coming 3 years, the cash-strapped South Asian nation has a worse debt profile than some of Africa’s nations. According to Bloomberg data, the estimated default probability of Senegal and Ghana is below 9, while Nigeria sits well below 8.

For Pakistan, debt markets are indicating a growing gap between emerging market (EM) corporate borrowers and their sovereign counterparts, as concerns grow about the country’s ability to refinance at higher rates.

While corporate and sovereign EM debt risk premiums were low at the start of 2022, insurance entities are still demanding over 7,000 basis points (~71 percent) more from investors as premiums against risk portfolios in Pakistan’s dollar-denominated bonds.

On the buyer (investor) side, the cost of incurring new debt is prohibitively expensive, effectively keeping high-rated investors out of the market. Those who have successfully placed bonds face exorbitant fees and imminent downgrade from rating agencies. More significantly, keeping in view the State Bank of Pakistan’s (SBP) recent monetary policy announcement, a tighter policy rate of 16 percent has fueled the cost of doing business in Pakistan, making debt payments more expensive and reducing liquidity available to the nation.

On the issuer (Pakistan) side, EM borrowers are suffering not only from tightening monetary policy but also from increased currency volatility, which often makes hard-currency debt payments more expensive for EMs.

As of 25 November, the five-year third Pakistan International Sukuk Company Limited yield increased by 1,724 basis points to 170.99 percent. The yield on a 10-year Eurobond maturing on April 15, 2024, decreased from almost 65.25 percent to 64.41 percent. The yield on the 10-year Eurobond maturing on September 30, 2025, decreased from 46.62 percent to 46.28 percent.

The debt profile isn’t doing any favors to other indicators as well. To note, inflation is above 26 percent, reserves have fallen below $8 billion, remittances are down 9 percent and foreign direct investments have dipped by over 50 percent since the beginning of the new fiscal year.

Pakistan has a tough few years ahead, and the default scare might just be the beginning.

Will Pakistan default in the months to come? Let us know what you think in the comment section below.