The Federal Board of Revenue (FBR) will charge a reduced rate of 15 percent customs duty on the import of components for the assembly/manufacture of new motor cars including station wagons and racing cars.

The FBR issued SRO.02(I)/2022 to amend the SRO.656(I)/2006 here on Monday.

Earlier, a 32.5 percent customs duty was applicable on the same components.

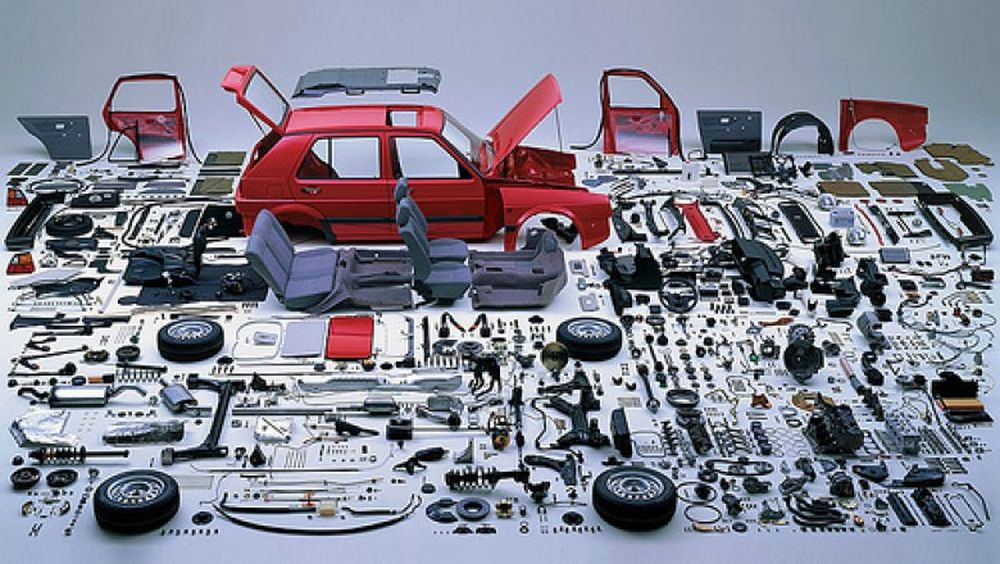

The S.R.O. 656(I)/2006 deals with the exemption of components (which include sub-components, components, subassemblies, and assemblies but exclude consumables), imported in any kit form and direct materials for assembly or manufacture of vehicles.

Under the amended notification, a 30 percent duty is applicable, but it will be reduced to 15 percent for new make or model as certified by the Engineering Development Board (EDB) for three years from the date of issuance of the manufacturing certificate or up to June 30, 2026, whichever is earlier.

The 15 percent duty would be applicable on the import of components for assembly/manufacture in any kit form used in the vehicles of Pakistan Customs Tariff (PCT) heading 87.03 up to 1000cc (excluding specially designed twin cabin type taxi PCT heading 8703.3227 and 4-stroke auto rickshaw of PCT heading 8703.2115).

The FBR will charge 16 percent duty on the import of tires and tubes used in the vehicles of Pakistan Customs Tariff (PCT) heading 87.03 up to 1000cc (excluding specially designed twin cabin type taxi PCT heading 8703.3227 and 4-stroke auto Rickshaw of PCT heading 8703.2115).