The Pakistani Rupee (PKR) continued its fall against the US Dollar (USD) for the 21st consecutive day today, with rates out on the streets rising as high as 271.

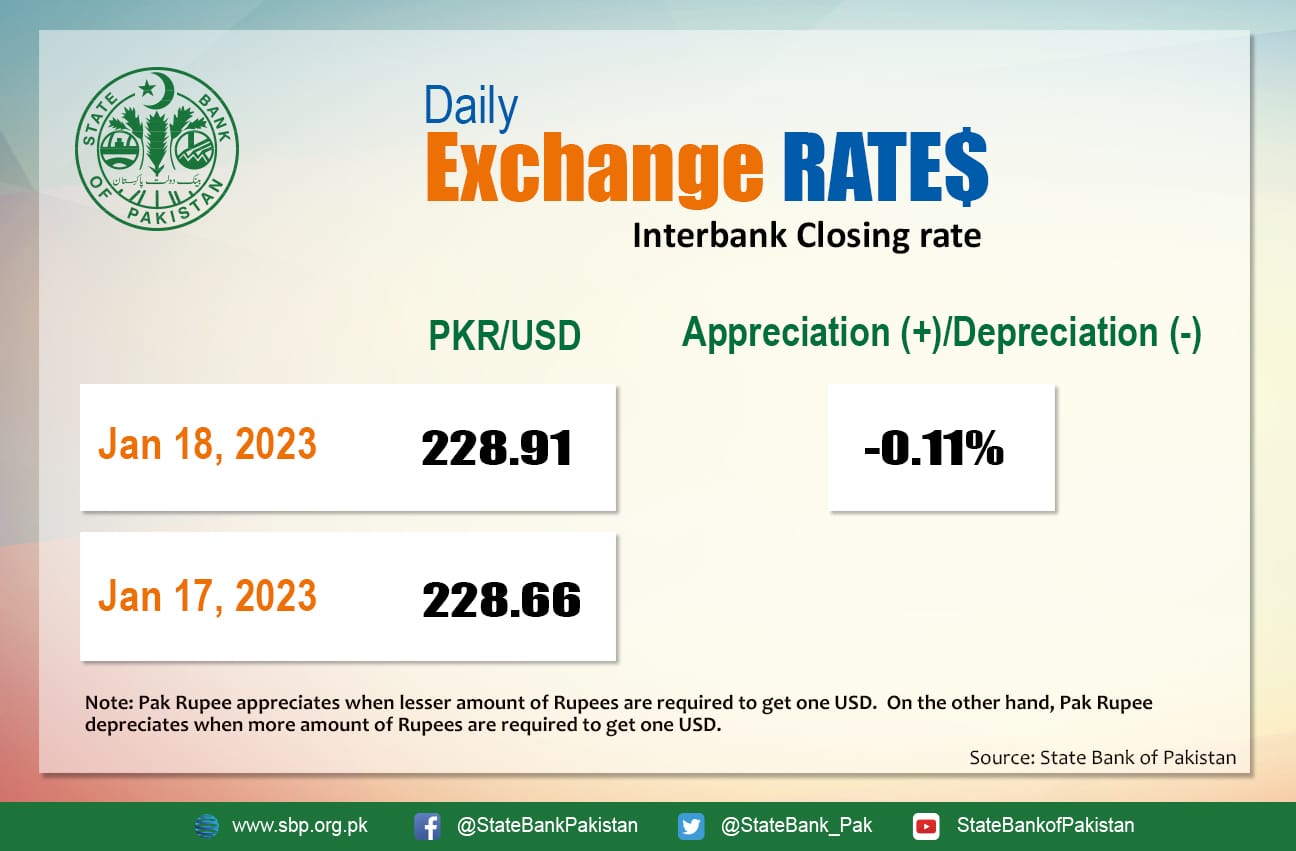

The PKR depreciated by 0.11 percent and closed at Rs. 228.91 after losing 25 paisas. It quoted an intraday low of 229.725 against the greenback before close.

The local unit was all red against the greenback and opened trade at 228.825 in the open market. By midday, the greenback moved higher against the rupee. After 1 PM, the local unit slowed losses and stayed at the upper 229 level against the top foreign currency before the interbank close.

The rupee reported losses against the US Dollar today after the World Bank (WB) delayed the approval of a $1.1 billion loan until the next fiscal year. Money changers see today’s historic 21st consecutive drop as the market’s punctured faith in the current government’s capabilities to restart the economy.

While the default gossip has made big moves during the ongoing fiscal year, the expectation is that Pakistan is likely to remain default-free for the next 6 months in the event that the IMF releases its pending bailout to the country.

Bloomberg Economics predicted last week that the IMF will release the remaining bailout totaling $2.6 billion. Subsequently, the lender’s approval will help unlock $5 billion in financing from bilateral creditors and $1.7 billion from the World Bank. All funds will be used to cover $5.9 billion in debt payments and estimated deficits by the end of the current fiscal year.

Globally, oil prices rose to their highest level since early December on Wednesday, as investors bet that the lifting of China’s strict COVID-19 curbs will result in a recovery in fuel demand in the world’s top oil importer.

At 4:35 PM, Brent crude was up by $1.40 or 1.63 percent to reach $87.32 per barrel, while the US West Texas Intermediate (WTI) was also green at $81.74 per barrel. Both had reached their highest levels since early December 2022.

The International Energy Agency (IEA) said on Wednesday that the lifting of COVID-19 restrictions in China is set to boost global oil demand this year to a new record high, while price cap sanctions on Russia could dent supply.

According to a Reuters poll, crude stockpiles in the United States are expected to fall by 1.8 million barrels in the week ending January 13.

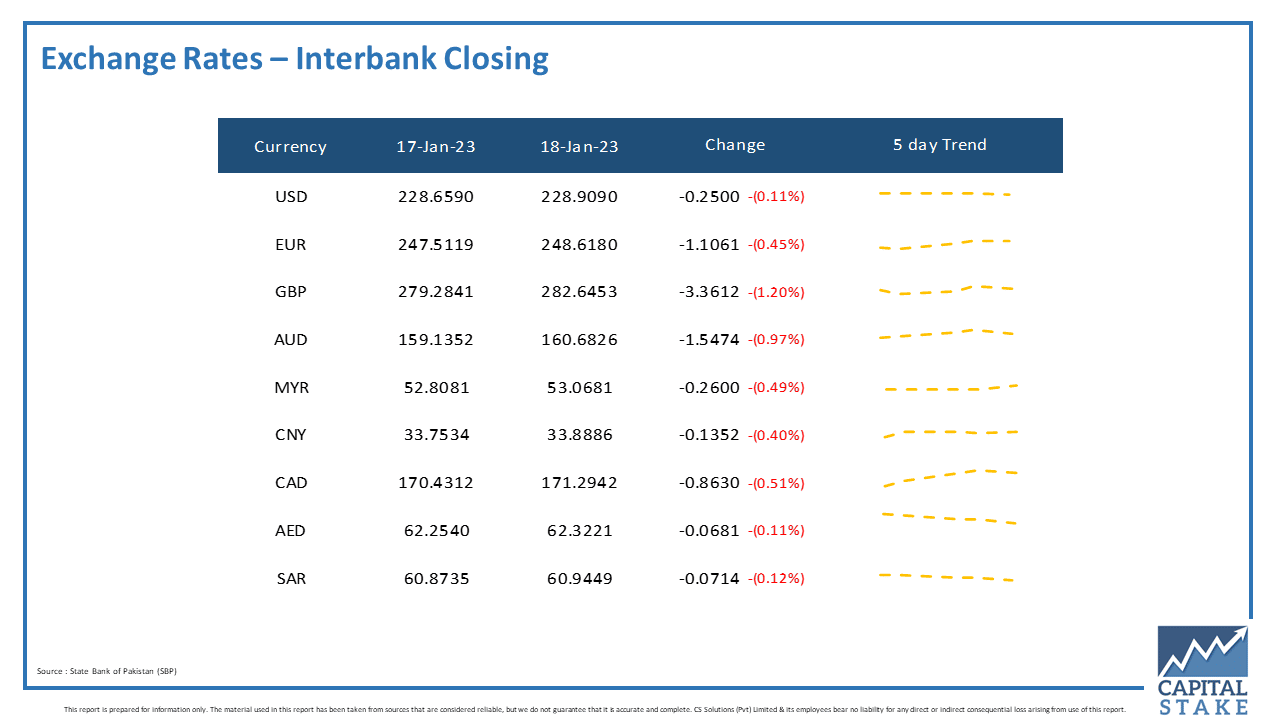

The PKR was bearish against all of the other major currencies in the interbank market today. It lost six paisas against the UAE Dirham (AED), seven paisas against the Saudi Riyal (SAR), Rs. 1.11 against the Euro (EUR), and Rs. 3.36 against the Pound Sterling (GBP).

Moreover, it lost 86 paisas against the Canadian Dollar (CAD) and Rs. 1.54 against the Australian Dollar (AUD) in today’s interbank currency market.