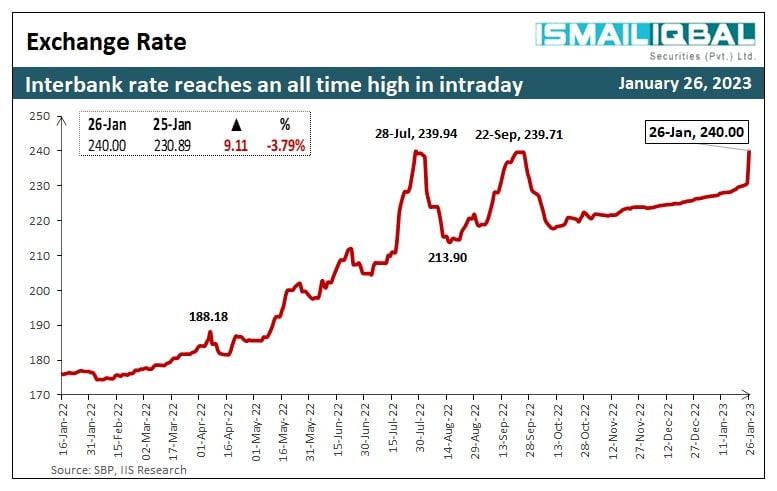

The Pakistani rupee has fallen 6.32 percent during the first two hours of intraday trade today with the interbank rate losing Rs. 9.61 to fall as low as 240.23. Meanwhile, the open market rates across multiple currency counters registered highs of 250-251 after initial asks for the greenback opened at 247.

Our channel checks have confirmed that the PKR is expected to move beyond 255 in the market and while the interbank rate may further depreciate before closing later today. Market sources have touted the local currency to be at the mercy of market forces today after a wide consensus established in the past two trading sessions that neither SBP nor exchange companies would be able to control dollar movements against PKR.

The PKR has sharply fell off the handle ever since the State Bank of Pakistan (SBP) hiked its policy rate to 17 percent on Monday, forcing foreign exchange firms to lift the cap on dollar trade citing “artificial” distortions for an economy in desperate need of IMF assistance.

Independent economic analyst A H H Soomro told ProPakistani,

It’s a belated adjustment of the currency that is extremely vital to remove grey market attractiveness and increase usd flows away from hawala hundi. Once interbank is closer to open market, you will see sharp improvement in the remittances drop that will easily bring current account to surplus. With exporters bringing money back, economy will stabilize enough to comfort lenders for a while. The real improvement would be a function of new IMF plan-led structural reforms happening only after new elections.

Since the appointment of Ishaq Dar as Finance Minister on Sep 28, 2022, PKR against US$ in the interbank market is moving in a narrow band and was being managed to show signs of stability. In fact, PKR gained after touching a low of Rs. 240 before his appointment as he believed that PKR is undervalued.

According to Topline Securities, now it seems that amid desperate efforts to revive IMF funding, PKR is moving back to market forces. Today interbank rate for US$ was between Rs. 238-252 in the morning with deals executed at around Rs. 240, down Rs. 9 or 4 percent from the last closing of Rs. 231. PKR is now down 26 percent in 1 year and 33 percent in 2 years against US$.

In any case, money changers say today’s massive spiraling is due to a lack of dollars in the market which has caused the spread between interbank and open market rates to widen significantly.

The rupee’s official value has depreciated 12 percent against the dollar since the start of the 2022-23 fiscal year, which ends on June 30. Prior to the removal of the rupee cap, markets looked at three different rates to determine its value: the official rate set by the state bank, the rate set by foreign exchange companies, and the black market rate.

While some experts have suggested an improvement in the PKR/USD parity in the coming days, trends suggest fundamentals are crippled and sentiments are ignoring fiscal movements which have made exchange rate recovery and forecasting a near-impossible job for those on economy watch.

Today’s trends show currency controls are slowly shifting from the clutches of the central bank to the mercy of a market-determined free float. This may kill the influence of the black market for good, but stakeholders on both ends of the equation should be ready to see PKR forming resistance in the sticky range of beyond 250.

This is an intraday market update.

9 nai 19 gira hai