Pakistani-American economist Atif Mian said Wednesday the government has cut the country’s GDP to sell petrol 20-25 percent cheaper than Bangladesh, Sri Lanka, and India.

In a series of tweets, the former member of Pakistan’s Economic Advisory Council (EAC) explained that it has become more difficult for Pakistan to pay off its debt due to the reduced GDP, adding that the authorities must address all issues decisively, restructure aggressively, and take courageous decisions.

A 🧵comparing Ghana, Sri Lanka and Pakistan, and what it teaches us about dealing with crises …

Ghana and Sri Lanka formally defaulted during the last two years, Pakistan did not

but currency devalued by 1/2 for both Pakistan and Ghana, and 1/3rd for Sri Lanka

— Atif Mian (@AtifRMian) May 24, 2023

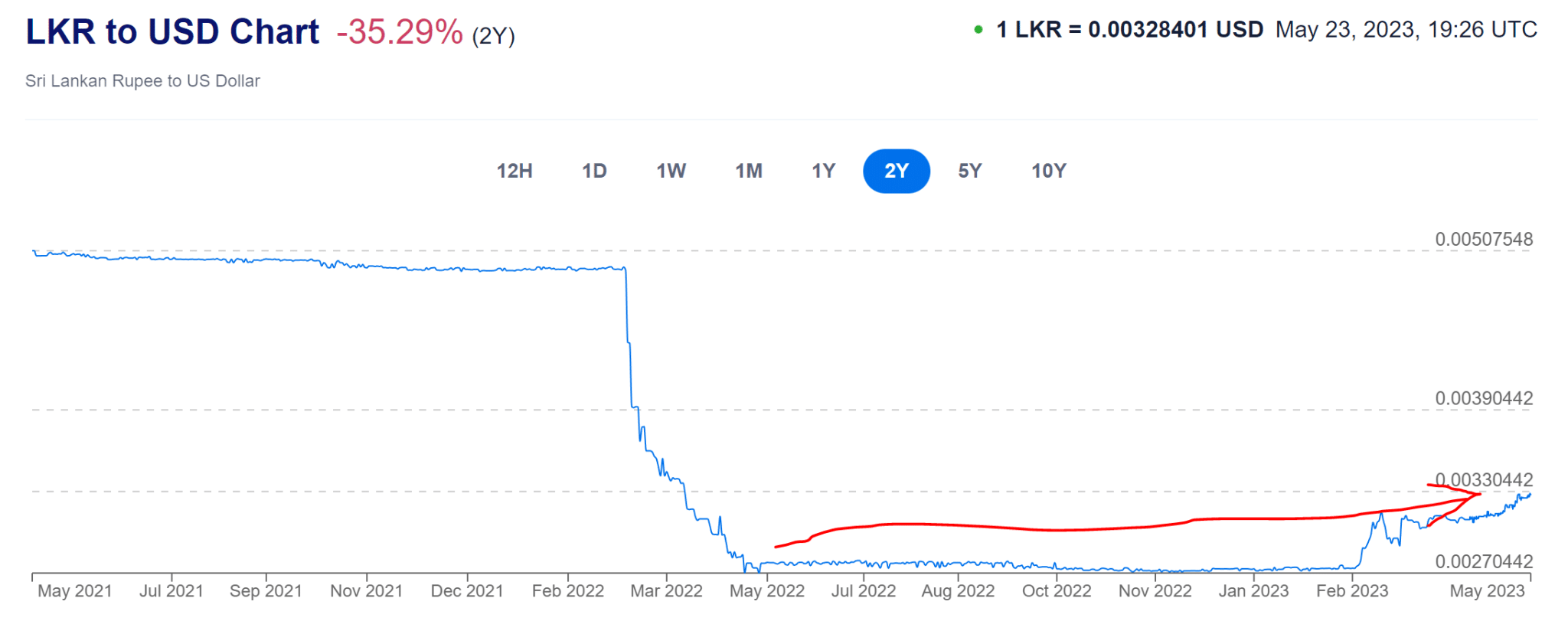

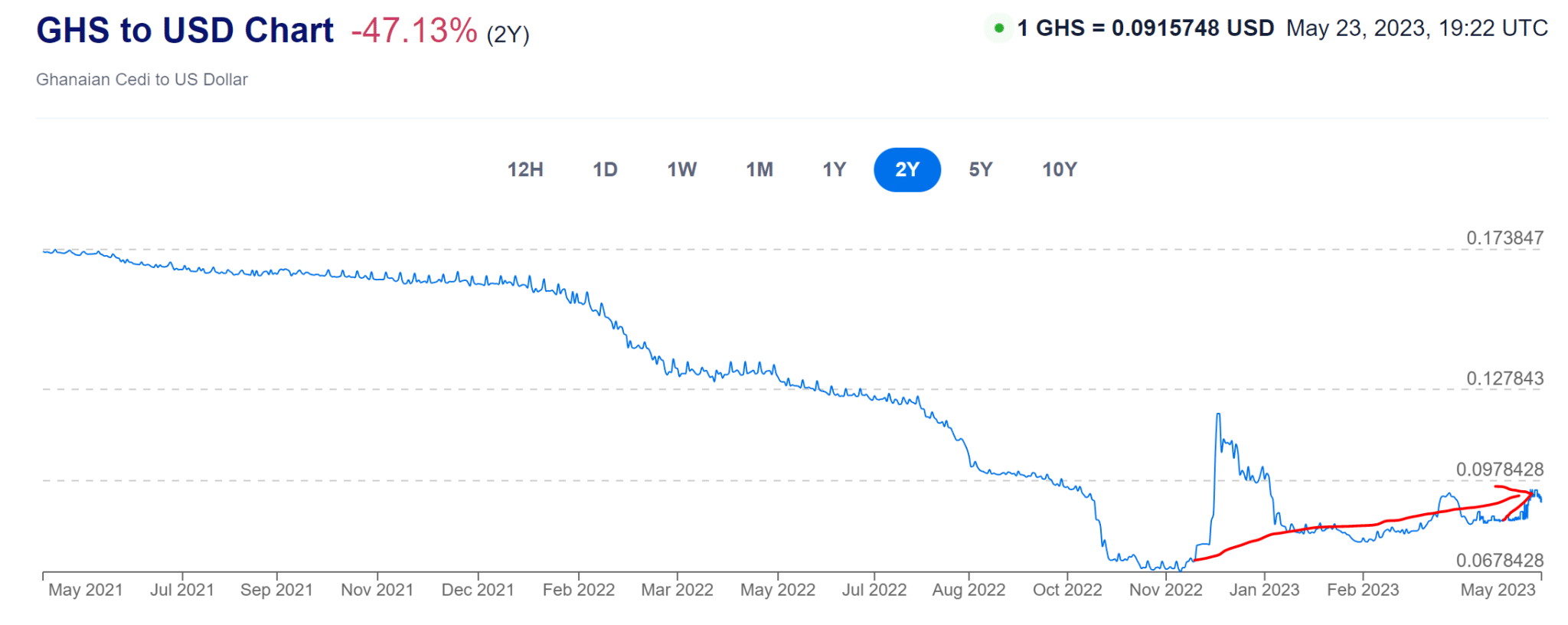

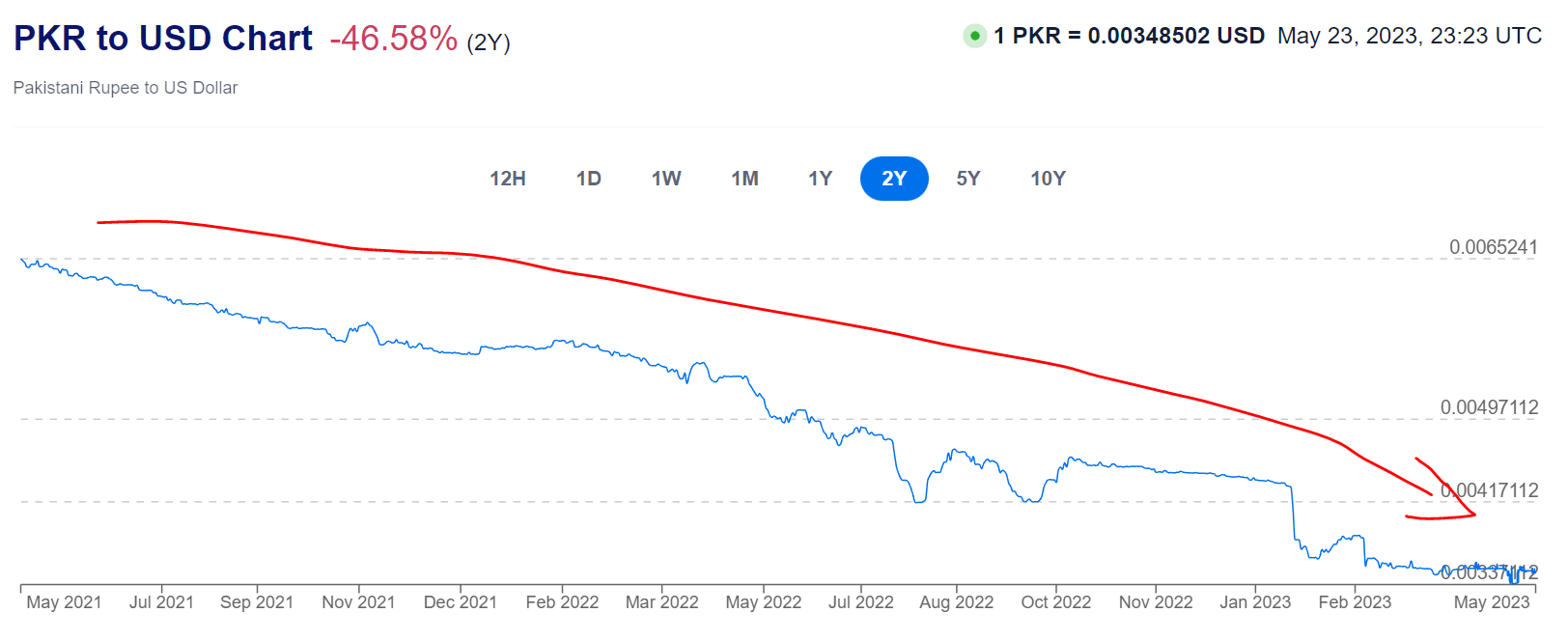

Underlining Pakistan’s case, Mian briefly highlighted that while Ghana and Sri Lanka had formally defaulted during the last two years, Pakistan didn’t. However, currencies devalued by half for both Pakistan and Ghana, while the Sri Lankan Rupee (LKR) depreciated by just one-third despite falling as low as 360 against the US Dollar. Meanwhile, the Pakistani Rupee (PKR) has devalued significantly more than the LKR, he noted.

Comparing Pakistan’s trajectory with that of Sri Lanka and Ghana, the researcher pointed out how the LKR and the Ghanaian cedi (GHS) started appreciating after the two countries defaulted on their debts and soon entered restructuring programs.

LKR Trend Post-Default

GHS Trend Post-Default

Compared to LKR and GHS, Mian highlighted that there is no end in sight for the PKR as the local unit continues to go downhill, a trend that it has consistently shown in the past two years.

PKR Trend (Not Defaulted Yet)

“To thump your chest and say “see we have not defaulted” means nothing if you continue to ignore the underlying crisis,” he argued, adding that “the only thing worse than indecisiveness in the face of a crisis is incompetence”.

He explained the situation by mentioning how Pakistan was selling petrol at a price 20%-25% below the rates in Ghana, Sri Lanka, India, and Bangladesh. Mian said the Pakistani government was selling cheaper fuel at the cost of restricting imports of raw materials needed for production and exports.

“In other words, the government would rather cut the country’s GDP in order to sell cheap petrol!” he exclaimed, further warning that “lower GDP will make it more difficult to pay off the debt – leading to more devaluation – more misery – and higher petrol prices in terms of purchasing power”.

Addressing a balance-of-payment (BoP) crisis requires that a country acts decisively, restructures aggressively, and takes courageous decisions that demonstrate a clear break from the past, Mian concluded.

ملک کی کس کو پرواہ ھے۔ اقتدار کی جنگ لڑی جا رھی ھے۔جمہوریت ختم پوشیدہ مارشل لا لاگو ھے جب اجتماعی سوچ زیر زمین چلی جاتی ھے ملک کو متحد رکھنا مشکل ھو جاتا ھے اس ملک کے اصلی وارثوں کو ملکی مسائل سے دور کر دیا گیا ھے۔

ملک کی باگ دوڑ نا اھل لوگوں کے ھاتھ میں ھے۔