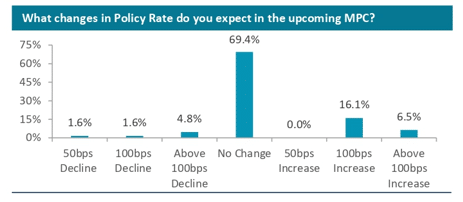

The majority of market experts expect no change in the policy rate in the upcoming Monetary Policy Committee (MPC) meeting, according to a poll conducted by Topline Research.

The State Bank of Pakistan’s (SBP) next Monetary Policy Committee (MPC) meeting will be held on June 12. To gauge the view on monetary policy outlook, Topline Research conducted a poll of key market participants on expectations over policy rates and key macro estimates.

As per the survey, the majority of the participants (69 percent) expect no change in the policy rate, while 23 percent of participants expect an increase. Out of these, 16 percent of participants expect a 100 bps increase, and 7 percent of participants expect an above 100 bps increase.

Meanwhile, 8 percent of participants expect a decline in the policy rate.

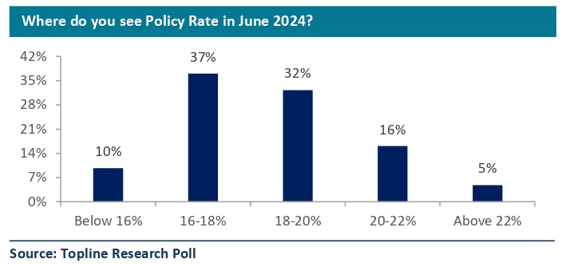

Responding to a question on where they see the policy rate in June 2024, 69 percent of the participants anticipate the policy rate to be between 16-20 percent of which 37 percent participants expect it to be between 16-18 percent and 32 percent expect the policy rate to be between 18-20 percent.

16 percent of the participants anticipate the policy rate to be between 20 and 22 percent. On the other hand, 10 percent of participants expect the rate to be below 16 percent, while 5 percent of participants expect it to be above 22 percent.

In its last MPC meeting on April 4, the central bank raised the policy rate by 100 basis points to 21 percent, the highest-ever policy rate in history.

In its statement at the time, the MPC considered its monetary policy stance appropriate and stressed that the decision, along with previous accumulated monetary tightening, would help achieve the medium-term inflation target over the next 8 quarters. However, the Committee noted that uncertainties attached to the global financial conditions as well as the domestic political situation pose risks to this assessment.

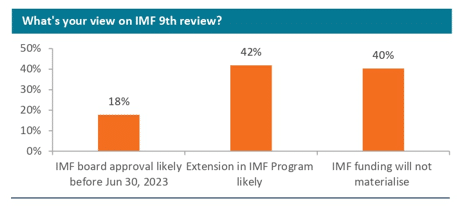

IMF

In response to the question on the IMF’s 9th Review, 42 percent of participants expect an extension in the lender’s program, while 40 percent of participants expect IMF funding will not materialize and 18 percent of the participants expect an agreement with the IMF Board approval before June 30, 2023.

Inflation

CPI Inflation in May 2023 rose to a record high of 37.97 percent YoY vs. 36.4 percent in April 2023 led by higher food inflation.

The survey report predicts monthly CPI inflation to soften from June 2023 and gradually decline over the next 12 months majorly because of the base effect along with tight monetary and fiscal policy.

Petrol and Diesel prices are also down by 7.12 percent since last month. This will also ease inflation in the coming months unless there is any major pressure on the Pakistani Rupee (PKR).

Considering the above factors, the report sees no change in the upcoming MPC meeting.