Given the increased strain on the import bill in recent times, the Fiscal Year (FY) 2023-24 budget is anticipated to prioritize the agriculture sector, making self-sufficiency in food staples a top priority.

The government aims to take prompt measures this time to prevent the agriculture sector from getting affected like last year by the impacts of heavy rainfall, according to Deputy Head of Research at JS Global, Muhammad Waqas Ghani.

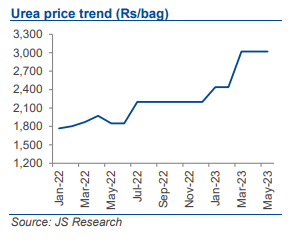

Incentivizing the farmer would bode well for the fertilizer sector since higher farmer income will allow them to tolerate fertilizer price increases in the event of any further hike in input costs. Smooth price pass-on would be vital for fertilizer manufacturers given the gas price increases on the cards.

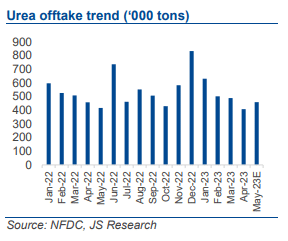

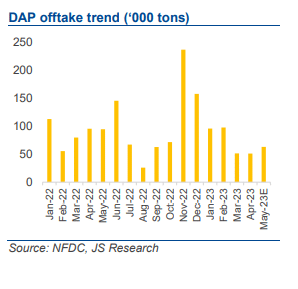

On the offtake front, however, sales have shown growth during May 2023. As per provisional data for the month, Urea sales are expected to clock in at 460,000 tons, up 10 percent year-on-year (YoY), taking 5MCY23 offtake to 2.5 million tons, down by 1 percent YoY. On the other hand, DAP offtake for May-2023 is expected to clock in at ~63,000 tons vs. 94,000 tons in the same period last year (SPLY) depicting a decline of 33 percent YoY.

Incentives to lift farm income Beneficial for Fertilizer Sector

The report anticipates that the agricultural sector would be prioritized by the government in the FY24 budget, given the need to manage food inflation and maximize the export potential from exportable products such as rice and cotton. The government aims to take prompt measures this year to prevent the agriculture sector from getting affected like last year by the impacts of heavy rainfall. A higher allocation for Research and Development of Agriculture is hence likely in the FY24 budget.

The government is also expected to allocate resources to farmers for the delivery of quality seeds, solarization of tube wells, and agri machinery. Fauji Fertilizer Bin Qasim (sole manufacturer of DAP), has proposed the government to either exempt GST at the input stage for the company or impose GST or duty on imported DAP. This does have weight as the company has been at a relative disadvantage to peers. It is also expected that incentives regarding farm credit policies will provide greater access to capital for the agriculture community.

Higher Input Cost on the Cards

The aforementioned incentives would benefit the fertilizer sector since higher farmer income will allow farmers to tolerate fertilizer price increases in the event of any further hike in input costs. As gas price increases are on the cards again, where the previous gas price increase announced in Feb-2023 still hasn’t received clarity, it is vital for the fertilizer sector to gear up for any pass-on.

Sales Growth in Urea Expected to Rebound

Urea sales during May-2023 to clock in at 460,000 tons, up 10 percent YoY. Fauji Fertilizer Company (FFC) is likely to post a 16 percent YoY (55 percent MoM) improvement in sales as it held inventory last month to ensure buffer stock to meet demand in the Kharif season.

On the other hand, Engro Fertilizers Ltd (EFERT) is expected to post a decline compared to the previous month as the company’s base plant was shut for almost the whole month owing to technical issues. With production estimates at 480,000 tons, the report sees the industry’s closing inventory to clock in around 262,000 tons for May-2023.

DAP Offtake to Show Some Improvement

DAP off-take for May-2023 is expected at ~63,000 tons, a 24 percent MoM improvement. On a YoY basis, offtakes are expected to remain dull and show a 33 percent decline.

Fauji Fertilizer Bin Qasim Limited (FFBL), the sole manufacturer of the product, is expected to post an offtake of 39,000 tons for May. FFC and EFERT on the other hand, are expected to post DAP sales volumes of 9,000 tons and 13,000 tons during the same period, respectively.