Only 24 emerging economies account for more than half of the global GDP and have outperformed the developed countries in two decades prior to Covid-19.

According to the Economist Intelligence Unit, most emerging economies in Asia are forecasted to grow by 2 to 3 percent on average between 2022 and 2050, but developed countries in Western Europe will average around 1-2 percent.

According to a Bloomberg survey conducted last month with 234 money managers, 61 percent stated that they are planning to expand their portfolio in emerging markets citing that these economies have become more resilient and their central banks are better equipped to cope with inflation.

It is becoming easier and easier for people to start businesses in countries like Nigeria, Pakistan, and Brazil. Gig economies are benefiting masses with little capital in these countries which we believe is a game changer,” stated Michael Friedman, Co-founder of Reflect Ventures in an exclusive interview with ProPakistani.

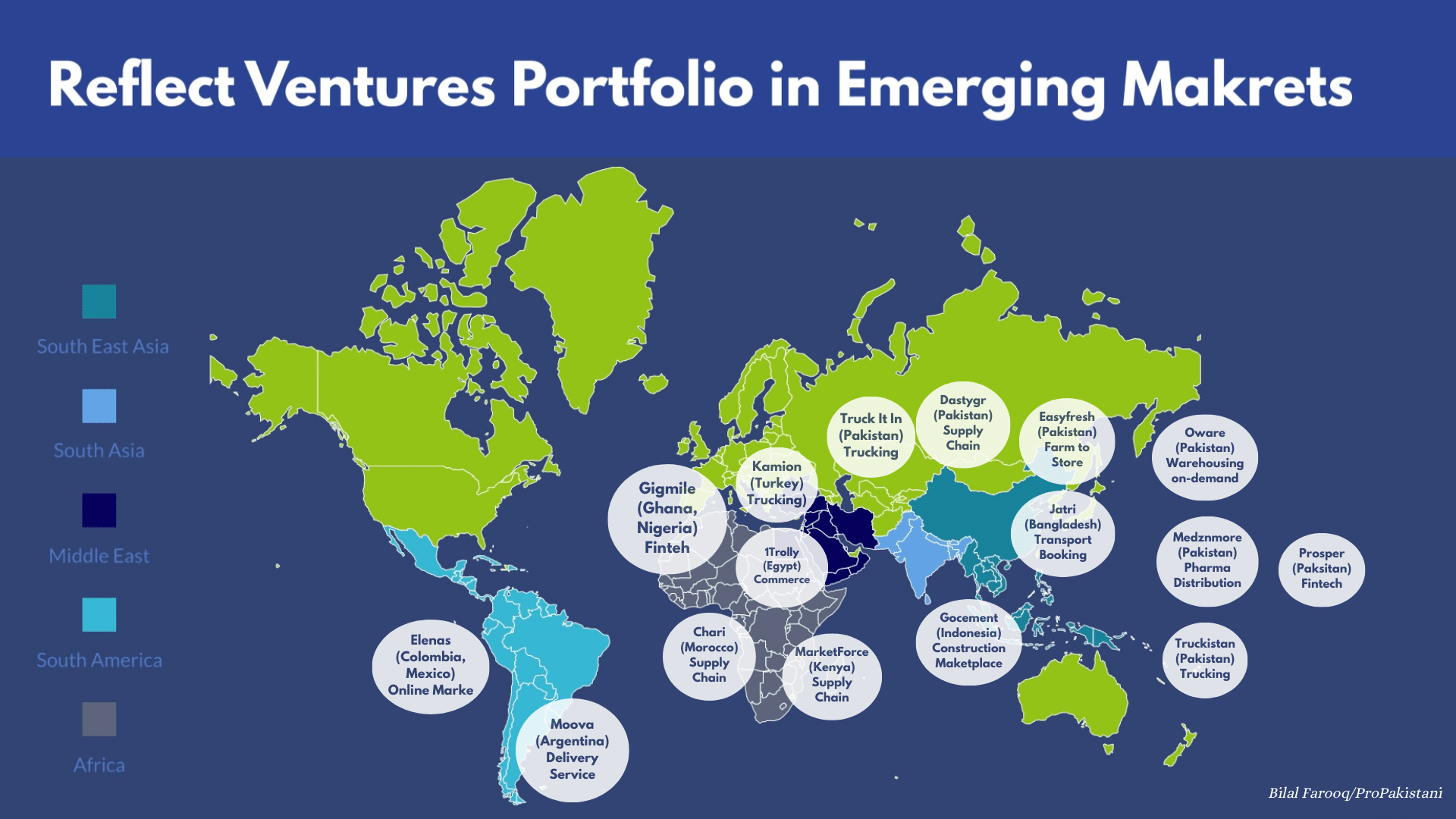

Reflect Ventures is a US-based venture capital that funds critical value chain startups in emerging markets and has invested nearly $10 million in twenty developing economies on five continents. It targets startups in supply chain, distribution, and logistics and their portfolio has raised $193 million in aggregate.

Friedman highlighted that these economies are still in the developing phase despite prioritizing government-backed and multilateral programmes, but now new technologies are enabling bottom-up growth.

On the other hand, US economic outlook is little changed after the bi-partisan debt ceiling deal. Despite hiking interest rates to 5-5.25 percent, inflation is still up, unemployment is down, and the economy is still fighting back, but it is affecting third-world economies like Pakistan tremendously with increasing sovereign default risk, dampening capital flow, depreciating currencies and decreasing equity prices.

Pakistan’s Startup Ecosystem showed little signs of revival with $23.1 million in venture funding in the Q1 of 2023, 55 percent higher than the previous quarter but still 86 percent down compared to the same period last year. Logistics and fintech dominated the six funding rounds that happened while only two deals worth $3.5 million in total happened in April and May.

Pakistan is set to present its annual budget on Friday with the IMF programme still nowhere to be found as deadlock stays on additional funding requirements. Inflation is at an all-time high and the provisional GDP for the current fiscal year is only 0.29 which some analysts also say is fudged for political face-saving.

There is no sugar-coating the fact that the US recession is choking the economies like Pakistan which may or may not get bailed out by Saudis or Chinese, and it’s unfortunate to say, but it makes it a buying opportunity at the same time ” added Friedman.

Reflect Ventures has invested in seven startups in Pakistan in Trucking, Supply Chain, Commerce, Fintech, Agritech, and Healthcare.

Their largest collective funding round was $37 million for Dastygr, a B2B marketplace that claims to link two million retailers in the long run and has ventured into FMCG, agriculture, construction, and chemicals.

The second-biggest funding round was $13 million for Truck It In, a trucking marketplace for digitizing and connecting truckers with industries.

Market Research Firm aiSight reported last year that B2B marketplaces in Pakistan while making huge claims, are serving a very little portion of retail space as only 20,000 out of 0.85 million retailers were found to be using any kind of tech, rendering new B2B startups as modern distributors.

On the other hand, the trucking industry has also been hit badly with shrinking volumes and the rising costs of doing business as Egypt-based Trella shut down operations after raising $42 million in series A. Pakistan’s Fintech Landscape has witnessed an unprecedented boom over the years. However, the kind of disruption people were hoping for, or the kind that happened in our neighbourhood is still far-fetched.

Pakistan fintechs and digital banks have a hard time getting profitable, even when it comes to behemoths like Jazzcash and Easypaisa with the State Bank of Pakistan (SBP) abolishing IBFT charges and competition driving down transfer fees. Digital banking is only one of dozen business models through which fintechs make money, but Pakistan is not ripe for a whole ecosystem yet.

There are only 1.9 million credit cards in circulation in Pakistan. While a non-existent credit scoring model and lack of recovery channels bogged down digital lending, the lack of SME clusters in the country is also a big hurdle. There are a number of free POS providers that plan to lend to SMEs, but there are too many of them which makes the space too competitive.

Other than the fact that traditional banks have been shy of funding SMEs due to having a default-free client like the government, their reluctance also stems from dubious bookkeeping practices and a cash-dominant economy. But Friedman remains hopeful despite all that.

We invest in industries that have to keep going regardless of how bad it gets. Trucks will keep rolling, or you will have no food in the cities. We invested in supply chain and distribution for FMCG and pharma, the fast-moving consumer products. This is very recession-resistant compared to people who are trying to make money off of sneakers, makeup, mobile phones” Friedman explained.

“We are investing in so many regions that the likelihood of all those regions being in a recession at the same time is unlikely,” said Dan Deac, another co-founder of Reflect Ventures. He pointed out that they are hedging the risk well by investing across all geographical regions.

Talking about the fintech space, Friedman argued that most fintechs around here are overhyped as people inherently assume profitability if they are going to manage money, but that’s not how it works. Interest margins go down over time and one has to move closer to the edge under competition which mounts losses. Secondly, if one starts lending to the unbanked, they will be at odds with a struggling government that wants people to buy sovereign bonds.

Reflect Ventures, on the other hand, has invested in Prosper in Pakistan, which is an API for the banking system. In Ghana, it funded Gigmile which finances bikes and smartphones for gig workers. In Indonesia, it invested in a pre-mixed cement provider in the middle of a construction boom with online marketplaces in Colombia and Egypt and Supply Chain startups in Kenya, Morocco, and Argentina.

But while they are bullish for most of the developing economies, they have been reluctant to venture into the markets like India and Brazil citing that these places have no shortage of local capital and while these are good places to develop unicorns, that requires a reasonable price to invest, but that’s not possible in these markets.

These emerging markets are also facing a number of challenges, the foremost being the tightening of global monetary policy and the second from rising global commodity prices, worsened by the Ukraine war. Although these economies still pose to perform better than the developed world due to younger demographic advantages, the long-term growth will depend on better factor productivity and technological advancements.

Coming to emerging markets, the Chinese economy rebounded from the coronavirus pandemic restrictions faster than expected, but now it’s facing an uneven recovery with lowering consumer & business confidence and declining exports.

But things have been looking better in the rest of the developing world. Inflation is retreating in Brazil, Colombia, Peru, South Korea, Indonesia, Philippines, Thailand, Hong Kong, Kenya, and Morocco which will increase consumer confidence and eventually ease the investment ecosystem of these economies.

Pakistan’s inflation is also expected to come down in the coming months with a three-fold decrease by June 2024 if the policy rate starts falling in the second half of the upcoming fiscal year. But even if that happens, the purchasing power has worn down so much over the last year and a half that it might take time for markets to regain consumer confidence.

‘Pakistan is more developed than other regional economies like Bangladesh and the acquisition of Careem by Uber made many people a lot of money & they are ready to enter into new ventures and the people who missed that boat, have resulted in a community of angel investors who do not want to miss the next opportunity” added Friedman.

Talking about the future, he pointed out that short-sighted governments in some developing countries are likely to cut open these golden-egg-laying geese but the key opportunity here for the governments is to support and build on this by getting out of the way and letting this development happen.

Bilal, thanks so much for writing such a great article.