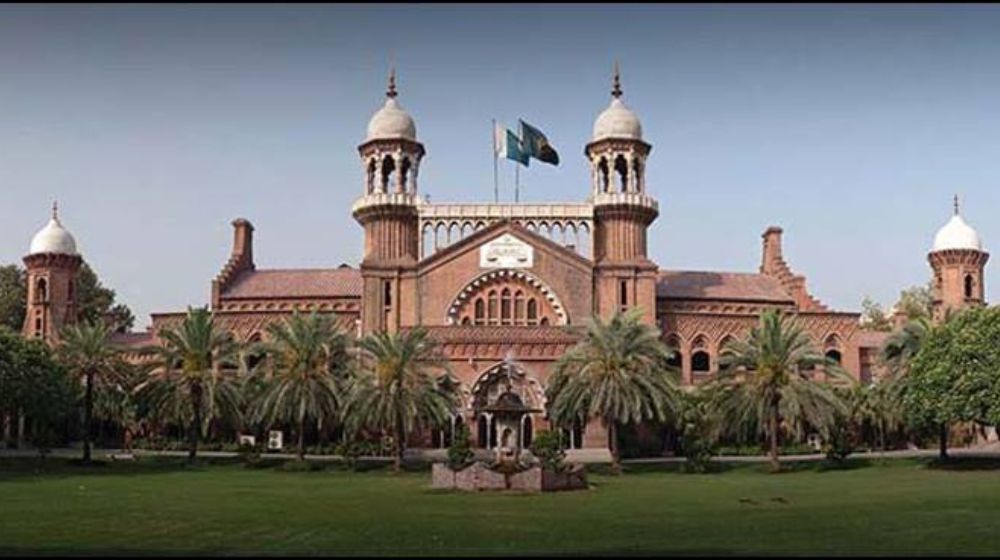

LAHORE: The collection of advance tax from individuals who do not have taxable income has been ruled unlawful by the Lahore High Court.

According to details, LHC ruled that the collection of income tax is prohibited in the absence of an income estimate.

Additionally, the court ruled on 22 petitions filed by low-income mobile phone customers and against the imposition of an Rs. 20,000 advance tax on the reservation of wedding halls.

Furthermore, the bench declared that people who do not fall under the tax net are unable to recoup the tax that was paid for the use of mobile phones, booking of wedding venues, sales or purchases of real estate, or the use of passenger vehicles, which is why citizens have rightfully agitated against the advance or withholding tax.

The LHC further argued that advance tax can be adjusted when completing an annual tax return, but individuals who are not required to pay taxes or file returns, lose the revenue that was initially withheld.

The bench ruled that income tax was intended to be collected from those who had income, while those not earning taxable amounts deserve compensation from the government.

Besides, the Lahore High Court directed the case to the Federal Board of Revenue (FBR) and Attorney-General for appropriate modifications within 90 days.

The judge hoped that “the government would not appeal against the ruling since advance tax is inherently unfair and exploitation and the government should amend the relevant laws and regulations in light of the court’s ruling.”