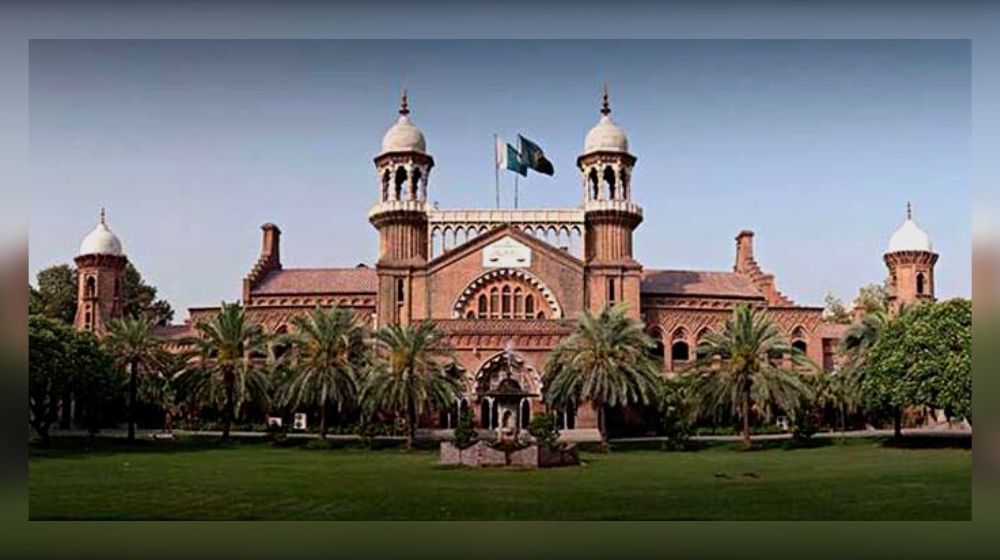

LAHORE: The Lahore High Court (LHC) has delivered a decisive ruling on the legitimacy of a tax imposed on overseas assets of residents, as per Section 8(2)(b) of the Finance Act, 2022.

The court has declared that the tax is both constitutional and in accordance with the law, thereby rejecting arguments made by the petitioner that taxes cannot be imposed on foreign assets declared under federal government amnesty programs.

The ruling emphasized that the tax on assets capital should not be confused with a municipal tax, which is imposed on overseas real estate.

The court stated that provincial legislatures have the authority to impose taxes on real estate within their jurisdiction, regardless of the owner’s residency or domicile.

For instance, real estate located in the city of Lahore is subject to taxation under the Punjab Urban Immovable Property Tax Act 1958.

In conclusion, the LHC has firmly established that residents are subject to tax on their overseas assets, and the provisions of the Finance Act, 2022 are valid in this regard.