In the wake of emerging mobile technologies, the spread of mobile phones across Pakistan presents a remarkable potential for m- banking/ m- payments for financial providers as well as mobile operators. With the influx of alternate delivery channels (ADCs) in the banking sector, mobile banking has undoubtedly become the most popular trend in the buzzing services industry.

While State Bank of Pakistan has continued to place emphasis on Financial Institutions and Telecom operators to form viable partnerships so as to introduce banking services to financially excluded communities, the initiative has come forth with Tameer Microfinance Bank and Telenor Pakistan’s easypaisa.

Website: www.easypaisa.com.pk

Facebook: www.facebook.com/telenoreasypaisa

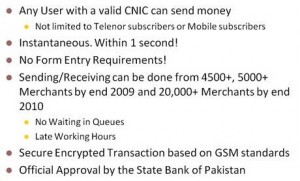

The brand, based on bank-led model, aims to offer a suite of products including micro payments to merchants, P2P transfers between individuals, bill payments to utility companies and domestic remittances. While easypaisa has launched bill payment and money transfer, its initial two over the counter products to cater to the basic financial needs of the population; the potential for increased financial access and service penetration has life changing prospects with mobile products that are yet to come.

Mobile banking is in its infancy in Pakistan and the concept is somewhat alien to the consumers as new products are being launched. However the social impact can be analyzed by looking at some of the mobile banking models that have been introduced in the developing world. Also, by understanding how these models have been adopted and practiced.

The uptake of m-banking/m-payments systems has been particularly strong in Philippines, where three million customers use systems offered by mobile operators Smart and Globe and also in Kenya, where nearly two million users registered with Safaricom M-Pesa system within a year of its nationwide rollout.

In Pakistan, only within a month of money transfer launch, the transactions that have been carried out has already exceeded a number of 50, 000. Customer feedback has been encouraging and merchants report a hefty walk in number on a daily basis.

Features of Telenor Easy Paisa

Considering the kind of acceptance and reception of these services by the consumer so far, the impact is not extraordinary as yet but successful nonetheless. Also looking at how these services have gained popularity in the world and have sustained to extend beneficial effects on rural communities and economies at large, it can be said that the next few years will make for an exciting time for financial trends in the country.

Very little research is available on poor household incomes and their financial needs because of informal channels of transferring money. Mobile banking and products such as Money Transfer should also help bringing informal flows into the mainstream. Providing remittance services also allows banks to get to know and reach out to unbanked recipients, build up information on the size and stability of their cash flows, and then offer other financial services such as savings or credit.

A 2009 World Bank report states remittances can potentially form a large part of income for poor and vulnerable groups (not yet the case in Pakistan), helping lift this population out of poverty. Remittances help families increase spending on basic needs, such as food and clothing, as well as health and education. The key drivers in formalizing cash flows in the unbanked population are by providing affordable and easily accessible services that are going to gain credibility through transparent processes and by enhancing financial literacy.

Needless to say, mobile banking holds immense promise in a country such as Pakistan where banking infrastructure only caters to 12% adults, while 62% of the population uses a mobile phone. Moreover, it will help to formalize cash flows that will not only bring new clientele but will also enable customization of services to suit client-specific needs.

Great topic you choose to speak up. i was just going to post some info like that but you done your job good. Keep it up Mehwish

Cheers!

M.Farooq

information of how to register with my bank

m. Banking