For any Pakistani administration, one of the most pressing issues has been to do something meaningful about raising the tax net. Getting people to pay their taxes is an insurmountable task. Keeping this in mind, the Punjab IT Board (PITB) has come up with a unique, and significant way to enhance the number of taxpayers in Lahore, the capital city of Pakistan’s biggest province. PITB has rolled out the Restaurant Invoice Monitoring System (RIMS) in Lahore for the Punjab Revenue Authority, helping it get food businesses get registered with the tax authorities.

Restaurant Invoice Monitoring System – What is It And How Does It Work?

The idea behind RIMS is simple – eateries which get registered with the Punjab Revenue Authority will be getting a special PITB-developed invoice generating system.

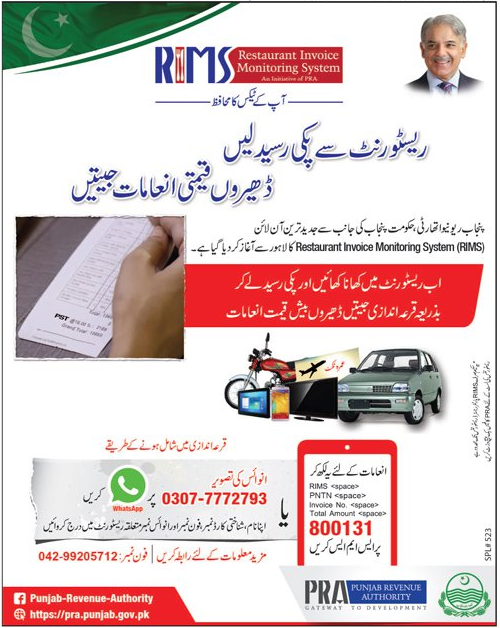

Every time a customer orders food from a PRA-registered eatery, they’ll be getting an invoice, one which also entitles them to win prizes via lucky draw. Prizes include TVs, tablets, smartphones, airplane tickets, motorbikes and cars among other things.

Consumers will also be able to claim some 40 billion in tax refunds that usually don’t end up in their pocket as the majority do not file sales tax.

This way all the stakeholders win: the customer qualifies for a lucky draw, the local food business sees its business enhanced and the provincial tax authority broadens their tax net as more and more restaurants opt for the PITB-developed invoicing system.

This is Huge for Pakistan’s Battle Against Tax Non-Filers and Here’s Why

For a country with one of the lowest tax-to-GDP ratios worldwide, such a move has significant implications. Even though right now it’s a tiny step that targets only restaurants and local eateries, this invoicing system can be expanded to other industries with minimal modifications.

List of Restaurants Currently Using RIMs in Lahore

125 million mobile subscribers throughout Pakistan do not file their taxes. Total non-filers make up more than 99% of our population. Not resorting to the stick and dangling a carrot is a refreshing change of pace and it will be interesting to see how effective it is.

Mobile subscribers alone had 40 billion in unclaimed taxes (collected under the head of WHT) last year and potentially billions more can be retrieved by people if they start filing taxes.

Imagine if even half of the Rs. 40 billion was used for the prizes in the lucky draw for those filers who use mobile phones as well, millions of Pakistani citizens would be compelled to come under the tax net.

We can say this with a moderate amount of certainty considering the passion and fervor for prize giving shows that get airtime on our local channels these days.

Overall, RIMS is a non-traditional way to increase the tax net. It possesses the means to become self-reliant and can let Pakistani businesses, citizenry and officialdom come together and solve Pakistan’s long-standing financial woes.

Maybe we would also benefit from transparency from the government on where exactly they’ll be spending the taxes they are so actively trying to get from the citizenry.

This sort of system has been active in China for several years now; Google for “fapiao lottery.”

Excellent move in Punjab to help the Govt. What is happening merchant’s charge for the VAT, Sales taxes to the buyer. But never deposit. Secondly the software given to the consumer is merely a thermal coated paper strip for the itemised list of grocery which is bundled with the Sales Tax/VAT. But not declared to the consumer a separate figure he is paying for the Taxes. This should be made most essential by all grocery stores, super markets to give a figure of the tax collected by them. A routine check software or App., developed should check the tax collected under the head and make sure if the payment is transfered electronically to FBR.

Pakistan Zindabad

I think it would be much better and a lot more effective if they introduce a partial “refund” of the sales tax (or VAT) for the purchases based on authentic receipts.

If the common man can claim some of the money back for the stuff he purchases, people will insist on getting a receipt from the shopkeeper. This will automatically bring the businessmen in to the tax net and will encourage the non-filer public to file their tax returns in order to get the refund.

The key here will be to make the refund process simple and easy, otherwise people won’t go for it and the whole idea would fail.

Great Initiative.

Do you automatically get picked up for the lucky draw once you have the receipt or do you have to register yourself and the receipt to Rims website (if any) to get selected in the lucky draw?

i have gone through the registered resturents list on which punjab government is giving prizez to people to motivate TO PAY tax, those limited restturents are very few, punjab government did not do the homework properly ,there are so many resturants missing like BONEGEADS MEXCICAN GULBERGE C BLOCK NEXT TO MM ALAM ROAD,,,FRI CHICKS,LAHORE CATKHARA, MM ALAM ROAD AND ALL BRANCHES,, NANDOS FORTRESS . MACDONALDS KFC , PUJAB GOVERNMENT MUST INCLUDE BUTTLERS, INTERNATIONAL BRAND ICECREAM PARLORS, AND AT LEAST ALL THE RESTURENTS OF FORTRESS STADUM AND MM ALAM ROAD PC AWARI AND OTHER 5 STAR HOTELS ,,,,,..NARGIS KHAN LAHORE 0321-8506486