Branchless banking in Pakistan is becoming increasingly popular among the masses for the payment of their utility bills, showed by a survey which estimated 67% of Pakistanis believed that making payments with mobile money agents is a useful innovation.

According to a survey conducted by Gallup Pakistan in collaboration with State Bank of Pakistan (SBP), majority of the populace consider branchless banking a useful channel for making monthly utility bills for electricity, gas, water and sewerage and internet.

On the other hand, 33% of respondents didn’t consider it as an innovation.

According to State Bank of Pakistan (SBP), the number of branchless banking agents is more than 0.3 million who perform bill payments on the behalf of customers.

In the last quarter of 2015, there were 27 million transactions made on account of utility bill payments and Rs 35.8 billion were transferred to different utility companies throughout the country.

There are nine branchless banking services in Pakistan naming Easypaisa, Jazzcash, U Paisa, Mobile Paisa, Timepey, HBL Express, Meezan Upaisa and UBL Omni.

Branchless Banking is becoming a well-received concept in the country as services like Telenor’s Easy Paisa, UBL’s Omni and Ufone’s U-Payment have played their part in popularizing the concept of mobile money transfers and mobile banking within Pakistan.

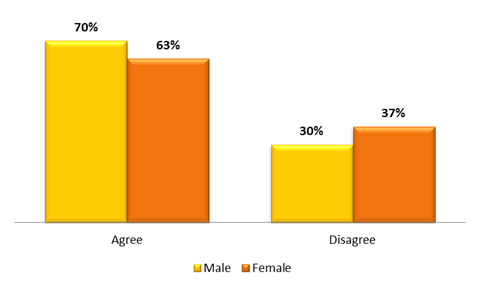

Gender Breakdown

Slightly more men than women agree that making payments through mobile money agents is a useful innovation

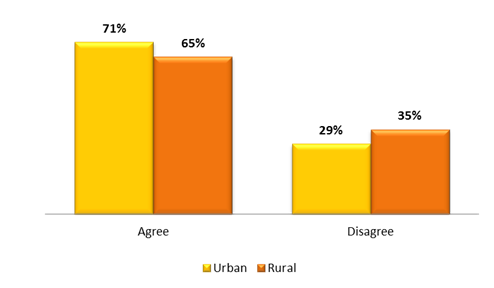

Urban-Rural Breakdown

A majority of urban (71%) and rural (65%) respondents agreed that sending and receiving money through mobile money agents is a useful innovation within financial services

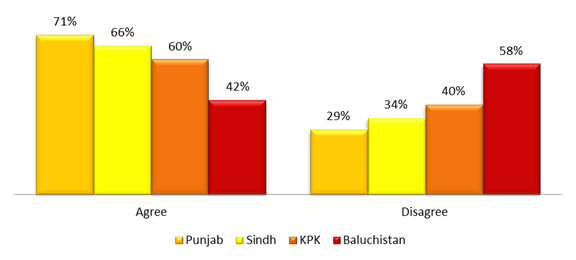

Provincial Breakdown

Majority respondents in all provinces except Baluchistan agree that making payments with agents such as EasyPaisa is a useful innovation

A rural/urban breakdown reveals that 71% of the respondents in urban areas and 65% in rural areas agreed to the statement that ‘making payments with agents is a useful innovation’.

Based on these empirical results, it is encouraging to see that the concept of mobile money has also managed to penetrate the rural population of Pakistan. This relatively high figure for the rural population is a testament to the growth and increasing familiarity and popularity of mobile money transfers via agents such as EasyPaisa, UPaisa, UBL Omni etc.

Urban areas, with a greater concentration of high income individuals and banking facilities, naturally have more respondents who are aware of this digital financial service. Furthermore, 29% in the urban areas disagreed with the statement while the same answer was given by 35% of the respondents in rural areas.

Majority respondents in all provinces except Baluchistan agree that making payments with agents is a useful innovation

According to the provincial breakdown, 71% of the respondents in Punjab, 66% in Sindh, 60% in KPK and 42% in Baluchistan agreed that making payments through mobile money agents is a useful and beneficial innovation. On the other hand, 29% of the respondents in Punjab, 34% in Sindh, 40% in KPK and 58% in Baluchistan disagreed with the statement.

Gallup Pakistan, in collaboration with HORUS Development Finance, conducted an extensive survey in over 10,000 households across Pakistan.

Thanks to Branch-less Banking.

Informative article posted in a childish manner of nonstop addition and percentages. One’s brain continues to remain entangled in all the calculations given rather than concentrating on the theme of the article itself.