United Bank Limited (UBL) has launched a new QR code-based digital payment service in partnership with MasterCard. The new service is called Masterpass and it has the potential to change how payments are made in Pakistan.

About UBL Masterpass

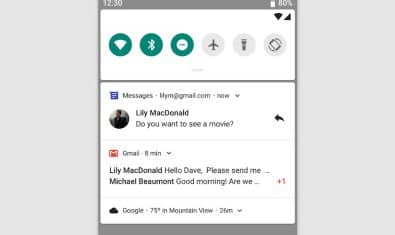

MasterPass is a first of its kind service in Pakistan. It allows the customer to use their mobile banking app to scan a QR code. By scanning QR codes, a customer can pay for items in-store, pay their bills (invoices) and delivery via one secure account. The service ensures a fast and secure payment system for existing UBL customers that takes a few seconds.

How Does it Work

If you are shopping or paying your bills, the UBL MasterPass mobile app can be used to make payments at supported retailers.

This can be done when you’re checking out from an online store, using your smartphone to scan the QR code. To process the transaction, you will then be prompted with a confirmation for the same and your PIN code. The payment goes through once you enter your PIN.

The whole process saves time, since instead of manually filling out a form with your name, phone number, email and physical address, you only need to scan the code and confirm it from the app. Rest of the details are automatically registered by the payments system.

CEO/President of UBL, Wajahat Hussain had this to say on the launch of the UBL Masterclass service:

UBL has been a leading financial institution for the last 57 years. During this period, the Bank has come to be acknowledged as a Progressive and Innovative bank. These two attributes of the Bank have propelled the institution in taking lead in financial inclusion and economic development of Pakistan.

Details about service availability and retailers that are on-board the service will be shared later.

Good Service better than NFC

Good to see Pakistan progressing and now companies are seriously considering to introduce the online payment solutions for consumers. I have a question, Can this service be used by an online business, so that end-users can make online payment through credit card, visacard, mastercard etc.

Also what are the other available options in Pakistan for online-business portals to have the online transactions or purchases for end-users? I would like to know the companies who are selling their products through online payment methods ( minus cash on delivery model).

Regards,

Abid

Great news…Hope other banks start following

beside pass-code it should also work with finger prints

I guess it works this way: A merchant gets UBL account, and a unique QR code on their website. A customer uses UBL’s app (even if they are not UBL account holder), to scan QR and authorize payment. Did I get it right? A very good idea. Now thats innovation. Innov8 ya hear me?

Bhai ubl QR code kahan sy bany ga shop k liye please guide me. thank u

Hopefully, won’t have to wait with a wad of cash in hand for a CoD now. Good going UBL.

Bhai ubl QR code kahan sy bany ga shop k liye please guide me

Aap ki shop ka account hai UBL mein? Tu phr UBL Digital app download kren, apni shop ke bank account se login kre. QR ke section mein ja kr Receive Money pr click kren. Jo QR code screen pr aye, usse Save kren. Ab ye QR code aap ke phone ki picture gallery mein save ho jaye ga. Aap isse print krva kr dukaan mein laga den.

Bhai us sy sirf ubl omni customer payment ker sakty hai jo shop k liye hota hai us main tamam company kay customer payment kr sakty hain

UBL account is what that matters. Aap ka UBL account hai, chahe personal, ya business ke naam pr, aap upr vala method use kr skte hain.

Every retail bank is making their own small worlds here, these guys are still thinking in the traditional sense, how can they uptake their banked consumers. Peeps, you need to think about being the bank that disrupts the very traditional banking industry you ought to benefit from.

Barclays UK has started an accelerator and taken on board those fintech companies whose aim was to challenge the way traditional banking works, Barclays essentially said ‘ Okay if you want to destroy us, why dont we fund you and become your partners, so you can learn from us and we from you” essentially a journey whereby Barclays would be ready for the technological disruption that comes in the next coming years.

My point is this, these guys have to think outside the box and come up with solutions that totally revolutionize banking in Pakistan, they have the money. They have the necessary licences and regulatory approval. They just need to acquire the right entrepreneurial & Digital talent who have the purpose and drive to build the next big thing for Pakistan ( by Next big thing, i mean an innovation like EasyPaisa back in 2009)