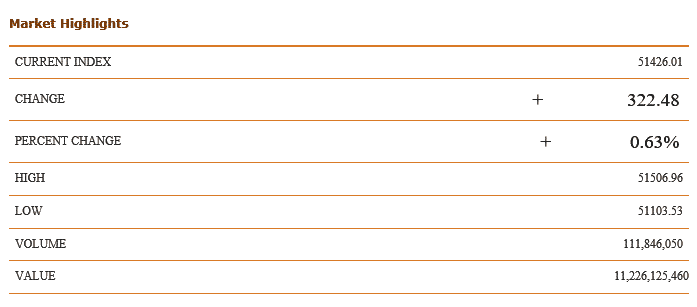

KSE-100 recorded a gain of 322.48 points or + 0.63 % by the end of the trading session to close at 51426.01 points as the news regarding an amicable solution being reached on the “Dawn Leaks” yesterday helped the bourse register good gains.

The positive vibes from emerging clarity on the political front and the ongoing MSCI euphoria kept index names in the limelight.

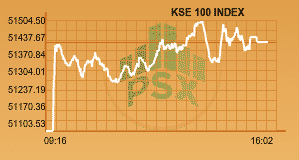

The KSE-100 Index performance increased over 402 points in intra-day trading today as the Bulls drag the KSE 100 index to new all-time intraday high of 51506.96

The Index opened positive and continued to gain profits throughout the last trading session while closing in green, with heavy volumes.

Overall, volumes surged to over 397 million shares while in KSE 100 index around 111 million shares were traded.

COMMERCIAL BANKS was the top traded sector with total traded volume of 72,414,400 shares. It was followed by TECHNOLOGY & COMMUNICATION with a total traded volume of 56,081,500 shares and CEMENT sector with a total traded volume of 35,460,500.

Shares of 381 companies were traded. At the end of the day, 229 stocks closed higher, 136 declined while 16 remained unchanged.

Summit Bank was the volume leader with 31.23 million shares, gaining Rs 1.00 to close at 6.30. It was followed by World Call Telecom with 24.89 million shares, losing Rs 0.17 to close at Rs 2.89, Dewan Cement with 20.52 million shares, gaining Rs 0.96 to close at Rs 27.81 and BYCO Petroleum with 20.35 million shares, gaining Rs 1.10 to close at Rs 23.17

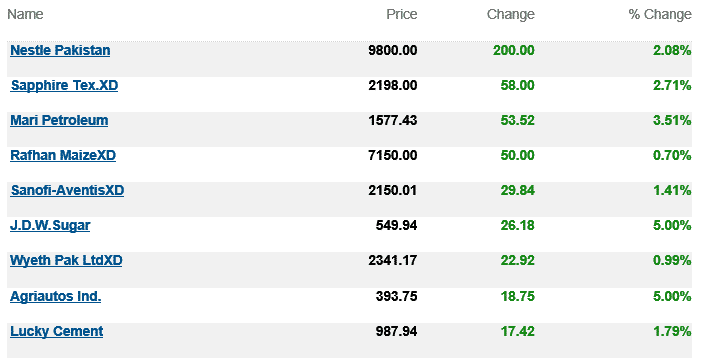

The top advancers of the market were:

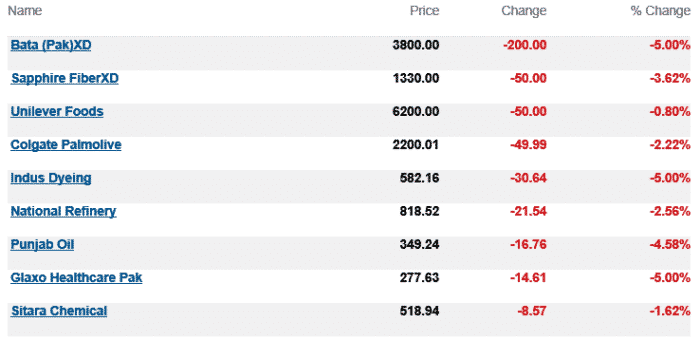

Top decliners of the market were:

Pakistan Stock Exchange (PSX) will be selling the remaining 20 percent of PSX shares to the general public soon, announced the board of directors of the bourse. These shares will be sold through an initial public offering (IPO). With 40pc shares of the PSX already distributed among the brokers and another 40pc sold to the Chinese consortium, the remaining 20pc stock is to be offered through an initial public offering (IPO).

Good