The benchmark KSE 100 index plunged over 1899.88 or 4.08% in the intraday trading falling down to 44000 index level. The benchmark plunged almost 4.12 per cent to touch the day’s low at 44639 points during the trading session with a intraday low of almost 1926 points.

The investors adopted the dump and run strategy because of the political uncertainty. The Ongoing Panama case proceedings of the joint investigation team (JIT) probing Prime Minister Nawaz Sharif and his family’s offshore assets is the chief was the reason behind this immense pressure to sell. Heavy net selling by foreign investors and the political uncertainty has led to panic selling with the index shedding close to 15% in the last five weeks.

According to the analysts the uncertainty will prevail in the market until July 10, which is when the JIT is expected to submit its report before the Supreme Court.

Whereas Finance Minister Ishaq Dar, announced that the federal budget that was widely seen as a negative for stock market investors.

It was a one-way street, as the market’s open at 46,565 remained the day’s high. The market was down by 1900 points on the intraday basis. Each point is worth of $2 million; that’s $3.8 billion worth of capitalization lost in one day said the market analysts.

Overall the volumes were very low, 156 million shares were traded, While in KSE 100 index 77 million shares changed hands with a total worth of nearly Rs 7.18 billion.

COMMERCIAL BANKS was the top traded sector with total traded volume of 34,039,100 shares. It was followed by CEMENT with a total traded volume of 21,499,750 shares and TECHNOLOGY AND COMMUNICATION sector with a total traded volume of 16,655,000.

Shares of 361 companies were traded. At the end of the day, 27 Stocks closed higher, 321 declined while 13 remained unchanged.

Engro Polymer was the volume leader with 10.51 million shares, losing Rs 1.82to close at 34.68 It was followed by Mapple Leaf Cement with 9.47 million shares, losing Rs 2.47 to close at Rs 108.51, Bank of Punjab (R) 8.39 million shares, losing Rs 0.02 to close at Rs 0.02 and Bank of Punjab with 8.16 million shares, losing Rs 0.83 to close at Rs 311.03.

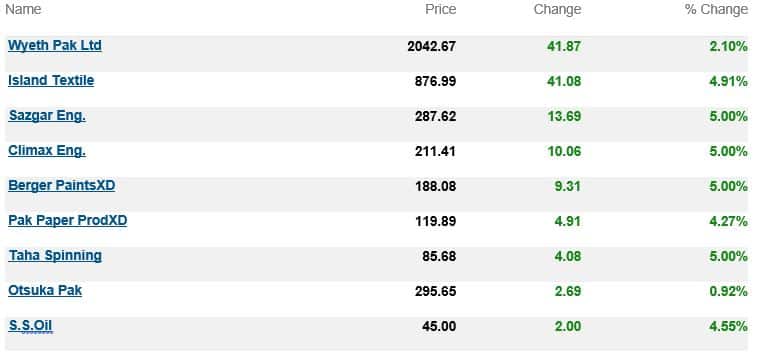

The top advancers of the market were:

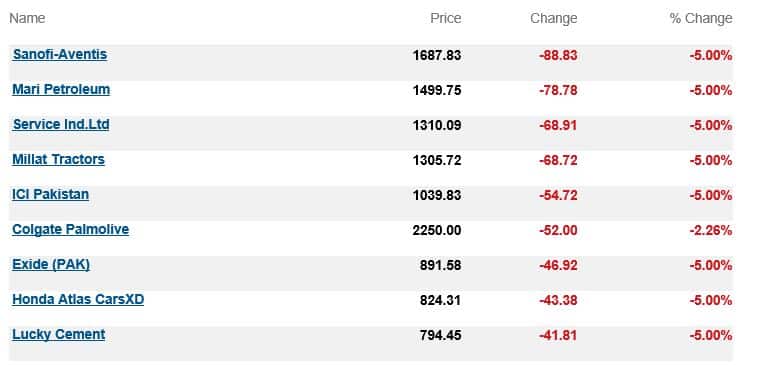

Top decliners of the market were:

Oil prices rose on Monday, lifted by the first fall in U.S. drilling activity in months, although gains were capped by reports of rising OPEC output last month even as the group has pledged to cut supply. U.S. West Texas Intermediate (WTI) crude futures rose 24 cents, or 0.5 percent, to $46.28 per barrel, adding to last week’s 7 percent gain.

I want to learn trading any good way to do it while feeling the orignal market