Abraaj is close to reaching an agreement with the Pakistani government that will allow the private equity firm to sell its 66 percent stake in Karachi-based K-Electric to a Chinese group, reported Financial Times.

The report states that two years ago, the company’s sale price to Shanghai Electric Power was quoted at about $1.8 billion, which would have earned Abraaj about $450 million (due to the debts owed by K-Electric).

Now the deal, which had been held up by regulatory approvals, is being renegotiated, probably at a lower price, according to senior people at Abraaj and people close to the deal.

The proposed sale is still likely to be the biggest source of recovery funds for Dubai-based Abraaj’s creditors and will also provide some money to investors, the people added.

“There is more momentum than ever before,” one Abraaj executive said, as reported by Financial Times.

Abraaj once was the Middle East’s largest buyout fund with close to $14 billion of assets under management. It was sent into a death spiral last year after investors accused the indebted firm of misusing funds. The company and its Pakistani-born founder, Arif Naqvi, have denied any wrongdoing.

The report states that the company owes over $1.1 billion in debt and Liquidators have since been negotiating to sell assets to recover. In recent months, Mr. Naqvi has been using his connections with the new Pakistan government of prime minister Imran Khan to salvage the transaction, even though it comes too late to save Abraaj itself.

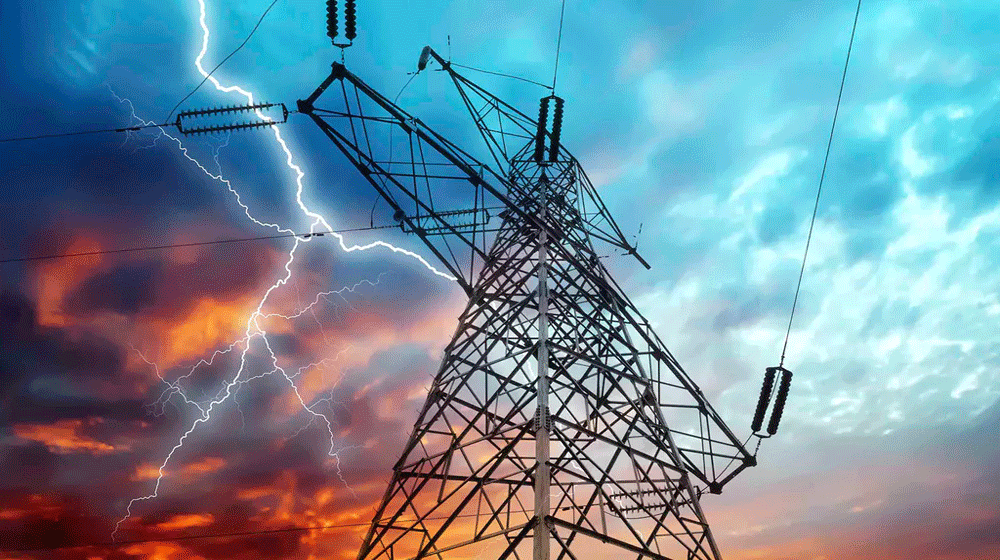

At the end of December, Shanghai Electric informed the Pakistan Stock Exchange that it intended to make a revised offer for a majority of the utility, which is a critical supplier of electricity to Karachi, a city with a population of nearly 15 million and rising. That announcement followed a meeting between Shanghai Electric, Mr. Khan and Mr. Naqvi in Islamabad.

According to the report, The reduced valuation is in part due to a change in the tariffs, that utilities are allowed to charge, introduced before the original sale was agreed upon.

There has been a huge growth in the number of transactions between Chinese interests and Pakistani companies. Chinese infrastructure companies are building ports, power plants, roads and railways as an initiative which is expected to see about $65 billion in spending over the next five years.

Kindly Sell All Shares to Chines Firm : Hum Tang A Gaye hai Abraaj Wale Tum Se