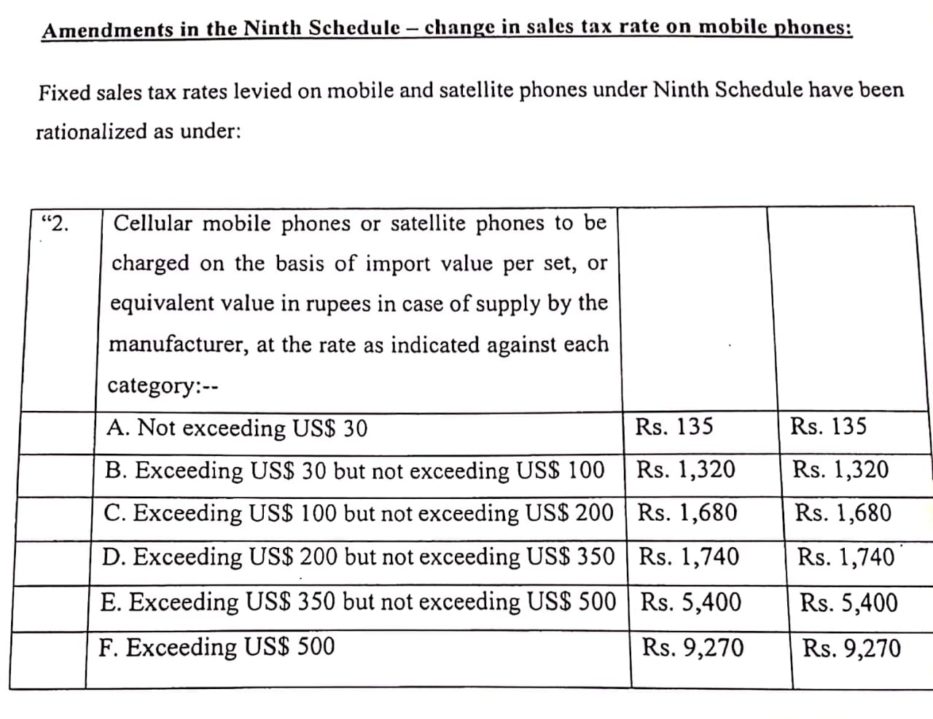

The government has officially revised the sales tax charged on import of mobile and satellite phones. We have confirmed these new rates with the FBR.

The minimum amount that you will be charged is now only Rs. 135, whereas the maximum amount charged can now only go as high up as Rs. 9270 (previously 10,300) on a phone above USD 500.

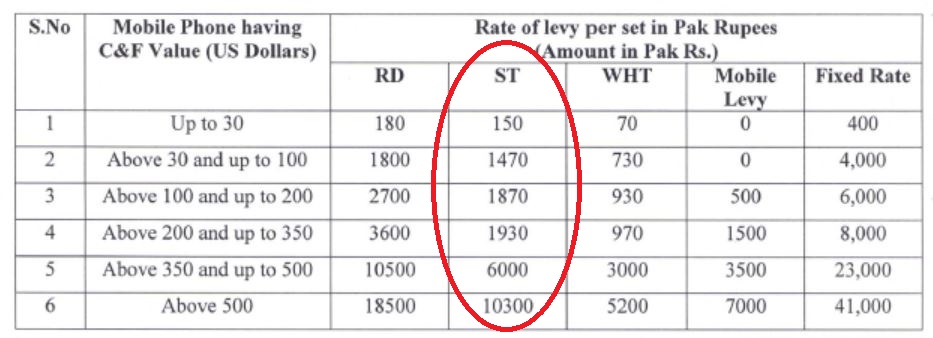

Comparison: Old vs New Tax

Here’s a comparison between previous and current sales tax rates.

Finally. Taxes are reasonable now.

hope you’re being sarcastic.

yar register karana kahan se hye.mn tu zaleel hu gia hn..can anybody help..i have a phone which i want to register. PROpakistani, please make a comprehensive guide.

Go to ur celluler network’s frenchies, like zong/jazz etc

Dial *8484# & Apply Registration Via SMS :

Final PTA Ki Taraf Se Amount A Jayega

Wo Kisi Bhi telecom Franchise (telenor, Ufone Etc) Ya E-Sahulat Pe Ja K Jama Karwa Sakte hai

Ye Bat PTA Ki WebPage Pe Bhi hai

register your self or go to any mobile franchisee… but after 1st august .. its easy

Current Mobile Price Should be Less : According to Current Tariff

Ye sirf sales tax ki list hai jis me maximum 1000 rupay kam kiya huwa hoga… Baqi levy duty w.h.tax,ar RD waghayra uthe hi hai jitne pehle thy, to is article ko parh kar mujhy lagta hai k baray mobiles par maximum 1000 ya 2000 kam hoga is se

I mean to say kbpehle jitna tax tha taxab bhibutna hi hai bas kuch 1000 rupay kam huwa hoga total amount se

Ya Fix Tex hai Bhi dobra Read kro ap es ky elwa ko Azafi Tex nae ho ga Fbr ke trf sy

this is fixed sales tax rate. You have to pay Regularity duty + WHT + Mobile Levy in addition to sales tax amount. Which means only 1000 to 1500 will be less. for mobile having value exceeding USD 500 tax amount will be almost 34,000 plus

Darn it. Still too expensive for middle-class folks. Oh well, my S7 Edge has plenty of gas in the tank left. I’ll just stick with it, I guess.

Can u plz tell tax on Iphone xs 64 gb plzzzzzzzz

Same tax no relief! PTA still showing me tax of iPhone Xs Max of PKR 58000/-

Apka tax taqreeban 35000 se 40000 tak jona chahiye new rules k mutabiq, 58k bohat zyada bata rahe hain aap

May be jis waqt ye mobile pehli baar pakistan me uae huwa us waqt is mobile par tax 58k ban raha tha

Ap k liye yahi suggestion hai k aap pta ko email ya helpline par call kar k apna issue discuss karien k nee rules k mutabiq total tax around 40k banta hai but mujhy 58k require kiya jaraha hai. I hope k apka ye issue resolve hojayega,

Ik chhoti suggestion haj k pta se communicate karne se pehle thora sa homework kijiyega k current rules k mutabiq kitna tax lag raha hai ap k mobile par ta k dono parties k beech understanding rahy as per law

Thanks mene aj he sms krky check kea tu 58000 tax likha aya maybe hoskta ha abi PTA ke database me ye new tax update na hoa ho. PTA ko chye agr munasib tax rakhy tu log sahi tarh ada bi karen gy. I think 25k is sufficient for this phone.

Ohh bhai … yeh notification 1st august se applicable hai .. baar baar check naa kerin.. hosla rakhein 2 ya 3 august ko check ker lena..

I don’t know what and how are they trying to collect money from mobile users. Mobile users had already been paying all the taxes as they are purchasing it from the market. The tax should be paid by the retailers who are importing mobile phones. If any Pakistani is travelling outside of the country and there if he or she buys a mobile phone for himself or any family member so why should he pay tax when he returns to Pakistan. All the Pakistanis are already paying the taxes for each and everything. Other than that our neighborhood country India is promoting all the neq technologies like electric cars etc for very very less taxes so people can buy and live executive lives. I’m not against the taxes but they should start from the higher classes and authorities to lower and do not ruin the lives of common man.

What a contrast between human beings…!

https://propakistani.pk/2019/07/27/over-50-percent-of-families-in-pakistan-cant-afford-two-meals-a-day-report/amp/

What about old resale phones? If a phone market value is 7000pkr, no matter if it was released at 500$,it should be taxed at market value! Please help us.

Samsung galaxy a20 ka kitna hoga?

1700 rs maiy pta say registered hogaa ayesha sister 1 august sy..

Tax on S10+ is 46400 which is totally insane. Has Imran Khan become PM for such constraints on public

how do you confirm that tax on S10+ is 46400?

tax change sirf kit mobiles pr hoa hai k new box pck mobile jis pr shop walo ne khud s he price bharha dia tha own pr he kamhoa hai or kitna fark prne wala hai agr aik cell phone 36k ka hai market mai toh

How much pay for Tax S10 +

sir yeh new tax kab say kam honge

How much is the tax on iphone 5S?

Bht hi buray hain PTA waly 8 june se m Pakistan ai hun r bar bar register kr rhi mobile phly mobild tax free tha fr tax laga dya lgta hy PTA wlay pgl hain ya Awam R ab kah rhy Jo mbl 1st july se phly ay wo free hian to mjy tax q bhja

pta waly hy hi pagal

hawaii nowa 3i ka tex kitna ho ga

plz reply nae

Iphone xs max ka kitna tax ho ga koi help kary yar

How much tax apply on iPhone 7?

They emailed me to pay 40,000 for iPhone 7 as tax

Samsung m20 ka tex kitna ho ga

Sir I register our selfphone can you explain or detail what is a procedure

It’s a bit misleading as you mentioned the total tax in previous table but only sales tax in the current table. Do you mean to say other taxes are abolished?

There is this message doing rounds on WhatsApp which also seems to mention only the sales tax

*بیرون ملک سے لائے جانے والے موبائل فونز پر نئی ٹیکس پالیسی کا اعلان*۔

*1۔ 30 ڈالر کے موبائل فون پر:*

*نیا ٹیکس ریٹ: 135 روپے*

پرانا ٹیکس ریٹ: 400 روپے

*2۔ 30 تا 100 ڈالرز کے فون پر:*

نیا ٹیکس ریٹ: 1320 روپے

پرانا ٹیکس ریٹ: 4000 روپے

*3۔ 100 تا 200 ڈالرز کے فون پر:*

*نیا ٹیکس ریٹ: 1680 روپے*

پرانا ٹیکس ریٹ: 6000 روپے

*4۔ 200 تا 350 ڈالرز کے فون پر:*

*نیا ٹیکس ریٹ: 1740 روپے*

پرانا ٹیکس ریٹ: 8000 روپے

*5۔ 350 تا 500 ڈالرز کے فون پر:*

*نیا ٹیکس ریٹ: 5400 روپے*

پرانا ٹیکس ریٹ: 23000 روپے

*6۔ 500 ڈالرز سے زئد مالیت کے فون پر:*

*نیا ٹیکس ریٹ: 9270 روپے*

پرانا ٹیکس ریٹ: 41000 روپے

TAX utna hi hai….Bs 19,20 k frk ha

koi bata skta hai k 200USD se 350USD k mobile per kitna taxa dena hoga total..

Its not reasonable its still show same amount of tax for my mobile

tax on iphone six plus 128 gb which i purchase on 800drham from dubai