Despite being one of the most lucrative businesses in the country, for some reason, jewelers have, over time, unfortunately, lagged behind in upgrading the technology aspect of their financial transactions. The lack of technological reforms in their day-to-day operations is apparent in various areas such as calculations, payments, and disbursements.

Rehman Qayyum, a 41-year-old Gujranwala based jeweler, has become one of the earliest adopters in the ever-changing financial digital landscape of Pakistan. A Bank Alfalah account holder for the past 12 years, he is now also the first merchant to accept QR payments in his particular jeweler market.

We sat down with Mr. Qayyum to discuss how AlfaPay has helped his business transactions to be effectively managed, and following is what he shared:

I have always been a tech-savvy person by nature, hence I hold a certain fascination for technology especially in terms of how it is making life easier with every passing day. Alfa by Bank Alfalah has done just that by providing me relief in my day-to-day payment issues. It is far easier and cost-effective as compared to POS. Cash payments received through QR are efficient and auto settled.

This is saving me time and energy because now I don’t have to worry about the security and deposit of my cash. Being a jeweler, cash transactions of high value are quite risky, but with AlfaPay QR I don’t have to worry about cash handling, and I also get instant payment notifications. I believe that the future for us is very promising because digital payments is the way forward for a progressive economy.

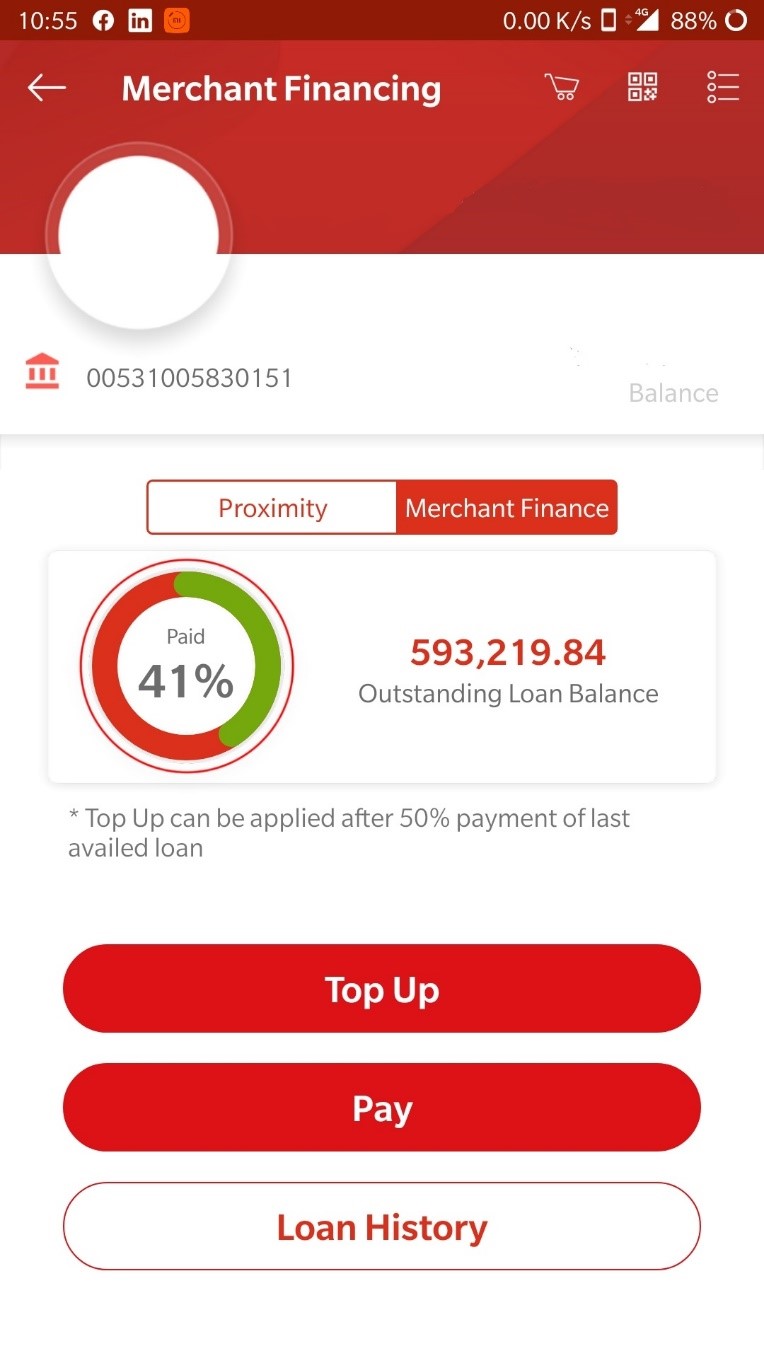

Mr. Qayum is also the first QR Merchant to get Rs.1 million in digital merchant financing from Bank Alfalah. This is owed to Mr. Rehman’s success as an IT literate Alfa QR merchant who holds a good payment history and willingness to adapt to the ever-changing digital landscape of Pakistan. This loan will help Mr. Qayum reach new heights in his business and help fulfill his dreams.

About Alfa Merchant Financing

Merchant Financing is a feature for the loyal Alfa QR merchants who are looking forward to expanding their businesses. It encompasses key benefits of use such as, a fully digital & completely paperless process, no hidden charges, no hassle of visiting the branch, payment of daily installments directly adjusted from QR transaction volumes (percentage of transaction adjusted to repay the instalment) , no locking period and no prepayment charges or penalties, which means that you can settle your loan anytime by pay off the amount due.

The loan facility is right now available for selected merchants, but any merchant can become eligible for the loan by performing a minimum of 100 QR transactions along with a business presence of 6 months and at least a month of Alfa QR history.

This is indeed a milestone for Bank Alfalah as it demonstrates how small & medium enterprises like that of Mr. Rehman can digitize their day-to-day payments and benefit from digital merchant financing to grow their business.

Bank Alfalah has worst customer service i have experienced so far. i Have been complaining for a n issue and its been four months now without resolution. HATS OFF to them.

Is it a “Press Release” or a “Sponsored” post?

AlfaPay is not the only one that accepts QR payments in Pakistan, or is it?

Amazing things will happens when you Listen to your customer and e360.pk is doing that

I HAve successful business / platform that boost the business of others and i.e.e360.pk