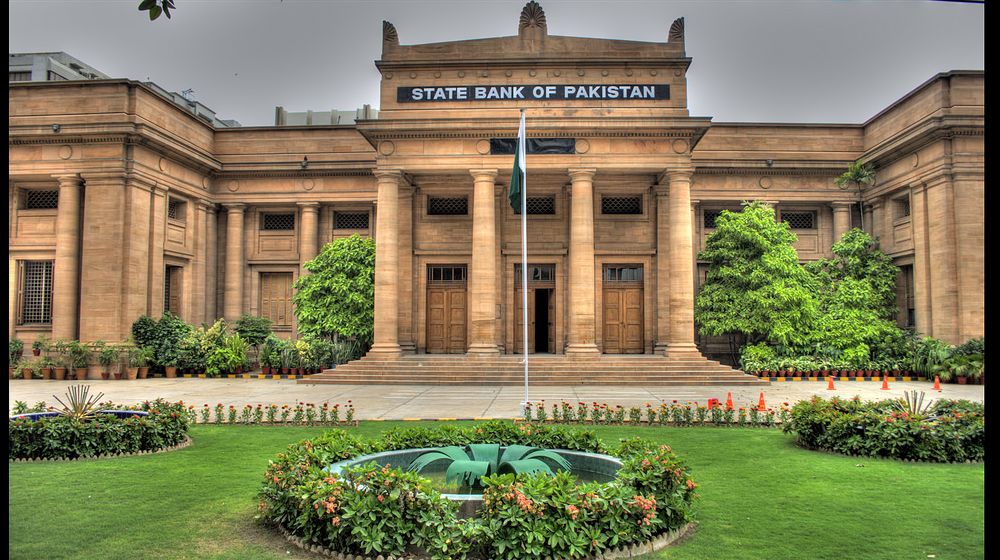

State Bank of Pakistan has confirmed that it has received US$1.39 billion from the International Monetary Fund (IMF) under the Rapid Financing Instrument to address the economic impact of COVID-19.

The central bank, through Twitter, announced that, “SBP has received $1.39 billion under Rapid Financing Instrument by the IMF.”

#SBP has received $1.39 bn under Rapid Financing Instrument by the #IMF.

— SBP (@StateBank_Pak) April 22, 2020

The Executive Board of the International Monetary Fund (IMF) had approved the funds under the Rapid Financing Instrument (RFI) on April 17, equivalent to SDR 1,015.5 million (US$ 1.386 billion, 50 percent of quota) to meet the urgent balance of payment needs stemming from the outbreak of the COVID-19 pandemic.

The official statement from the fund stated that with the near-term outlook deteriorating sharply, the authorities have swiftly put in place measures to contain the impact of the shock and support economic activity. Crucially, health spending has been increased and social support has been strengthened.

As the impact of the COVID-19 shock subsides, the authorities’ renewed commitment to implement the policies in the existing EFF will help support the recovery and strengthen resilience.

“While uncertainty remains high, the near-term economic impact of COVID-19 is expected to be significant, giving rise to large fiscal and external financing needs. The IMF support will help to provide a backstop against the decline in international reserves and provide financing to the budget for targeted and temporary spending increases aimed at containing the pandemic and mitigating its economic impact,” said the statement.

The IMF remains closely engaged with the Pakistani authorities and as the impact of the COVID-19 shock subsides will resume discussions as part of the current EFF.

ALSO READ

IMF Says Its Working Closely With Pakistan on the Upcoming Budget

Following the Executive Board discussion, Geoffrey Okamoto, First Deputy Managing Director and Acting Chair, made the following statement:

The outbreak of Covid-19 is having a significant impact on the Pakistani economy. The domestic containment measures, coupled with the global downturn, are severely affecting growth and straining external financing. This has created an urgent balance of payments need.

“In this context of heightened uncertainty, IMF emergency financing under the Rapid Financing Instrument provides strong support to the authorities’ emergency policy response, preserving fiscal space for essential health spending, shoring up confidence, and catalyzing additional donor support,” he added.

ALSO READ

China to Contribute Over $6 Billion as IMF’s EFF Put on Hold

He further stated that,

In response to the crisis, the government of Pakistan has taken swift action to halt the community spread of the virus and introduced an economic stimulus package aimed at accommodating the spending needed to tackle the health emergency and supporting economic activity. Crucially, the authorities are increasing public health spending and strengthening social safety net programs to provide immediate relief to the most vulnerable.

Similarly, the State Bank of Pakistan has adopted a timely set of measures, including a lowering of the policy rate and new refinancing facilities, to support liquidity and credit conditions and safeguard financial stability. In this context, the authorities’ policies should be targeted and temporary.

Lets hope these are utilized properly on medical equipments and aid for the poor