The government had decided to reduce the profit rates for national savings schemes with immediate effect in line with cuts in the benchmark interest rates in a short span of time.

Interest rates were revised down after the State Bank of Pakistan (SBP) aggressively cut the benchmark interest rate by 4.25% in one month.

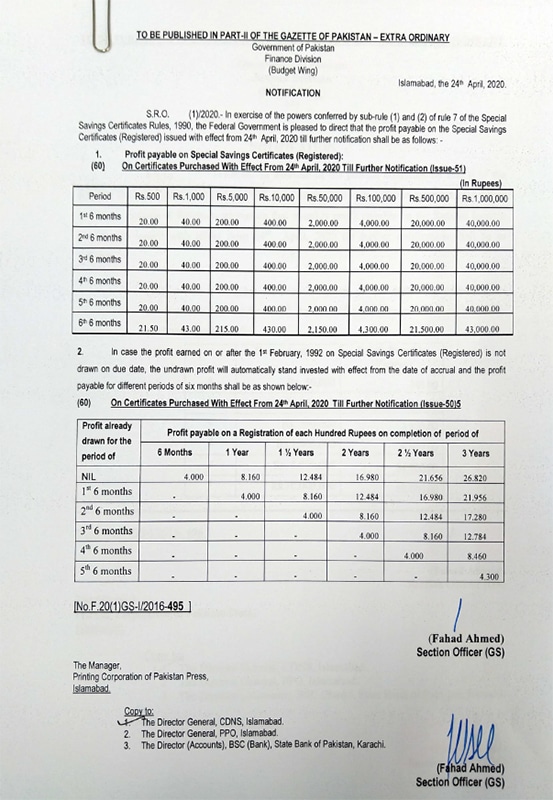

According to a notification, the profit rate has been slashed by:

- 1.86% to 8.54% from 10.54% on Defense Saving Certificates

- 1.92% to 10.32% from 12.28% on Behbood and Pension Funds

- 1.60% to 7% from 8.60% on Savings Account

- 3% to 8% from 11.13% on Special Saving Certificates (SSC)

- 2.28% to 8.28% from 10.56% on Regular Income certificate

The new rates were applicable from April 24, 2020. The profit is payable on the deposits made in the savings bank accounts where withdrawals are made through other than cheques was fixed at 7 percent per annum. The profit rate on monthly balances maintained in Shuhada’s family welfare account was set at 10.32% per annum.

During the first seven months, the directorate managed to collect Rs. 116 billion. It was tasked to collect Rs. 352 billion in savings during the current fiscal year, as opposed to the actual collection of Rs. 410 billion in the last fiscal year.

The arbitrary and unilateral action action in reducing the interest rates is averse to savings instead of encouraging and provide incentives to savers by fair and reasonable returns on their hard earned savings particularly when savings level back bone of economy is already very low.

The government action is unjustified succumbing to pressure of business and manufacturing groups /chamber of commerce (main beneficiaries) utilizing major share of borrowing from banks provided out of public/savers funds kept as trust in banks in the form of deposits on false pretext of controlled inflation and declining price levels. The borrowers want to utilize savers funds by victimising them with minimum or no interest return or even free the public funds. There is no decline in price levels, salaries and wages, rents, fares, gas and electric charges, conveyance and transportation charges despite decrease in oil prices. Even despite Chamber of Commerce falsely claiming decline in price levels and illegal pressure on SBP to bring down key interest rates, only a week earlier Indus Motors contrarily increased prices on all its models from Rs. 120,000 to 500,000.

These business groups already availing multiple advantages and incentives in the form of rebates, moratoriums, tax holidays, refunds etc., at the cost of tax payers. Further on loans also generally defaulters seeking rescheduling, waivers and even write offs on pretext of inability to repay public funds due to losses fraudulently shown despite all protections and favors. The government and SBP too for strange reasons obliges them burdening public instead of initiating bankruptcy proceedings.

Dishonesty, fraud and corruption is rampant on all levels victimising none but public.