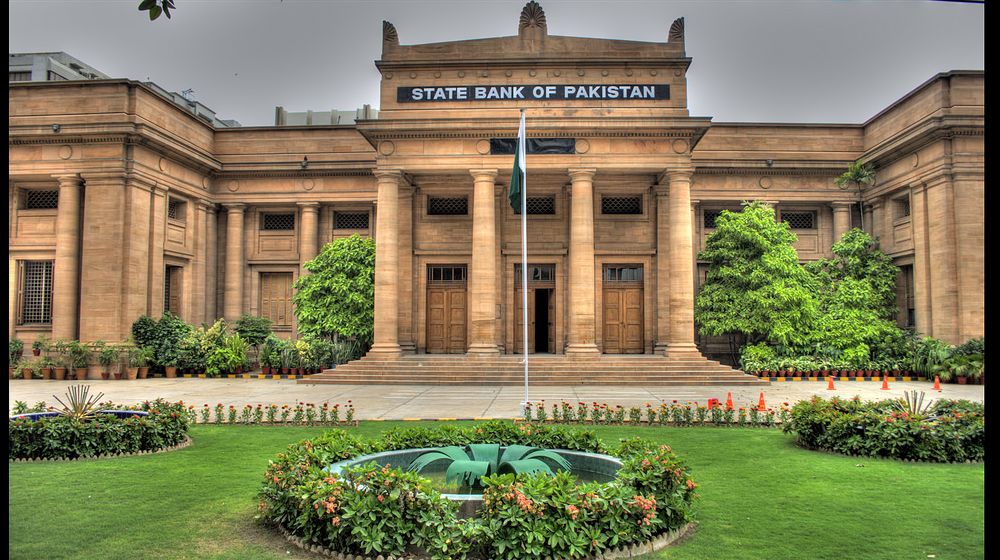

As many as 0.5 million employees have been saved from layoffs and non-payment of salaries in the private sector through the refinancing scheme introduced by State Bank of Pakistan recently, which apparently diluted the crisis to some extent during the prevailing lockdown.

According to the State Bank of Pakistan (SBP), over 700 companies from different cities and various sectors approached commercial banks for availing refinancing facilities to pay salaries to their employees on time.

On this account, the banks are in the process to approve loans of a whopping Rs. 65 billion for various corporations against a concessional rate of 3 percent which SBP introduced a few weeks ago specifically to cater to the private sector to avoid firing workers.

According to SBP,

There has been significant take-up in the refinance scheme introduced by SBP that provides concessional loans at 3% to any company that commits to not lay off workers for the next three months.

How To Avail The Loans

A corporation can avail loans of up to Rs. 5 million without submitting any documents of assets as collateral for its employees for a minimum period of three months but it will not fire its employees during the period, which is the core objective of the scheme.

Corporations seeking loans of over Rs. 5 million need to record collateral, however, it also depends on the relationship of banks which might relax conditions for a company that maintains its business accounts or has their credit history for years.

A company has to provide proof such as salary slips or certificates of the employee of the last three months along with documents such as employees CNICs.

Interestingly, banks will not issue loans to companies for disbursing the salaries to their employees but it will open bank accounts of the employees and disburse salaries to the account itself. This practice will stop the misuse of the loan available on concessional rates.

During the prevailing situation, it is likely that more corporations will approach the commercial banks to avail the refinancing scheme.

Issues and Challenges

Many corporations, particularly in the SME sector, did not get a positive response from the banks due to the unavailability of documentation and salary records of the employees.

Businesses of the services sector with limited infrastructure and assets are also being denied by the commercial bank due to risk. Different trade bodies and NPOs should also be considered for the refinancing facility by the banks.

In the scenario, SBP should address the issues and come up with relaxation and special arrangements.

Yaha Bhi 3 percent Commission : Rehman Karo Awam Pr SBP Wale

Seekho Mezan Bank se