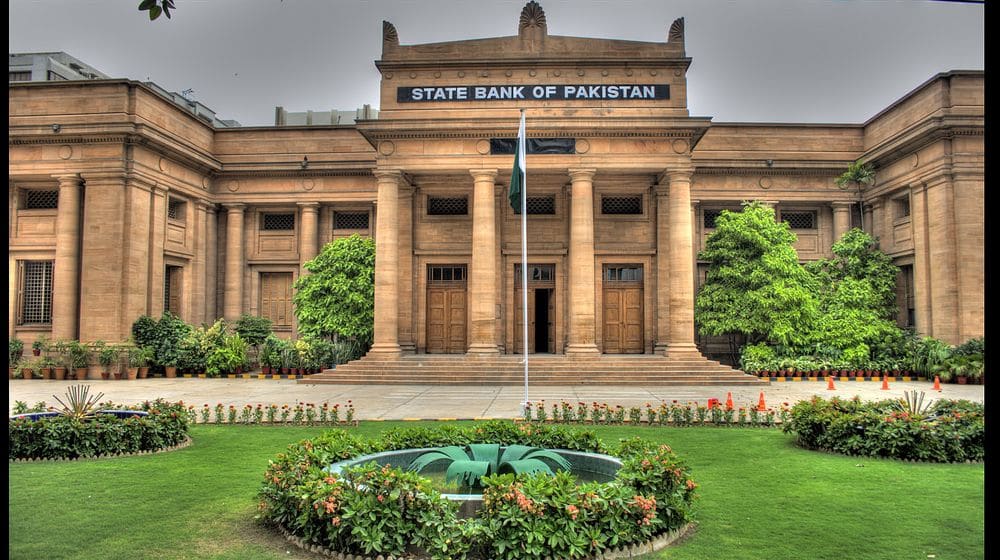

The State Bank of Pakistan has issued guidelines for banks and DFIs that will allow buyers to purchase housing units in under-construction projects through housing finance.

Its new guidelines provide a complete framework with necessary risk mitigation elements for the banking industry to support this area of housing financing. The purchasers of housing units that avail of housing finance will be able to enjoy a number of benefits.

First, the purchasers will get the housing units in under-construction projects that are relatively low cost as compared to fully constructed units.

Second, the banks’ strong monitoring and oversight will facilitate the timely completion and transfer of possession to the purchasers.

Third, housing units are new, which is why the purchasers may bear lower maintenance and renovation costs during the initial years. These benefits are expected to create incentives for the buying of under-construction houses, thereby creating a demand for the construction industry.

Prevalent Situation

The prevalent market practice is that builders allow the purchasers of housing units to make periodic payments when construction begins against allotment letters, which is a convenient process in enabling home ownership.

Banks are reluctant to offer finance for the purchase of housing units in under-construction projects, as compared to completed projects, and do not provide housing finance against allotment letters. Consequently, buyers are deprived of the opportunity of availing of housing finance from banks and owning affordable housing units in the under-construction phase of the projects.

Additionally, builders also complain that the non-availability of housing finance from banks for the under-construction projects reduces their demand and slows the development of the new projects.

Guidelines

The under‐construction projects may either be horizontal constructions (single or two-story standalone land-based houses) or vertical constructions (flats/apartments in multistorey buildings). Furthermore, the builders/developers of the housing projects may or may not have availed of construction financing. Thus, based on these two parameters, under‐construction projects may be categorized into four groups:

- Projects comprising horizontal houses where builders/developers have availed of construction financing.

- Projects comprising horizontal houses where builders/developers have not availed of construction financing.

- Projects comprising vertical houses where builders/developers have availed of construction financing.

- Projects comprising vertical houses where builders/developers have not availed of construction financing.

The creation of a legally enforceable mortgage in the case of the projects of horizontal houses is easy as the borrower owns the land parcel and the subsequent constructions thereon. The availability of clear title documents allows banks to extend financing and create mortgages. In fact, banks are already extending financing for the construction of horizontal houses, which is usually termed as the construction of a house on an already owned plot or the purchase of a plot and the construction of a house thereon.

On the other hand, the land parcel of the apartments/flats is inseparable and is jointly owned by the purchasers/owners of all the flats/apartments in the building. Also, the title documents of flats/apartments may not be valid during the construction period, such as an allotment letter for an incomplete flat in the grey structure of an under‐construction building or a flat on the seventh floor of a building that currently has three floors.

Bank(s)/DFI(s) will devise Builder Selection Criteria and Project Selection Criteria to select builders and their projects that are eligible to enter into arrangements for the financing of under-construction projects. The Builder Selection Criteria may inter‐alia include the builder’s/developer’s financial soundness, the track record of the builder/developer regarding compliance with legal and urban planning, as well as the fulfillment of milestones in the completion in previous projects.

For the purpose of these guidelines, builders/developers are entities that undertake the construction of vertical residential or commercial‐cum‐residential projects for the purpose of selling housing units in these projects to the general public. These builders/developers can be private entities or government-owned entities/departments/agencies.

Bank(s)/DFI(s) will sign a Master Financing Agreement (MFA) with the builder/developer. In addition to financing terms, this agreement will also include the construction plan, timelines for the completion of a project, different construction milestones, a loan disbursement plan, and the procedure for the repayment of financing to bank(s)/DFI(s).

Bank(s)/DFI(s) may decide about the debt-equity ratio for the project in consideration of the risk profile of the builder/developer. However, bank/DFI financing will not exceed 70 percent of the project value. In the case of cost overruns, bank(s)/DFI(s) will require the builder/developer to arrange for additional funds from their own sources.

Bank(s)/DFI(s) will ensure that the project feasibility accounts for cost overruns and the builder/developer withstand unexpected additional project costs.

Bank(s)/DFI(s) will create a mortgage charge on the project land and constructions thereon. During the interim period until the completion of the construction and the formalities for the legal transfer of the titles of housing units to the purchasers, consortium bank(s)/DFI(s) will keep the mortgage on the project land along with constructions and appurtenances thereon as an arrangement of a third party mortgage from the builder/developer on behalf of the housing finance borrowers.

The builder/developer will be required to obtain a No Objection Certificate (NOC) from the lead consortium bank/DFI on behalf of all financing banks/DFIs before selling any housing unit in the project to a purchaser.

The builder/developer will provide a guarantee to buyback the housing unit or arrange for an alternative purchaser in case of delinquencies, whether it is delinquencies in the payment of the markup installments by the borrowing purchasers or delinquencies in the regular construction payments in the case of non‐borrowing purchasers of housing units in the projects. Furthermore, in the case of delinquencies by the borrowing purchasers of housing units during the construction period, financing banks/DFIs will require the builder/developer to prioritize the re‐allotment/transfer of such a housing unit to interested/potential purchasers.

Bank(s)/DFI(s) will require a builder/developer to neither give possession nor transfer the ownership of a housing unit without the clearance of all the over dues at the time of the possession or transfer. All the payments to the builder/developer for the completion of the construction/project will be routed through an escrow account maintained by the lead bank/DFI of a consortium. The builder’s/developer’s equity and purchasers’ equity contribution and the subsequent payments of the purchasers through mortgage financing will be routed through the same account.

Disbursements to the builder/developer will be made in tranches upon the completion of construction milestones as per the agreed terms and conditions of the financing arrangement between the builder/developer and the bank/DFI.

Future Outlook

The State Bank of Pakistan (SBP) has decided to exempt banks/DFIs extending housing finance for under-construction housing units from the requirements specified under Regulation HF 8: Creation of Mortgage for Housing Finance. This exemption will be available until the arrangement of a completion certificate, NOCs, approvals, utility connections, and the registered title deed between the builder/developer and the buyers of the housing units.

In order to avail of this exemption, the banks/DFIs are required to meticulously comply with the provisions of the Guidelines for the Financing of Housing Units in Under-construction Projects.

With an increase in financing after the issuance of these guidelines, such concerns will be addressed. The SBP guidelines are a major step forward and are in line with its ongoing efforts to spur economic development through the promotion of activity in the housing and construction sectors.

It is expected that the housing finance of banks will grow significantly in the near future. Apart from providing borrowers the opportunity to avail of housing finance under ‘Mera Pakistan Mera Ghar’ in the under-construction projects, this will also help builders to enhance the stock of new apartments/flats across the country.