The new coalition government has introduced seven slabs of income tax on the salaried class in the country for the upcoming budget year.

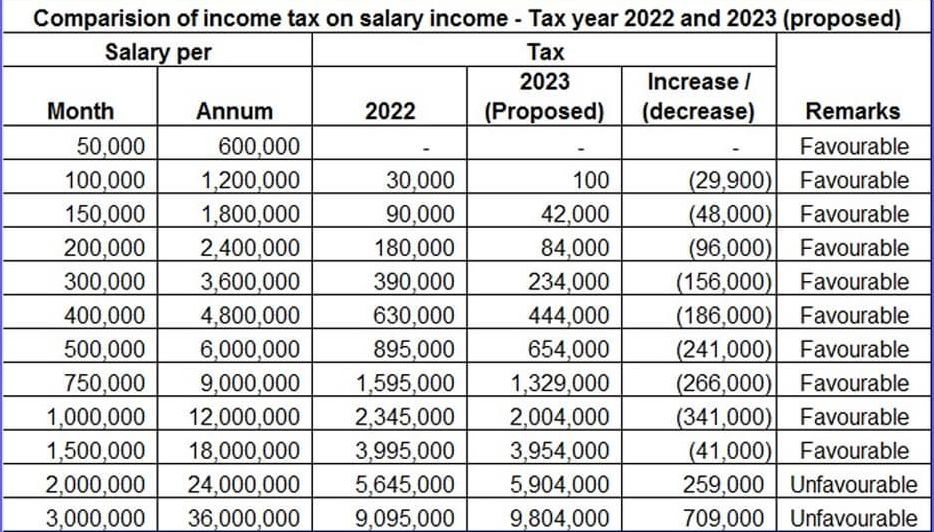

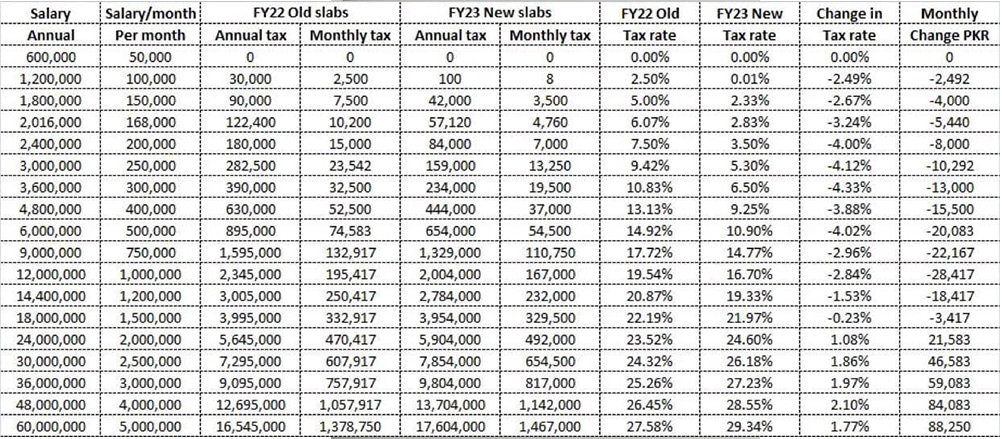

According to the finance bill 2022-23, the government has exempted the monthly salary of up to Rs. 50,000 (Rs. 600,000 annually) from income tax. The government will deduct a lump sum of Rs. 100 where taxable annual income exceeds Rs. 600,000 (Rs. 50,000 per month) but does not exceed Rs. 1.2 million annually (Rs. 100,000 per month).

Where the taxable annual income exceeds Rs. 1.2 million (Rs. 100,000 per month) but does not exceed an annual income of Rs. 2.4 million or Rs. 200,000 per month, the government will deduct 7% of the amount exceeding the annual income of Rs. 1.2 million.

Where taxable annual income exceeds Rs. 2.4 million or Rs. 200,000 per month but does not exceed Rs. 3.6 million annually or Rs. 300,000 per month, the tax rate will be 12.5 percent of the amount exceeding Rs. 2.4 million as well as a fixed amount of Rs. 84,000 annually.

Where taxable annual income exceeds Rs. 3.6 million or Rs. 300,000 per month but does not exceed Rs. 6 million annually/Rs. 500,000 per month, the rate of tax will be 17.5 percent of the amount exceeding Rs. 3.6 million with an additional fixed Rs. 234,000 annually (Rs. 19,500 per month).

The government will deduct Rs. 654,000 annually (Rs. 54,500 per month) + 22.5 percent of the amount exceeding Rs. 6 million if taxable annual income exceeds Rs. 6 million (Rs. 500,000 per month) but does not exceed Rs. 12 million (Rs. 1 million).

Where taxable annual income exceeds Rs. 12 million (Rs. 1 million per month), the government will deduct an annual income tax of Rs. 2,004,000 (Rs. 1,67,000 per month) + 32.5% of the amount exceeding Rs. 12 million.

The government has also introduced three slabs for the income tax rate on the income of companies through the Finance Bill 2023.

According to the new finance bill, the government proposed an income tax rate of 20 percent on the income of small companies, 42 percent for banking companies, and 29 percent for any other companies.

People earning 10 to 20 lac Rs per month would be getting tax relief! And instead blanket advance tax are being proposed to introduce for everyone including those that earn even less than 15000 Rs per month. What is this concept?