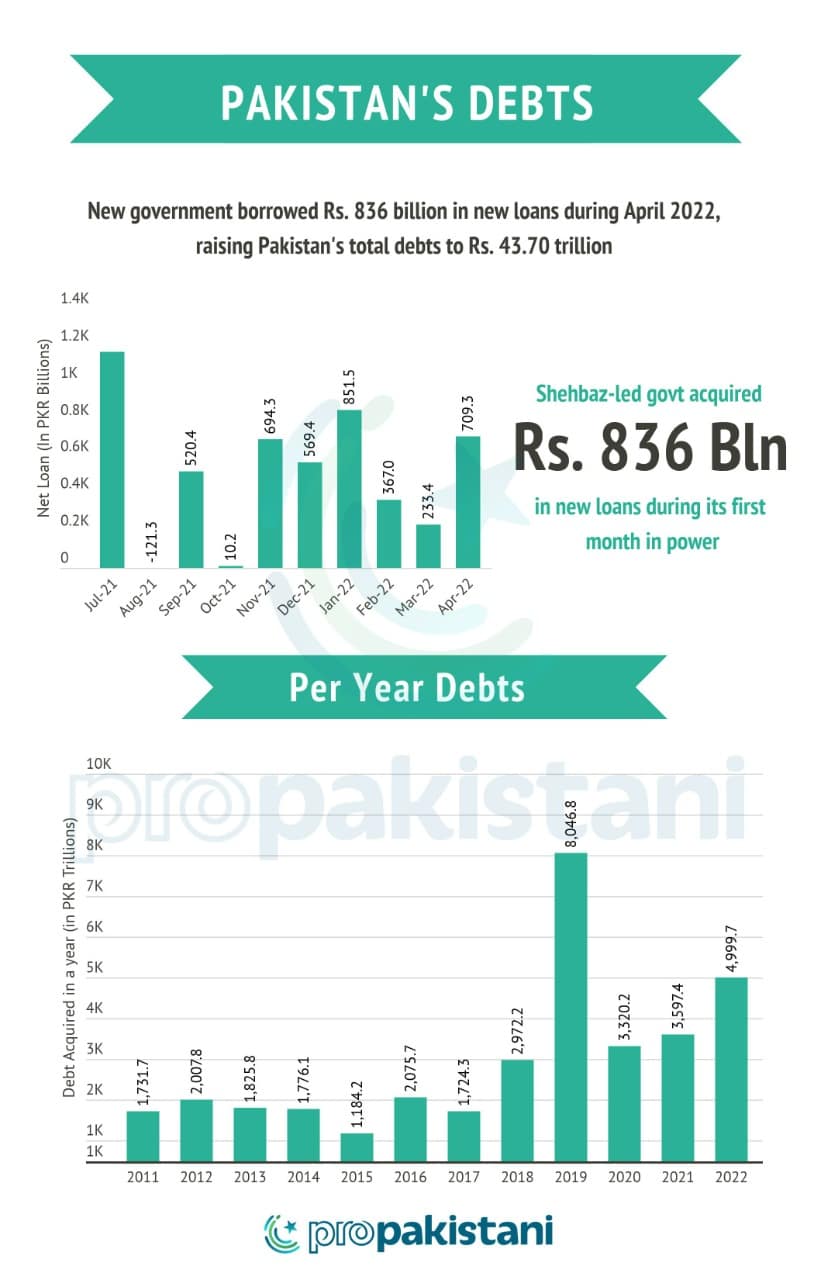

The new coalition government led by Prime Minister Shehbaz Sharif has added Rs. 709 billion in total central government debt stock during the first month (April) of its tenure due to reliance on heavy borrowing to run the country’s affairs.

According to a document from the State Bank of Pakistan (SBP), the debt stock of the federal government increased by Rs. 709 billion to Rs. 43.705 trillion in April from Rs. 42.995 trillion in March 2022.

The figures show that the Shehbaz Sharif Government has added debt stock by Rs. 23.63 billion per day during April.

It is pertinent to mention here that the previous government led by Imran Khan increased the debt stock by Rs. 15.88 billion per day during the first nine months (July-March) of the current fiscal year, amounting to Rs. 4,290 billion.

The document shows that the new coalition government has taken Rs. 836.6 billion in April 2022 from domestic sources. However, it has decreased by Rs. 127.3 billion external debt due to the repayment of some foreign loans during the same period.

The average value of the US Dollar also increased from Rs183.51 in March 2022 to Rs185.69 in April.

Out of total domestic debt resources, the long-term domestic debt was increased by Rs. 203.5 billion, while the short-term loan was increased by Rs. 335.6 billion during April. However, the debt stock of Naya Pakistan’s Certificates was decreased by Rs. 2.4 billion during the month.

Out of total long-term domestic debt, the government raised Rs. 137 billion through GOP Ijara Sukuk and Rs. 517 billion through Pakistan Investment Bonds, while it has paid back Rs. 150 billion of Saving Schemes during the period.

Out of total short-term domestic debt, the government obtained Rs. 335.6 billion through Market Treasury Bills during April 2022.