Update: According to Barwaqt’s response to ProPakistani, the app was taken down for backend maintenance. They claim that the app was removed by their own team and that it will be back on Monday, 18 July 2022.

On the other hand, a Google spokesperson has confirmed the company’s involvement, saying, “After further investigation, we have found them non-compliant with our policy and have taken action.”

Barwaqt, a Pakistani finance app infamous for stealing user data and exploiting customers has finally been removed from the Google Play Store. It seems that numerous reports from the app’s unfortunate victims have finally been noticed.

Searching for the app on Play Store now shows that the link has been removed.

https://twitter.com/misterzedpk/status/1547296473557020672?t=UMv7k27_scby1GoSYRbpkA&s=19

For those unaware, Barwaqt is a Pakistani app for online loans that offers multiple ways of receiving money. The company claims that customer information remains secure, but the app has been notoriously infamous for stealing personal data including phone numbers, names, email addresses, and more.

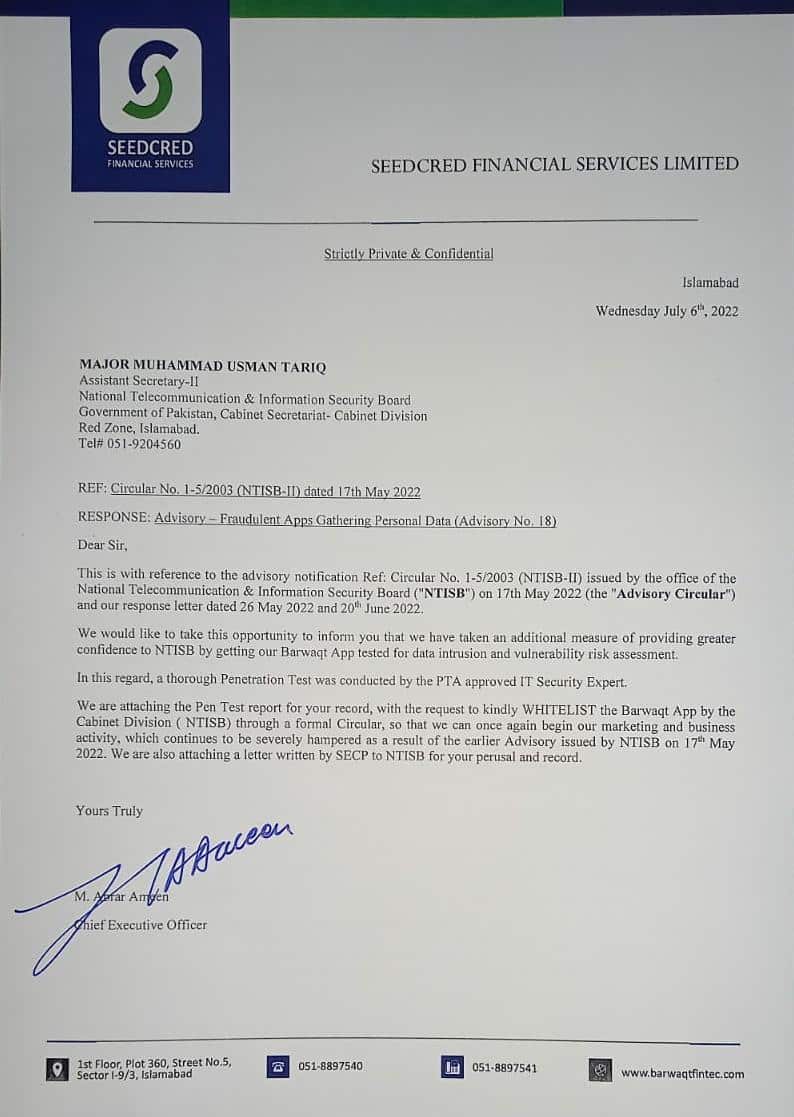

The government has also warned people against this app in the past. NTISB issued a statement against apps like Barwaqt and Olivecash. However, the lending app and the SECP have issued letters asking for a retraction of the official circular.

Loading...

Loading...

The Securities and Exchange Commission of Pakistan (SECP) had cautioned digital lending Nonbank financial companies (NBFCs) of regulatory intervention if full disclosure and fair business practices are not ensured by the industry as a whole.

SECP recently called a zoom meeting of the chief executives of NBFCs engaged in digital lending to discuss recent media reports about exorbitant interest rates, inadequate disclosures, and coercive collection practices, purportedly being resorted to by lending platforms.

The Twitter thread below details the controversies the app has been involved in over time.

1/ Predatory online lending apps in Pakistan have had 15M downloads according to @datadarbar_io. Many of them have extremely high interest rates i.e. 40%+ for 15 days. There should be zero tolerance for such exploitation, period. Including below good reporting from several folks:

— Aatif Awan (@aatif_awan) July 3, 2022

At the moment, the reason behind the app’s removal remains unclear, but it most likely has to do with mounting reports coming in from the fraudulent service’s victims.

Good

Are you sure they did the fraud? Or this poor app was put down by giants that were already in business for many years.

Google should have made it sure if app is dealing with money then encryption and other security requirements are met. I highly doubt that this is the case of fraudulent.

Today if i launch an app whose interest rate is 1% or less but performs almost 100% easy pay or jazz cash, who will be at most disadvantage..

Yes, it was a case of fraud I’m an App developer and according to Google play developer policies loan lending apps cannot ask for loan repayment before 60 days. Barwaqt used to show 70 days repayment time but it would ask for repayment within a week or two.

Me ny 7k ka loan liya tha…aj wapes krny k liye dubara download krny jarha tha app he band hogaye.. 😅😅 now 7k kesy return kru?

That’s good

Good

Now How can The persons repay the loan

SECP is not successful in properly regulating these dozens of registered and unregistered NBFCs. State Bank should also make rules for these lending apps just like Indian state Bank had done. It is written in the regulations of NBFCs that they will offer financial services on a minimum rate to public but they are looting poor people by charging high interest rates around 40 to 80% per month. Using unfair means, defamation, and bad practices for recovery. SECP can regulate them by keeping them within the lawful limits and bound them strictly following the regulations of NBFCs by providing finances on low interest.