The Pakistani Rupee (PKR) slid further against the US Dollar (USD) and posted losses during intraday trade today.

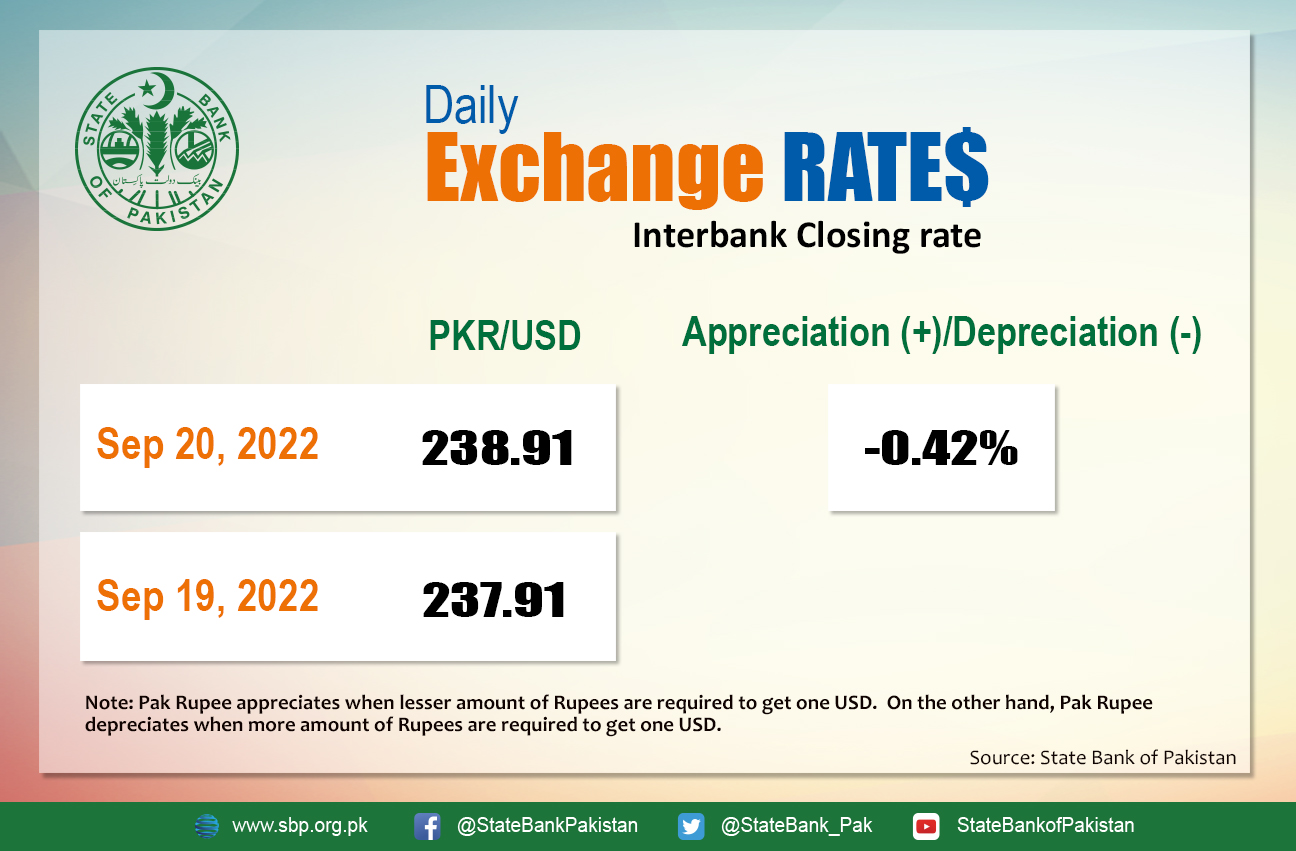

It depreciated by 0.42 percent against the USD and closed at Rs. 238.91 after losing 99 paisas in the interbank market today. The local unit quoted an intra-day low of Rs. 239.7 against the USD during today’s open market session.

The local unit was taking hits from the opening bell and was trading at 239.5 at 11 AM. By midday, the greenback went as low as 239.765 against the rupee. After 2 PM, the local unit stayed at the 239 level against the top foreign currency before the interbank close.

The rupee closed in red against the dollar for the thirteenth consecutive day today and now is just Rs. 0.94 away from its all-time low of Rs. 239.94 against the greenback. The open market is also experiencing a shortage of US currency.

The drop can be attributed to a number of factors, including the ongoing surge in dollar demand from local importers, the country’s dwindling forex reserves, and rising import bills in the aftermath of the worst floods.

The current PKR decline was caused by the onset of floods and their negative impact on the country’s external account, as crop losses would now need to be recovered through imports amid weak external flows.

No Recovery in Sight As Oil Prices Retreat, IMF Promises Help

Despite significant announcements from the government and institutions, market sentiments of the local unit are mixed. The International Monetary Fund’s (IMF) resident representative stated earlier that the money lender will assist Pakistan with reconstruction and relief efforts. However, even such good news has yet to change the market’s perception of the local unit.

Also, experts have said investors are a bit tipsy about the effects of the floods on the overall economy and the external sector especially. The main issue would be managing IMF expectations while allowing for relief and rehabilitation costs.

Globally, oil prices briefly soared before falling as the Organization of Petroleum Exporting Countries (OPEC) and its allies keep producing less than their quotas. Oil rates were headed for a fourth monthly decline ahead of an expected further US interest rate hike which may hamper economic growth and fuel demand across the globe.

Brent crude was down by 0.23 percent at $91.79 per barrel, while the US West Texas Intermediate (WTI) went down by 0.40 percent to settle at $85.39 per barrel.

A document from the OPEC nations and Allies, led by Russia, revealed that the group fell short of its output target by 3.583 million barrels per day (bpd) in August – roughly 3.5 percent of global oil demand. Meanwhile, the deadlock over reviving the Iran nuclear deal is preventing Tehran’s exports from fully returning to the market.

Nonetheless, both Brent and WTI are on track for their worst quarterly percentage drops since the COVID-19 pandemic began.

The dollar held near a two-decade high against major peers on Tuesday, making oil more expensive for holders of other currencies as central banks around the world look for solutions.

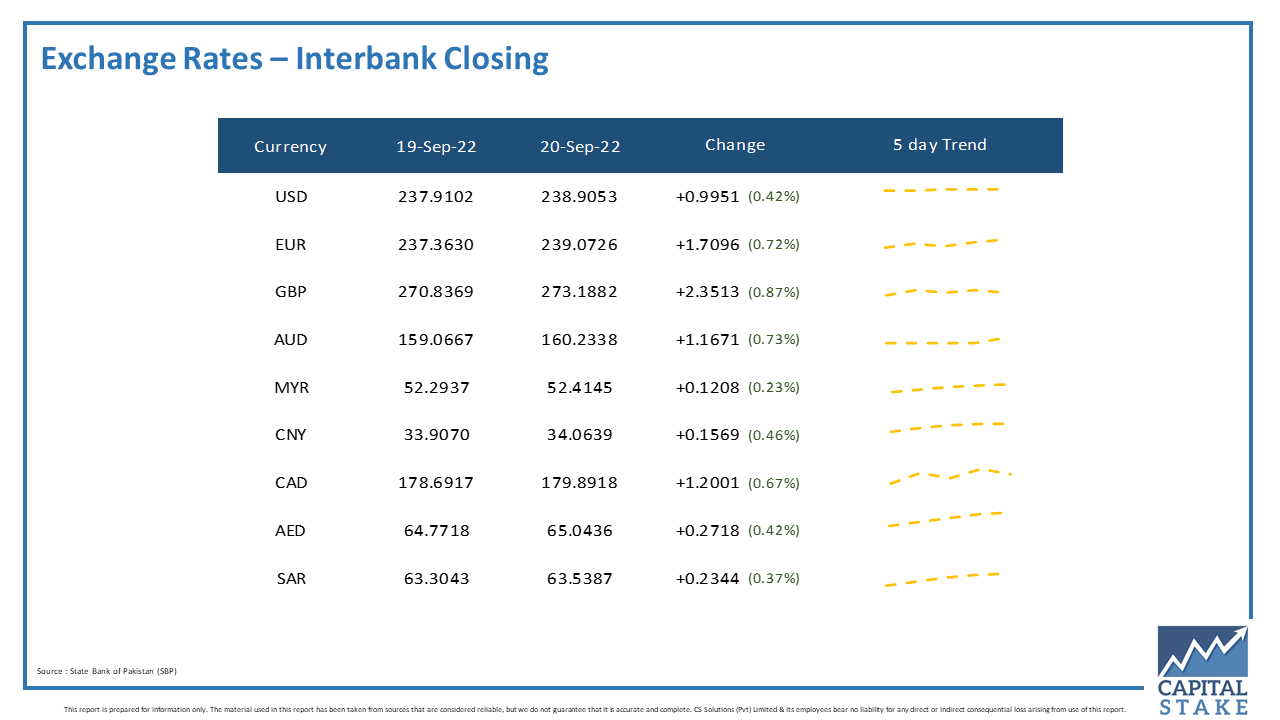

The PKR slid against the other major currencies in the interbank market today. It lost Rs. 1.16 against the Australian Dollar (AUD), Rs. 1.20 against the Canadian Dollar (CAD), and Rs. 2.35 against the Pound Sterling (GBP).

Moreover, it lost 23 paisas against the Saudi Riyal (SAR), 27 paisas against the UAE Dirham (AED), and Rs. 1.70 against the Euro (EUR) in today’s interbank currency market.