Exchange rate management is regarded as one of the most crucial components of economic policymaking, especially in countries like Pakistan that are prone to balance-of-payment shocks. Inflation, currency trends and trade data are some common indicators of economic health, with the Real Effective Exchange Rate (REER) recently gaining traction.

But what exactly is REER and how well do we understand it?

The REER is a measure of the value of a currency against a weighted average of several foreign currencies. Independent economic analyst A. H. H. Soomro told ProPakistani that the index’s trends could help gauge the rupee’s value. He said:

REER is a broad indicator to reflect currency’s inherent worth vis a vis inflation in other trading countries. It’s an index and does not imply 100 as a fair or unfair pivot. We may look at the trend nonetheless to be used as one factor for determining PKR’s value.

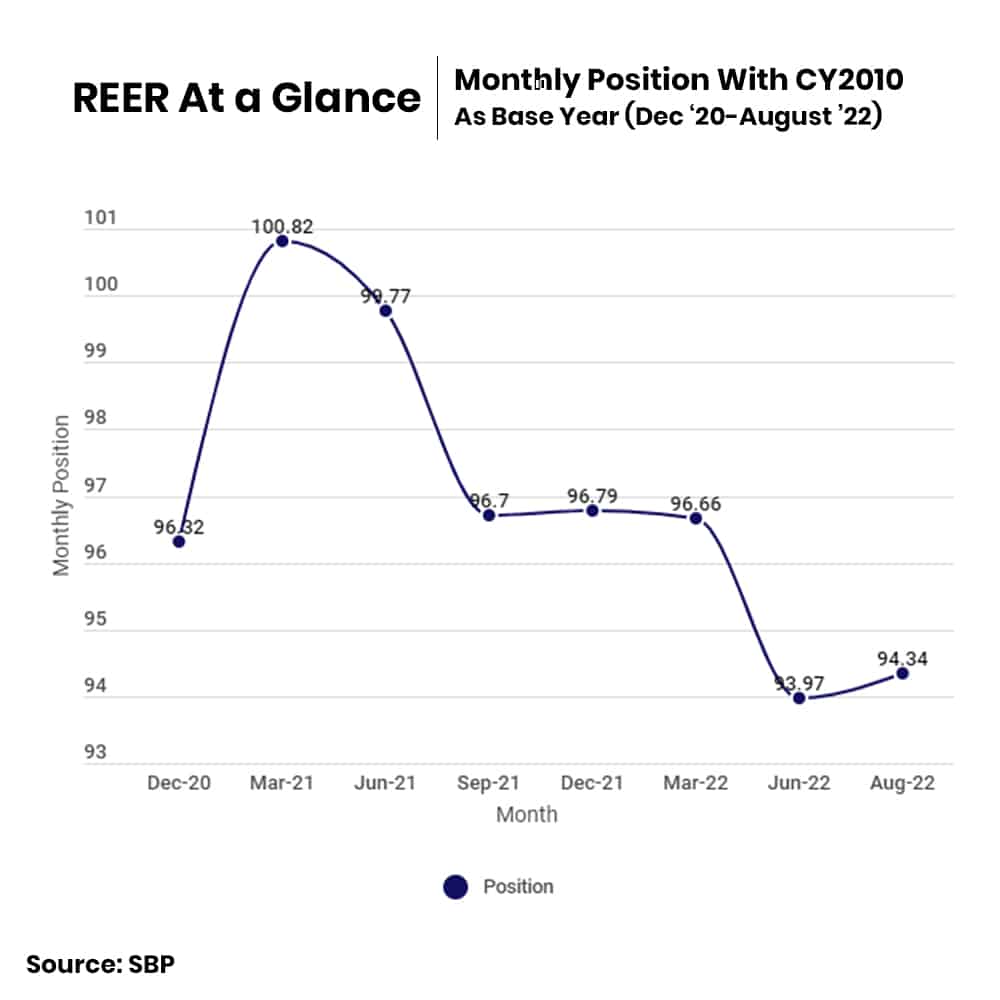

According to the latest monthly data released by the State Bank of Pakistan (SBP), the country’s REER currently stands at 94.3.

REER for Assessing Trade Flow

A rising REER indicates a loss in trade competitiveness with exports becoming more expensive and imports getting cheaper, according to the International Monetary Fund. While the PKR is currently appreciating against the US dollar, the REER may shrug off the improvement due to rising inflation.

Soomro explained:

REER may not drastically improve as domestic inflation is skyrocketing versus our trading partners, and thus, any short term PKR improvements may be negated by recent rounds of increasing CPI. Exporters have become competitive due to cheap LTFF and TERF and now PKR depreciation. However, expect some cries now as government withdraws regionally competitive energy tariff from next month.

The IMF projects Pakistan’s trade deficit to widen over the next five years with imports expected to be about twice the level of exports. Recent devastating floods could weigh on those projections.

Common Misconceptions About REER

The REER, as an indicator of the country’s trade competitiveness, is often prone to two common misinterpretations in the context of exchange rate valuation. First, appreciation of the REER is often confused with currency overvaluation, while depreciation is believed to represent undervaluation. However, the REER index could move regardless of the rupee being overvalued, undervalued, or remaining near its equilibrium, according to a video posted by the SBP in 2021.

Additionally, a REER index value above or below 100 is frequently interpreted as overvaluation or undervaluation of the PKR, respectively. To clarify, the base year is only for reference and does not suggest that the currency was in equilibrium during that year.

To wrap it up, a deeper analysis is required for assessing an exchange rate valuation, covering several cross-country factors including foreign exchange reserves, fiscal balance, credit demand, demographics, real interest rate, country risks, and worker remittances.