The Pakistani Rupee (PKR) gained further against the US Dollar (USD) and posted gains during intraday trade today.

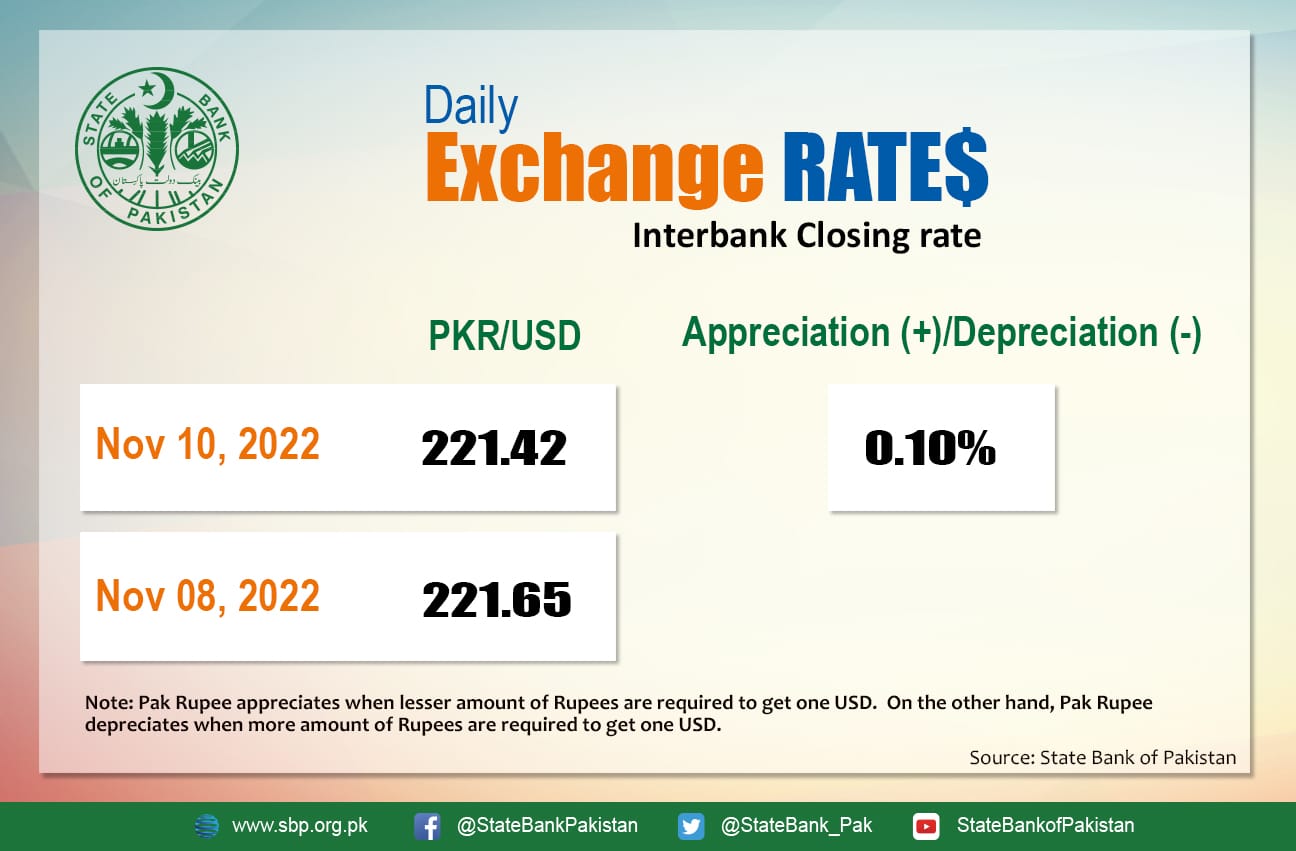

It appreciated by 0.10 percent and closed at Rs. 221.42 after gaining 22 paisas against the greenback. The local unit quoted an intraday low of 221.88 against the greenback.

The local unit was bullish in the morning against the greenback and resumed trade at 221.65 in the open market. By midday, the greenback moved marginally higher against the rupee. After 1 PM, the local unit stabilized and stayed on the 221 level against the top foreign currency before the interbank close.

The rupee gained further against the US Dollar today for the fourth consecutive day today after it was announced that SBP will receive $500 million from the Asian Infrastructure Investment Bank (AIIB) this month.

Money changers said the market response remained positive after the government Wednesday decided to withdraw applications filed in protest of the Shariah Court’s decision to impose an interest-free banking system in Pakistan. Finance frontman Ishaq Dar announced that the government will drop the application filed by the State Bank of Pakistan (SBP) and National Bank of Pakistan (NBP) against the Shariat Court’s ruling.

Meanwhile, there is a broad understanding among analysts that the central bank has been funneling currency notes into the market via OMOs which is generating gains and keeping the dollar below 222 against the PKR. While speculative, the view is the central bank is “only delaying” the PKR drop and that day isn’t very far.

Globally, oil prices fell for the fourth consecutive session on Thursday, as renewed COVID curbs in China raised concerns about fuel demand in the world’s largest crude importer.

At 4:10 PM, Brent crude was stable, up by 0.05 percent at $92.70 per barrel, while the US West Texas Intermediate (WTI) slid by 0.12 percent to settle at $85.73 per barrel. Both benchmarks rose more than $1 on Wednesday, helped by another drop in US oil inventories, despite the US Federal Reserve raising interest rates by 75 basis points.

Crude rose earlier this year as Russia’s invasion of Ukraine raised supply concerns, with Brent approaching its all-time high of $147. Prices have since fallen due to recession fears, with Brent dropping more than 6% this week.

A significant increase in US crude inventories weighed on the market on Wednesday. They increased by 3.9 million barrels, bringing inventories to their highest level since July 20, 2021.

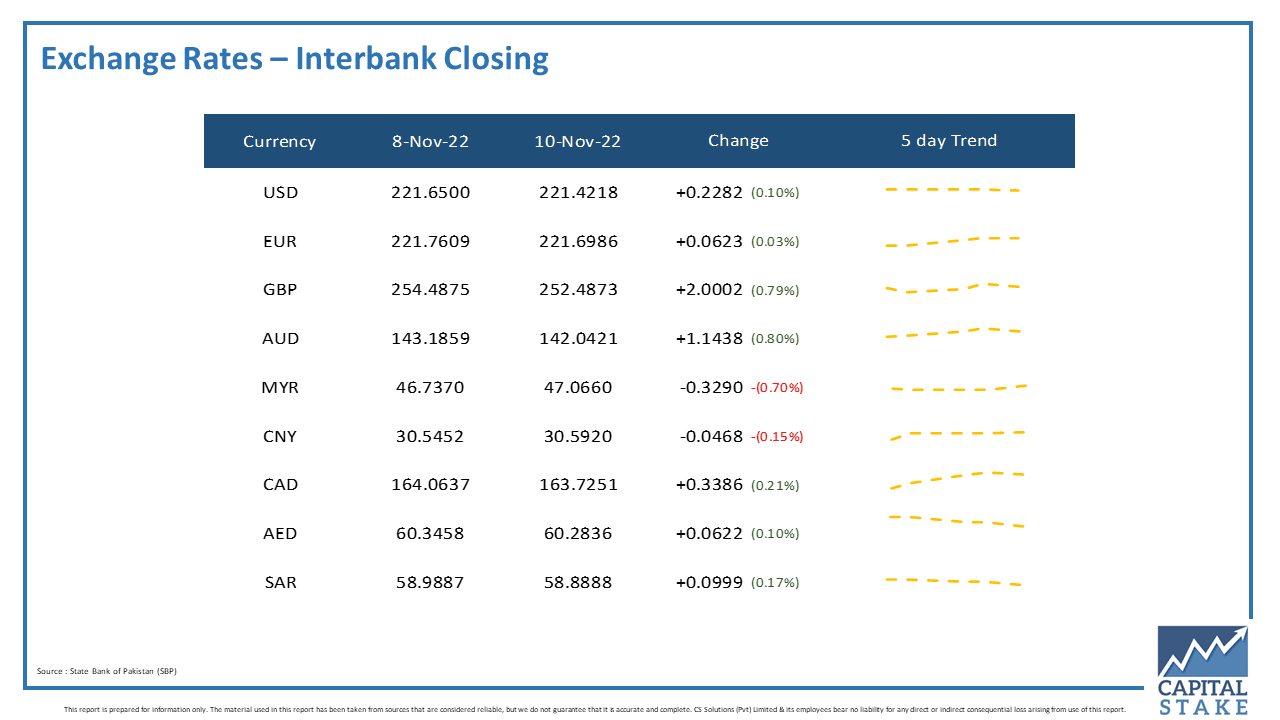

The PKR was bullish against the other major currencies in the interbank market today. It gained six paisas against the Euro (EUR), 33 paisas against the Canadian Dollar (CAD), Rs. 1.14 against the Australian Dollar (AUD), and Rs. 2.00 against the Pound Sterling (GBP).

Moreover, it gained six paisas against the UAE Dirham (AED) and nine paisas against the Saudi Riyal (SAR) in today’s interbank currency market.

Thanks to govt.