The telecom sector witnessed one of the toughest periods with respect to regulatory and policy measures during the last four years which has affected the sector negatively.

During the period, an excessive focus was put on enforcement and almost no growth measures were observed. The period also witnessed the highest litigation coupled with constraints on commercial space for industry.

The snapshot of the telecom sector during the last four years is given below:

No significant strategic measures

- Only one Spectrum Auction with just Ufone participating (34.2 percent of the total spectrum on offer) was sold. The spectrum auction was done for $279 million, less than one-third of the anticipated $1 billion. The failure was primarily due to onerous conditions attached by Pakistan Telecommunication Authority (PTA) to the license.

- No serious headway on 5G enablement

- No important regulatory frameworks mandated by the Telecom Policy 2015 were formulated (spectrum sharing, trading, re-farming). This resulted in lower interest in spectrum transactions.

- Critical licensing review mandated under Telecom Policy 2015 has still not been done and licenses have been renewed for a long term without review.

Excessive focus on Enforcement

- Close to a hundred show-cause notices were issued to the industry compared to the previous 4 years (in the previous four years the number of show-cause notices was zero).

- The industry was forced to incur massive costs for enhanced monitoring systems.

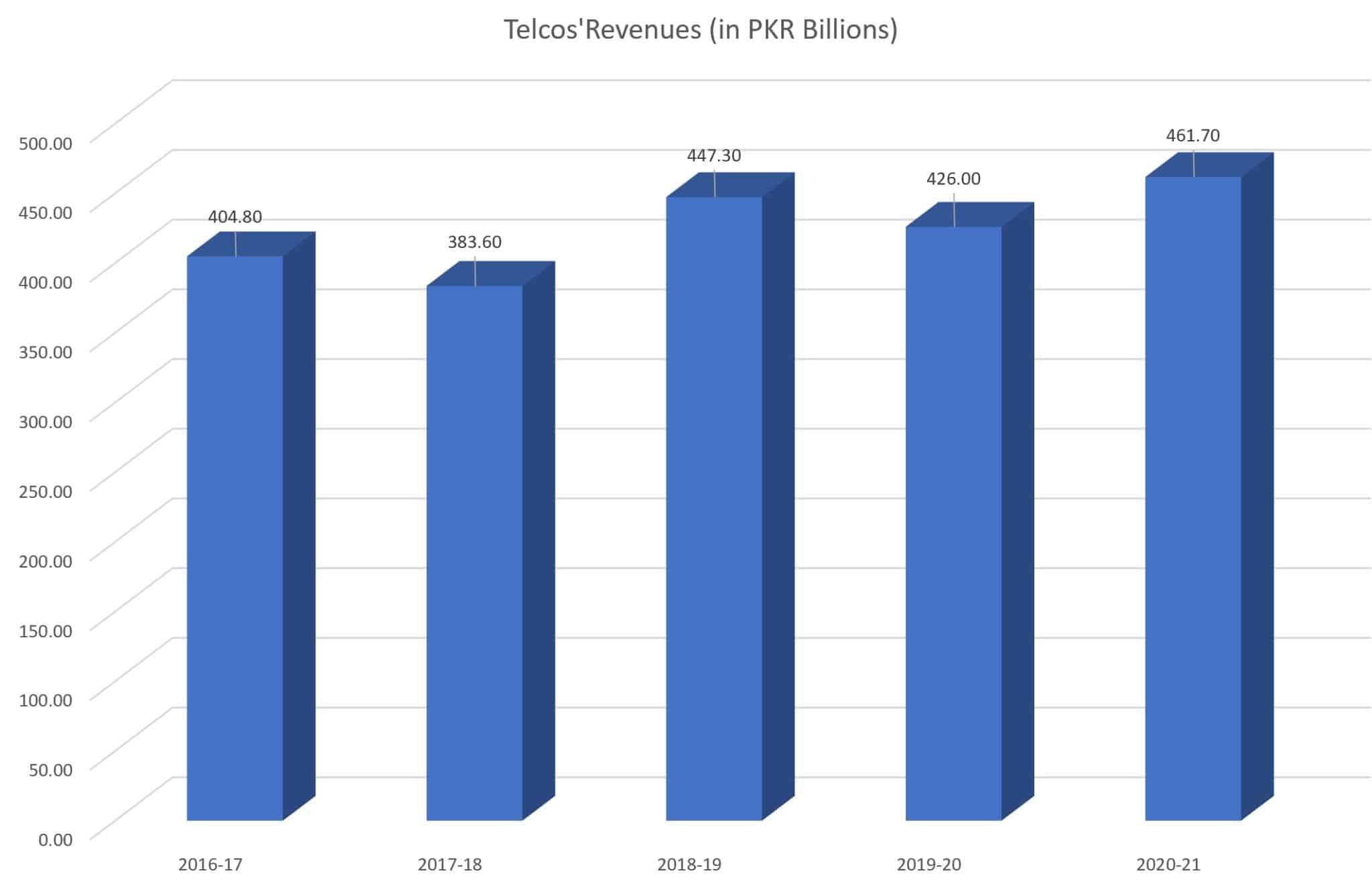

- Industry revenue growth underperformed with respect to all other industries and remained stagnant in PKR terms whereas in US Dollar terms it declined (from $4.8 billion in 2017 to $3.6 billion in 2021)

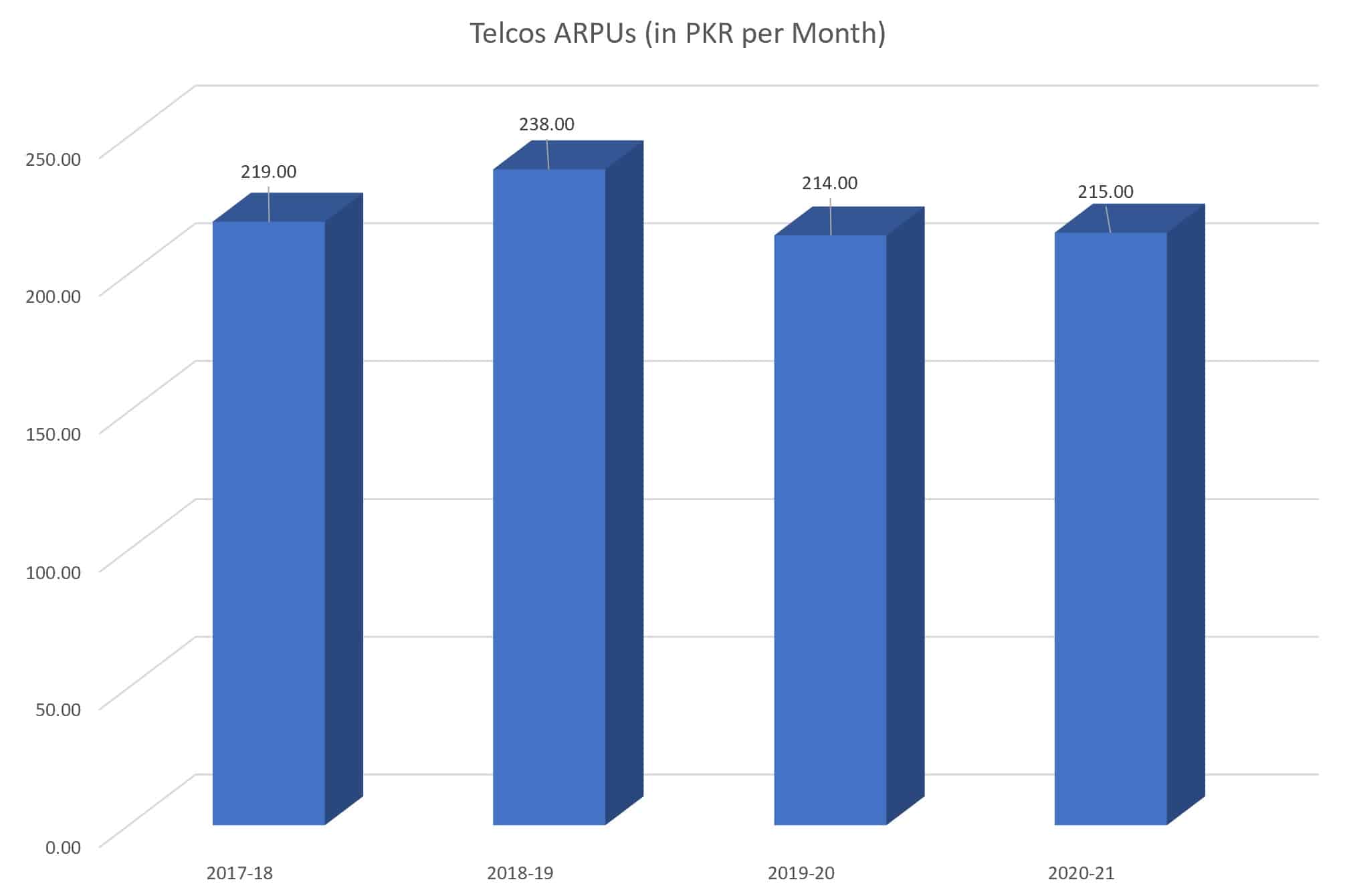

- Industry Average revenue per unit (ARPU) decreased from $1.6 to < $1 in the last 4 years

Constraints on commercial space for industry

- Disproportionate curbs on SIM sales and no improvement in SOPs despite industry expenses on SIM-related initiatives.

- Extensive promotion of free services for all government departments resulting in equivalent value loss for the industry.

- No regulatory support to prevent value erosion in the industry.

- Slow and insufficient approval of critical tariff proposals and further measures to micro-regulate tariffs across the industry

- Industry value which should be above a Trillion PKR (as in comparable markets like Nigeria) is still stuck at Rs. 644 billion.

Highest litigation

- 2019 -2022 were years of the highest litigation and conflict for the telecom industry

- All major license renewals of almost all operators (Telenor, Zong, and Jazz) were contested resulting in huge uncertainty and loss of investment interest.

- Zong contested all major orders of the regulator whereas the industry jointly contested major orders challenging the legal infirmity.

- There is severe unrest in the industry due to the escalation of conflict.

Growth Numbers

- Overall revenues stagnated during the last four years

- So was the case with ARPUs, which actually declined lately.

Below are a few graphs for your understanding.

All figures are taken from PTA’s website

A very good article indeed, truly reflecting the sufferings of Pakistan’s telecom industry. The mentioned era will always be referred to as a textbook case of “How not to regulate a telecom industry”.

Keeping fingers crossed for a new dawn, promising an exponential growth of telecom sector through industry-friendly policies with a progressive mindset. 🤞🤞🤞