Pakistan’s cement offtake declined by 19 percent year-on-year (YoY) in the first 7 months of the financial year 2022-23 as total cement sales during the month were recorded at 25.5 million tons against 31.4 million tons during the same period last fiscal year.

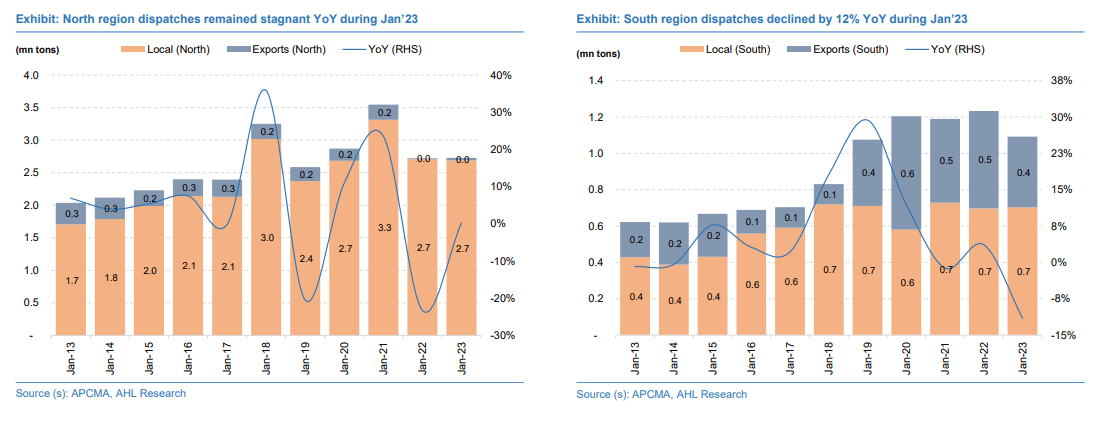

According to Arif Habib Limited (AHL), total cement sales during January were recorded at 3.82 million tons against 3.95 million tons during the same month last year, indicating a 3 percent YoY drop. Domestic dispatches remained stable YoY to arrive at 3.39 million tons.

Exports contracted by 23 percent YoY during January 2023 to 0.42 million tons primarily due to a 28 percent YoY decline in South-based exports to 0.39 million tons amid a slowdown in global demand, whereas North-based exports to Afghanistan surged by a stunning 155x YoY to 0.04 million tons as rehabilitation activity has begun picking up in recent months.

Moreover, month-on-month (MoM) dispatches appear dull, displaying a decline of 2 percent in January 2023 against 3.88 million tons last month led by an 8 percent downturn in domestic dispatches amid the winter season and increased smog (low visibility) in areas upcountry.

On the flip side, exports posted a stunning growth of 107 percent MoM (December 2022: 0.21 million tons), aided primarily by a 158 percent jump in exports from the South attributable to a decline in coal costs which have rendered exports viable once again, whereas exports from North dipped by 33 percent MoM amid peak winter season in Afghanistan and Pakistan.

As a result, utilization of the industry dropped to just 60.21 percent in January 2023 amid the addition of new plants coupled with a slowdown in demand. Utilization of the North region settled at 54.76 percent in January vis-à-vis 80.12 percent in the South region as all new plants (BWCL, FCCL – Askari plant, MLCF, and LUCK) have come online in the North region.

This took the 7MFY23 offtake to 25.58 million tons, down by 19 percent YoY, attributable to a 15 percent weakening in domestic demand tagged with a massive 45 percent decline in exports. In particular, South-based dispatches took a beating of 28 percent YoY to 5.76 million tons, given an 8 percent dip in local offtake and a 54 percent drop in exports due to low margins on exports amid high input costs. While offtake from North dwindled by 15 percent YoY in 7MFY23 to 19.83 million tons owed to a 16 percent weakness in domestic dispatches, exports posted a 10 percent YoY growth.

On a YoY basis, major laggards during January 2023 were as follows: DGKC (411,000 tons; -19 percent YoY), LUCK (612,000 tons; -17 percent YoY), ACPL (212,000 tons; -10 percent YoY), BWCL (501,000 tons; -7 percent YoY), PIOC (215,000 tons; -6 percent YoY), and CHCC (212,000 tons; -3 percent YoY).

On the flip side, companies that posted noteworthy growth in dispatches were POWER (307,000 tons; 36 percent YoY) supported by an exports jump of 68 percent, and FCCL (421,000 tons; 20 percent YoY) amid the addition of a new line and robust exports.

While others that also managed to depict a slight growth included KOHC (237,000 tons; 6 percent YoY), FECTC (48,000 tons; 5 percent YoY), MLCF (345,000 tons; 3 percent YoY), and GWLC (112,000 tons; 2 percent YoY).