Pakistan is a strange country that despite being rich in livestock resources, it contributes less than 0.5 percent to global leather exports.

Pakistan’s leather exports stood at $742.3 million in the first ten months (Jul-Apr) of FY23, witnessing a decline of 6.1 percent on a YoY basis against $790.6 million during the same period in FY22.

The biggest decrease of 18.4 percent was reported in tanned leather exports which were recorded at $140 million in comparison to $172.7 million last year. Exports of leather garments also shrunk by nearly 10 percent but leather footwear experienced a surprising increase of 14 percent with $117.6 million in exports compared to $102.7 million last year.

| Category | Jul-Apr – FY23 | Jul-Apr – FY22 | % Change |

| Leather Tanned | $140.8 million | $172.7 million | -18.4 |

| Leather Garments (Apparel and Clothing) | $236 million | $262 million | -9.9 |

| Leather Gloves | $235 million | $237.4 million | -1.01 |

| Leather Footwear | $117.6 million | $102.7 million | 14.4 |

| Other Leather Manufacturers | $12.9 million | $15.8 million | -18.5 |

| Grand total | $742.3 million | $790.6 million | -6.1 |

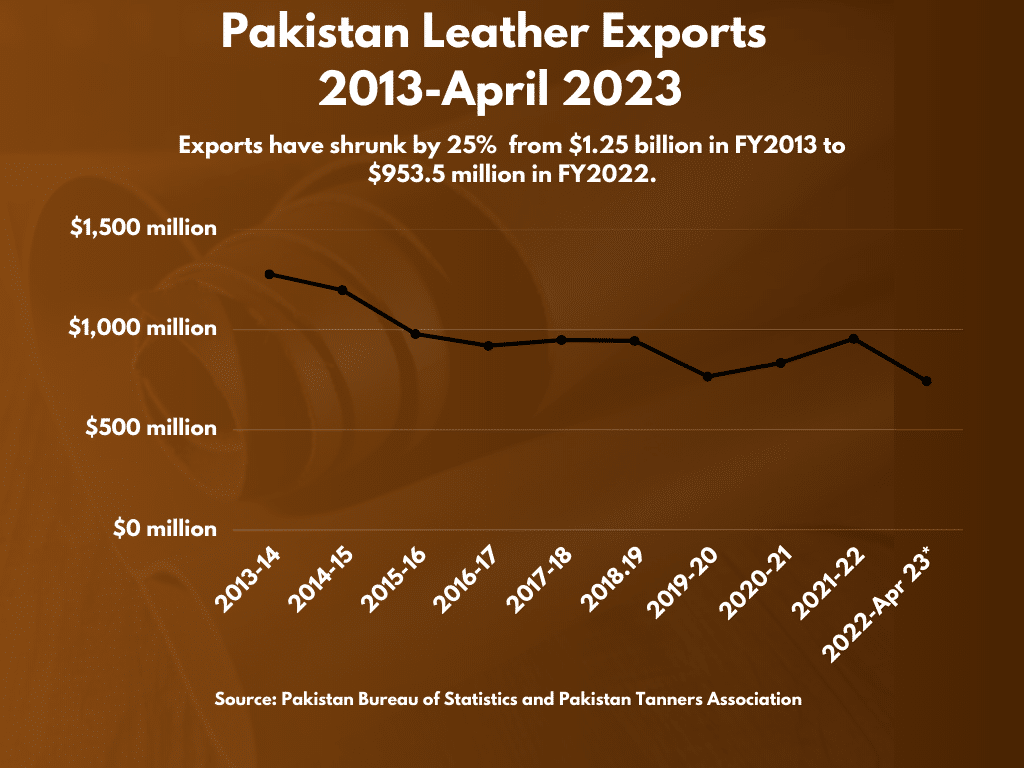

Although exports experienced a significant uptick post Covid when trade was restored in Pakistan relatively earlier compared to China and India, the industry has been under a declining trend overall for the past decade. Exports have contracted by 25 percent from $1.27 billion in 2013 to $953.5 million till last year with a range of issues that have plagued the industry.

“Pakistan has become a second-tier market given the lack of innovation, getting the orders only when the regional markets are at their capacity”, stated a famed leather merchant known in his circle as ‘The Leather Dude’ who is also a consultant at UN Industrial Development Organization.

He added that historically, manufacturers have only been prompted towards exports during sales tax regimes, motivated by rebates, refunds, and duty drawbacks.

He attributed the rise in footwear exports to the fact that footwear and gloves manufacturers took over a small share of the Chinese consumer base during COVID-19 as demand for environmental regulations is also relatively lighter for these sectors compared to apparel and tanned leather.

Value Chain Inefficiencies

There are nearly two dozen processing steps involved from curing the animal skins to ultimately measuring the finished leather, but the problems start long before that. From sheds to slaughterhouses, animals are mostly kept in unhygienic conditions with a lack of lightening & water supply and liquid & solid waste disposal.

All of this leads to diseases like pox lesions, ticks, and mites which coupled with a lack of flaying instruments and uncareful skin flaying practices that focus on getting the meat, badly damaging the skin even before it can be processed and preserved.

Then there are often delays in hide collection and the industry lacks the much-needed preservation techniques for animal skins as the majority of hides are accumulated on Eid-ul-Adha. The impact towards wastage is worsened due to electricity interruptions and the absence of refrigeration.

Nearly 90 percent of the dyes, chemicals, and other raw materials involved in the processes are imported which face significantly high duties with a lead time of up to three months that disturb the cash flow of up to six as they are bought on LCs.

On the other hand, there are no incentives for establishing chemical plants and the local engineering industry is also not capable of filling the demand with machinery, adding to the costs and uncompetitiveness of the products.

The Trade Development Authority of Pakistan (TDAP) claims that the domestic leather industry pays 22.2 percent per kWh higher in comparison to India and Bangladesh while gas cost 156.7 percent and 63.8 percent higher than India and Bangladesh respectively. On top of everything, the government has also withdrawn Regionally Competitive Energy Tariff (RCET) from five export-oriented sectors including leather which would only worsen the existing plight of the businesses.

Most of the firms are family-owned and operated and rarely invest in skills training. The only two leather institutes GILT and NILT have also become dysfunctional due to the lack of funding. Product diversification and value addition are non-existent with most exports going to intermediaries for further processing. The industry also blames the high duties on imported equipment for the lack of modernization.

Sustainability and International Environmental Standards

There are multiple environmental and sustainability protocols introduced over the years which the manufacturers delayed. Moreover, inadequate compliance has cost the industry dearly in terms of order cancellations and suspensions.

Zero Discharge of Hazardous Chemicals (ZDHC), Sustainable Leather Foundation (SLF) and Leather Working Group (LWG) are primary environmental frameworks. LWG constitutes more than 1,000 industry experts and has audited 16 percent of the global leather volume. It certifies and rates the tanneries on the basis of compliance with the separate site drainage systems, wastewater treatment plant and monitoring of wastewater discharge.

According to TDAP, only 14 manufacturers in Pakistan are LWG certified while the registered number from India is 192.

“The ultimate enforcement of these regulations comes down to the municipal governments which often fails at handling even the trivial management tasks of cleanliness in streets”, said The Leather Dude.

“In addition to the government, UN and other International Organizations are also providing financial and technical support for enabling businesses to upgrade” added The Leather Dude. He also added that businesses are still reluctant to take risks by innovating and investing back into enterprises.

Compliance with these regulations requires a significant overhaul of existing tanneries building and small tanneries after struggling to comply have either shut down or are relying on low-paying consumers as international trade is virtually impossible without these certifications.

Sustainability is not just limited to environmental regulations but also encompasses the socioeconomic landscape of the sector. It includes the national standings in deforestation, protection of biodiversity, animal welfare, health & safety standards/PPE, human rights, labour risks and gender equality.

Traditionally, animal welfare has been left for the meat and dairy sector to take care of, but leather manufacturers must realize its importance in their business and if they seek some control and improvement in hide quality, they must share this responsibility with other sectors.

Female labour is entirely missing from the value chain of animal husbandry and leather production. While it can be put at the cultural stereotypes or patriarchy, our competitors in the neighbouring country despite being more conservative have realized it and are benefiting from it. Perhaps our businesses are still trying to understand the market demand and adapt.

The majority of manufactured leather goods are bought by females and the global consumer base generally considers gender equality in their decision-making. Health and safety risks, PPE regulations, safe work environments and child labour protections are also completely ignored and even if there is some good being done somewhere, firms are simply incompetent in image building of the country.

The global demand for synthetic leather-like polyurethane and polyvinyl chloride (PVC) has also risen, fuelled by animal cruelty perceptions, lower prices, the harmful environmental footprint of traditional leather and the sustainability features of synthetic fibres. Despite often being less durable, these alternatives have been taking on the market share of real leather.

The market share of synthetic or faux leather is expected to reach $174.7 billion from $84.1 billion in 2020, growing by 7.23 percent. Numerous vegan-based alternatives like Piñatex from pineapple or mycelium from mushrooms have also been marketed internationally as eco-friendly, but what our animal lover friends forget is that most of these forms contain non-biodegradable plastic originating from fossil fuels and may damage the environment more in the long run.

“Most leather has been used in a fast fashion where no one cares about durability aspect” added The Leather Dude. He also pointed out that synthetic fibres have come at par in prices with real leather due to hikes in petroleum prices and that’s why companies are now indulging in ‘greenwashing’ by claiming an eco-friendly status to stay relevant.

He maintained that it will take years to provide legal protections for real leather like in EU countries and till then these materials are here to stay. The ultimate negligence comes down to the leather industry as well to ensure its regulatory compliance and deploy marketing resources to repair the dinged-up reputation.

Criminal Lack of R&D and Branding

Although Pakistan Tanners Association only knows to ramble about the incentives and subsidies, there is an argument to be made that these subsidies leave distorted market signals, add to fiscal imbalance and provide little incentive to businesses to invest in energy efficiency, sustainability, and innovation.

There is a lot that the industry can do on its own to improve its international standing. When it is abundantly clear that energy subsidies and import duty reliefs are entirely unfeasible considering Pakistan’s particular economic circumstances, what’s stopping the sector from innovating?

“The leather industry is still residing in the antique age where they refuse to acknowledge even great designers let alone spend money on R&D,” said The Leather Dude. He said that these people have already given up on the idea of developing brands and are continuously running a demand-driven strategy.

He also maintained that the industry-led subsidized institutes are only producing labour, instead of designers and thinkers and these businesses must focus their efforts on bringing up such talent from the grassroots level.

Unfortunately, the leather industry failed to embrace globalization, differentiate its product lineup from the competitors in value addition and partner up with local and international brands to compensate for the absence of FDI. The industry’s non-compliance with sustainability goals has also kept the brands and suppliers from approaching each other.

It is only a miracle that European Union GSP+ status has kept the sector afloat so far as it accounts for nearly 80% market share in export but worsening economic indicators have diminished any future hope of additional subsidies or relief in import duties. The only way the manufacturers can not just say competitive but can stay in business is by innovating and placing their products differently.

really surprised to see a quality post on propk

What kind of compliment is that?

Well done Bilal.

Thumbs up! 👍