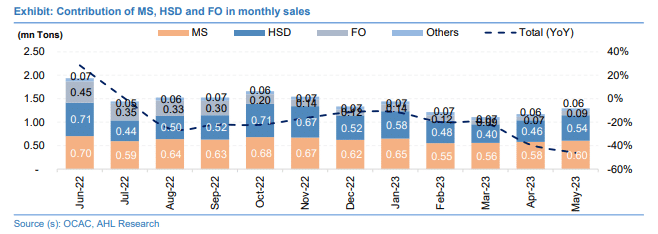

Total petroleum sales arrived at 1.30 million tons in May 2023, plunging by 40 percent year-on-year (YoY) amid a surge in petroleum prices, a slow economy, availability of smuggled petroleum products from Iran, and reduction in Furnace Oil (FO) based power generation.

According to Arif Habib Limited (AHL), MS offtake plummeted by 24 percent YoY, to arrive at 0.60 million tons in May 2023. Similarly, High-Speed Diesel (HSD) volumes descended by 36 percent YoY, to arrive at 0.54 million tons in May 2023. Furthermore, FO sales volumes declined by 80 percent YoY in May, clocking in at 0.09 million tons.

On a month-on-month (MoM) basis, petroleum sales recorded a growth of 11 percent during May amid harvesting during the month, which led to higher consumption of HSD, and a revival of demand for MS and HSD amid a drop in prices. With this, volumes of MS and HSD registered an increase of 4 percent and 18 percent MoM, respectively.

FO sales climbed up by 26 percent MoM given an increase in demand for FO-based power generation amid the commencement of the summer season.

During 11MFY23, sales of total petroleum products depicted a tumble by 26 percent YoY to 15.26 million tons compared to 20.62 million tons in SPLY. Product-wise data showed a decline in all categories; the offtake of MS, HSD, and FO clocked in at 6.78 million tons, 5.83 million tons, and 1.96 million tons, respectively.

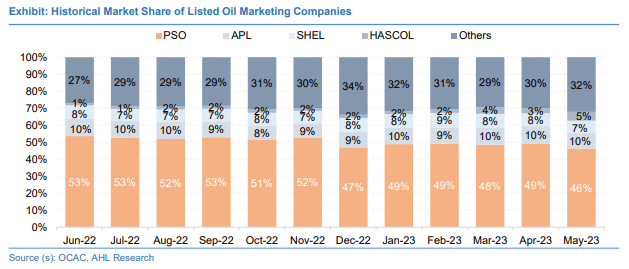

PSO’s Offtake Dwindled by 51% YoY in May

Company-wise analysis depicted that PSO’s offtake reduced by 51 percent YoY in May 2023, which was contributed by a decline in sales of MS, HSD, and FO by 33 percent, 40 percent, and 96 percent YoY, respectively. Likewise, sales of APL and SHEL reduced by 42 percent and 45 percent YoY, respectively. Whereas, HASCOL’s offtake reported a colossal jump of 8x YoY.

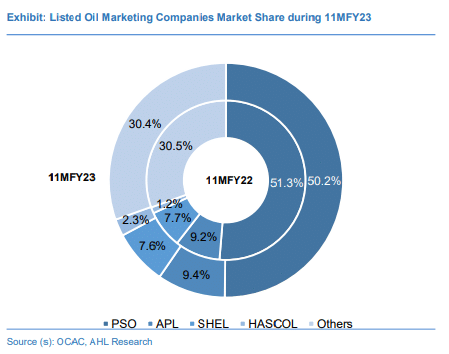

During 11MFY23, PSO’s market share declined by 1.1 percent to 50.2 percent compared to 51.3 percent in 11MFY22. Whereas, the market share of SHEL remained stable at 7.6 percent YoY.

Meanwhile, the market share of APL and HASCOL in 10MFY23 increased to 9.4 percent (9.2 percent in SPLY) and 2.3 percent (1.2 percent in SPLY), respectively. Meanwhile, the market share of other OMCs settled at 30.4 percent in 11MFY23 compared to 30.5 percent in 11MFY22.

Perfect we need to limit usage of tea import too